'Dramatic decrease' in finance jobs as Deutsche Bank swings axe

Financial services job vacancies suffered a “dramatic decline” in the second quarter, according to new data.

Recruiter Morgan McKinley’s second quarter London employment monitor, published on Monday, found a 33% slump in the number of finance jobs on offer in London. There were 50% fewer roles on offer compared to the same quarter last year.

The new data came just hours after Deutsche Bank announced plans to cut 18,000 jobs worldwide as part of a sweeping turnaround plan. Other major banks have also announced job cuts so far this year.

READ MORE: Deutsche Bank to axe 18,000 jobs and exit stock trading

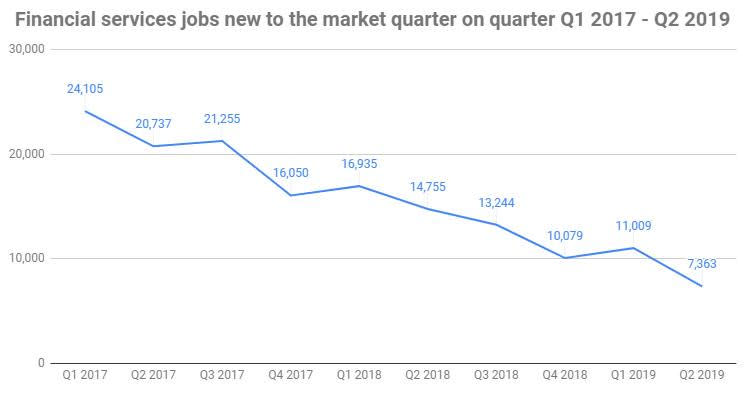

The figures point to a continued slump in financial hiring in the UK capital. Morgan McKinley said the number of quarterly new roles has collapsed from over 24,000 at the start of 2017 to around 7,300.

The decline in London finance jobs coincided with a similar, although less pronounced, fall in the number of people seeing jobs in financial services.

READ MORE: Deutsche Bank considers cutting up to 20,000 jobs

There were 22% fewer people looking to move roles in the City compared to the first quarter of the year, Morgan McKinley said. The number of job seekers declined 19% compared to the second quarter of 2018.

Morgan McKinley called the falls “dramatic.” Hakan Enver, a managing director at Morgan McKinley UK, blamed Brexit for the slump.

“Major banking organisations as well as those from the wider financial services space, have refrained from investing in talent due to the lack of clarity,” Enver said, adding that there were “countless projects and plans on hold.”

“If we have a no-deal Brexit, those projects and all the jobs they would have generated go from being on hold to being cancelled,” he said. “Whoever takes up residence on Downing Street must remember that financial services is the single largest contributor to Britain’s tax base.

“If those jobs keep being treated like collateral damage, eventually someone else is going to have to pick up the tab for the government’s expenses.”

READ MORE: Societe Generale cutting 1,600 investment banking jobs in London, Paris, and New York

The fall in new finance jobs also comes as most big banks focus on reducing headcount in response to tough market conditions. Societe Generale announced plans to cut 1,600 jobs, including some in London, at the start of April. Around the same time, Japanese bank Nomura announced plans to eliminate 100 jobs in Europe. HSBC is also in the process of cutting hundreds of investment banking roles.

Investment banking revenues fell by 23% in the first six months of 2019, according to data provider Refinitiv. Equity revenues fell by 31%. Bloomberg said in a recent article that the atmosphere in the City of London “may be the gloomiest since the financial crisis.”

Separately, another survey showed slowing hiring intentions across the UK. Accountancy firm BDO’s Employment Index declined for the second month in a row in June, after six years of growth.

Peter Hemington, a partner at BDO, also blamed Brexit for the slowdown in hiring intentions it found across the country.

“The glory years of rising UK employment figures could be coming to an end,” he said. “While the numbers remain in positive territory, growth is slowing. The labour market has been resilient to the potential effects of Brexit, but months of negative sentiment has finally taken its toll.”

————

Oscar Williams-Grut covers banking, fintech, and finance for Yahoo Finance UK. Follow him on Twitter at @OscarWGrut.

Read more:

Yahoo Finance

Yahoo Finance