Lovesac (NASDAQ:LOVE) Delivers Strong Q1 Numbers, Guides For Strong Full-Year Sales

Furniture company Lovesac (NASDAQ:LOVE) reported Q1 CY2024 results topping analysts' expectations , with revenue down 6.1% year on year to $132.6 million. The company expects next quarter's revenue to be around $156 million, in line with analysts' estimates. It made a GAAP loss of $0.83 per share, down from its loss of $0.28 per share in the same quarter last year.

Is now the time to buy Lovesac? Find out in our full research report.

Lovesac (LOVE) Q1 CY2024 Highlights:

Revenue: $132.6 million vs analyst estimates of $128.1 million (3.6% beat)

Revenue Guidance for Q2 CY2024 is $156 million at the midpoint, roughly in line with what analysts were expecting

The company reconfirmed its revenue guidance for the full year of $735 million at the midpoint

Gross Margin (GAAP): 54.3%, up from 50% in the same quarter last year

Free Cash Flow was -$14.31 million, down from $49.53 million in the previous quarter

Market Capitalization: $402.4 million

Shawn Nelson, Chief Executive Officer, stated, “We are pleased to deliver first quarter performance inline to slightly above the high end of our expectations. Our results reflect continued outperformance compared to the industry and demonstrate our commitment to executing against our objectives. We believe through our omni-channel infinity flywheel, designed for life platform and advantaged supply chain we are well positioned to continue to deliver results and capitalize on the tremendous opportunity still ahead. With the recent launch of our PillowSac Accent Chair we are continuing to expand our offering and see opportunity to further widen the aperture with exciting innovative launches yet to come.”

Known for its oversized, premium beanbags, Lovesac (NASDAQ:LOVE) is a specialty furniture brand selling modular furniture.

Home Furnishings

A healthy housing market is good for furniture demand as more consumers are buying, renting, moving, and renovating. On the other hand, periods of economic weakness or high interest rates discourage home sales and can squelch demand. In addition, home furnishing companies must contend with shifting consumer preferences such as the growing propensity to buy goods online, including big things like mattresses and sofas that were once thought to be immune from e-commerce competition.

Sales Growth

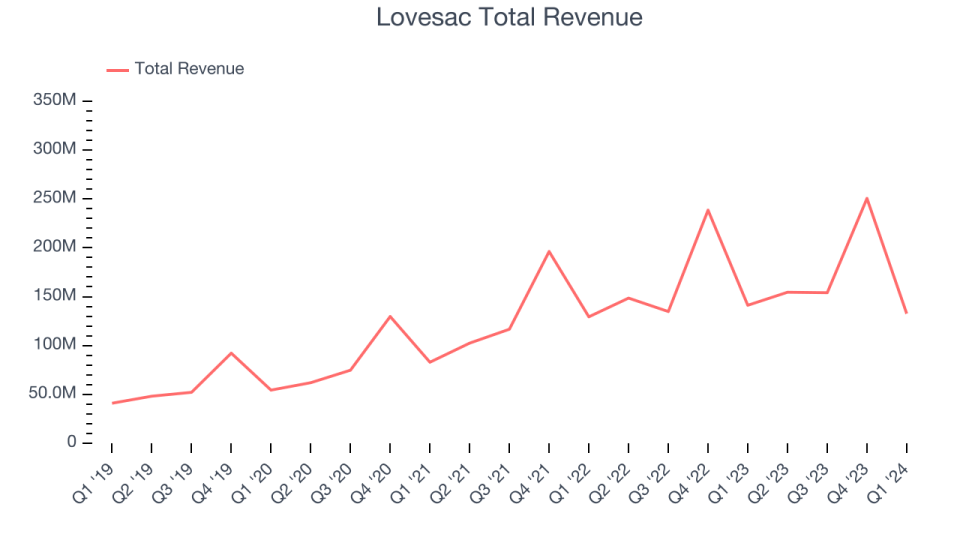

A company's long-term performance is an indicator of its overall business quality. While any business can experience short-term success, top-performing ones demonstrate sustained growth over multiple years. Over the last five years, Lovesac grew its sales at an incredible 30.9% compounded annual growth rate. This is encouraging because it shows Lovesac's offerings resonate with customers, a helpful starting point for our assessment of quality.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. Lovesac's recent history shows its demand slowed significantly as its annualized revenue growth of 12.7% over the last two years is well below its five-year trend.

This quarter, Lovesac's revenue fell 6.1% year on year to $132.6 million but beat Wall Street's estimates by 3.6%. For next quarter, the company is guiding for flat year on year revenue of $156 million, slowing from the 4% year-on-year increase it recorded in the same quarter last year. Looking ahead, Wall Street expects sales to grow 5.2% over the next 12 months, an acceleration from this quarter.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can't use accounting profits to pay the bills.

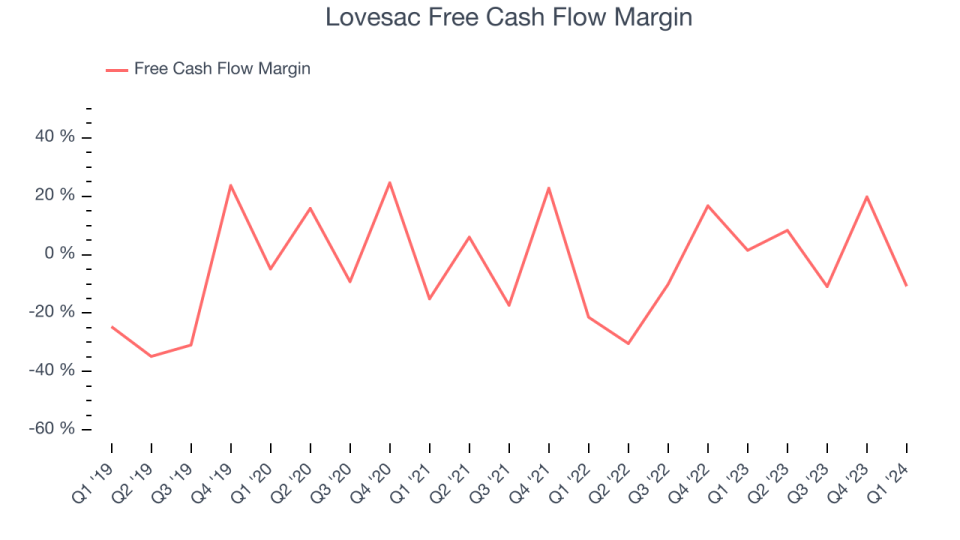

Lovesac has shown poor cash profitability over the last two years, putting it in a pinch as it gives the company limited opportunities to reinvest, pay down debt, or return capital to shareholders. Its free cash flow margin averaged 1.1%, lousy for a consumer discretionary business.

Lovesac burned through $14.31 million of cash in Q1, equivalent to a negative 10.8% margin. The company's quarterly cash flow turned negative after being positive in the same quarter last year, but we wouldn't read too much into it because working capital needs can be seasonal and cause quarter-to-quarter swings in the short term.

Key Takeaways from Lovesac's Q1 Results

We were impressed by Lovesac's optimistic earnings forecast for next quarter, which blew past analysts' expectations. We were also glad its full-year revenue guidance came in higher than Wall Street's estimates. Zooming out, we think this was a fantastic quarter that should have shareholders cheering. The stock is up 1.6% after reporting and currently trades at $26.40 per share.

Lovesac may have had a good quarter, but does that mean you should invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

Yahoo Finance

Yahoo Finance