A Look Back at Home Construction Materials Stocks’ Q2 Earnings: Griffon (NYSE:GFF) Vs The Rest Of The Pack

Let’s dig into the relative performance of Griffon (NYSE:GFF) and its peers as we unravel the now-completed Q2 home construction materials earnings season.

Traditionally, home construction materials companies have built economic moats with expertise in specialized areas, brand recognition, and strong relationships with contractors. More recently, advances to address labor availability and job site productivity have spurred innovation that is driving incremental demand. However, these companies are at the whim of residential construction volumes, which tend to be cyclical and can be impacted heavily by economic factors such as interest rates. Additionally, the costs of raw materials can be driven by a myriad of worldwide factors and greatly influence the profitability of home construction materials companies.

The 12 home construction materials stocks we track reported a slower Q2. As a group, revenues missed analysts’ consensus estimates by 2.4% while next quarter’s revenue guidance was 22.9% below.

Big picture, the Federal Reserve has a dual mandate of inflation and employment. The former had been running hot throughout 2021 and 2022 but cooled towards the central bank's 2% target as of late. This prompted the Fed to cut its policy rate by 50bps (half a percent) in September 2024. Given recent employment data that suggests the US economy could be wobbling, the markets will be assessing whether this rate and future cuts (the Fed signaled more to come in 2024 and 2025) are the right moves at the right time or whether they're too little, too late for a macro that has already cooled.

In light of this news, home construction materials stocks have held steady with share prices up 5% on average since the latest earnings results.

Griffon (NYSE:GFF)

Initially in the defense industry, Griffon (NYSE:GFF) is a now diversified company specializing in home improvement, professional equipment, and building products.

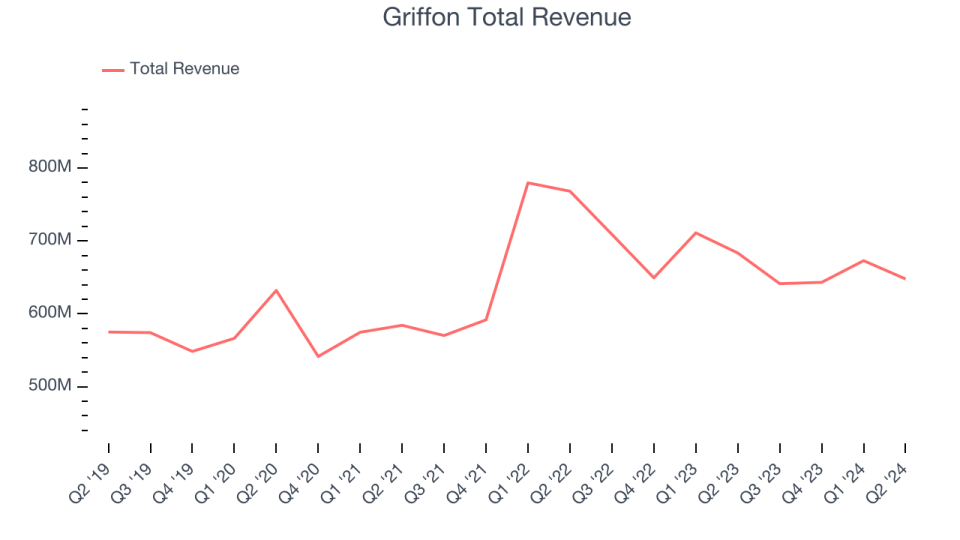

Griffon reported revenues of $647.8 million, down 5.2% year on year. This print fell short of analysts’ expectations by 6%. Overall, it was a mixed quarter for the company with optimistic EBITDA guidance for the full year but full-year revenue guidance missing analysts’ expectations.

“Griffon's third quarter results were highlighted by solid operating performance from Home and Building Products (“HBP”), improved profitability at Consumer and Professional Products (“CPP”) and strong free cash flow conversion,” said Ronald J. Kramer, Chairman and Chief Executive Officer.

Griffon delivered the weakest performance against analyst estimates of the whole group. Unsurprisingly, the stock is down 1% since reporting and currently trades at $68.80.

Read our full report on Griffon here, it’s free.

Best Q2: JELD-WEN (NYSE:JELD)

Founded in the 1960s as a general wood-making company, JELD-WEN (NYSE:JELD) manufactures doors, windows, and other related building products.

JELD-WEN reported revenues of $986 million, down 12.4% year on year, falling short of analysts’ expectations by 1.4%. However, the business still had a very strong quarter with an impressive beat of analysts’ organic revenue and earnings estimates.

The market seems happy with the results as the stock is up 5% since reporting. It currently trades at $15.42.

Is now the time to buy JELD-WEN? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: Gibraltar (NASDAQ:ROCK)

Gibraltar (NASDAQ:ROCK) makes renewable energy, agriculture technology and infrastructure products. Its mission statement is to make everyday living more sustainable.

Gibraltar reported revenues of $353 million, down 3.3% year on year, falling short of analysts’ expectations by 5.5%. It was a disappointing quarter with full-year revenue guidance missing analysts’ expectations.

As expected, the stock is down 14.7% since the results and currently trades at $68.41.

Read our full analysis of Gibraltar’s results here.

American Woodmark (NASDAQ:AMWD)

Starting as a small millwork shop, American Woodmark (NASDAQ:AMWD) is a cabinet manufacturing company that helps customers from inspiration to installation.

American Woodmark reported revenues of $459.1 million, down 7.9% year on year. This result came in 3.4% below analysts' expectations. Overall, it was a softer quarter as it also produced a miss of analysts’ earnings estimates.

The stock is down 9.8% since reporting and currently trades at $90.11.

Read our full, actionable report on American Woodmark here, it’s free.

Quanex (NYSE:NX)

Starting in the seamless tube industry, Quanex (NYSE:NX) manufactures building products like window, door, kitchen, and bath cabinet components.

Quanex reported revenues of $280.3 million, down 6.4% year on year. This result met analysts’ expectations. Overall, it was a strong quarter as it also produced a solid beat of analysts’ Cabinet Components revenue estimates and a decent beat of analysts’ operating margin estimates.

Quanex achieved the biggest analyst estimates beat and highest full-year guidance raise among its peers. The stock is up 11.1% since reporting and currently trades at $27.61.

Read our full, actionable report on Quanex here, it’s free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.