Lumen (LUMN) Holds Investor Day: Key Takeaways & Objectives

Lumen Technologies LUMN unveiled its growth strategy during Investor Day 2023. The company's top management team has outlined key financial objectives for both the short-term and long-term periods. Lumen's strategy focuses on three fundamental elements aimed at propelling the company's expansion.

The first element of the strategy involves securing the company's existing customer base by making proactive investments in enhancing the overall customer experience. The company aims to achieve this by leveraging strategic partnerships to aid customers in modernizing their infrastructure and transitioning from traditional voice communication technologies to more advanced options such as Voice over Internet Protocol, Unified Communications and Collaboration, Virtual Private Networks and Voice Migration.

Recently, the company partnered with Microsoft to announce the launch of Operator Connect for Microsoft Teams Phone, which will likely help companies to modernize their hybrid workforce. Operator Connect will allow users to make calls in Microsoft Teams without any on-premises equipment.

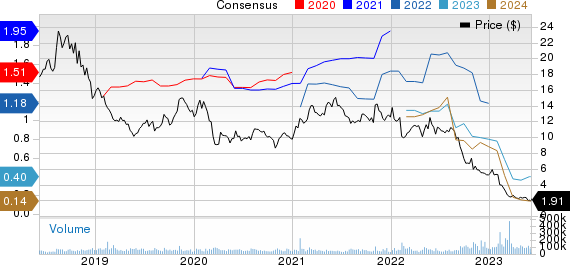

Lumen Technologies, Inc. Price and Consensus

Lumen Technologies, Inc. price-consensus-chart | Lumen Technologies, Inc. Quote

The second element of Lumen's strategy revolves around driving commercial excellence. This entails optimizing the productivity of the company's sales and channel operations, as well as capitalizing on its existing capabilities. Lumen aims to align its growth rates with market trends, ensuring it remains competitive and monetizes its offerings effectively. Lumen intends to maximize its revenue potential and capture a larger share of the market.

The third element of Lumen's strategy is centered on innovation for growth. The company aims to digitize customers, employees and partners’ experiences to foster stronger connections throughout its business ecosystem. Lumen plans to achieve this by implementing digital solutions that enhance connectivity, security and speed.

The company will invest in next-generation fiber networks and expand its footprint in the cybersecurity market. The company has also launched its ultra-fast broadband connectivity service, Quantum Fiber, which provides gig and multi-gig speed Internet across 18 cities.

As of Mar 31, 2023, the total enabled locations in the retained states stood at 3.3 million. The company expects total enabled locations to reach 5.4 million and 7.4 million by 2025 and 2027, respectively.

Lumen anticipates witnessing a healthy momentum in the Quantum business in the upcoming quarters. The company expects to add 350,000 and 450,000 Quantum fiber subscribers in 2025 and 2027, respectively. Further, the company added that it expects a capital expenditure reduction of $1 billion per year after the investment phase.

Owing to the above-mentioned factors, the company expects revenues to be $14.2 billion and $14.8 billion in 2023 and 2027, respectively, compared with revenues of $17.5 billion in 2022. The company expects adjusted EBITDA to be $4.7 billion and $5.3 billion in 2023 and 2027, respectively, compared with adjusted EBITDA of $6.8 billion in 2022. Free cash flow is anticipated to be in the range of $0-200 million in 2023 and $300-$500 million in 2027, compared with a free cash flow of $2.3 billion in 2022.

The company expects business segment revenues to be in the range of $10.9-$11.2 billion in 2023 and $11.2-$12.2 billion in 2027, compared with revenues of $13.04 billion in 2022. Also, the company expects mass market segment revenues to be in the range of $3-$3.2 billion in 2023 and $2.9-$3.2 billion in 2027, compared with revenues of $4.4 billion in 2022.

Lumen Technologies aims to position itself for substantial growth in the coming years by proactively investing in customer experience, optimizing sales and channel operations and embracing innovation.

Lumen currently carries a Zacks Rank #3 (Hold). Shares of the company have lost 83.8% compared with the sub-industry’s decline of 11.9% in the past year.

Image Source: Zacks Investment Research

Stocks to Consider

Some better-ranked stocks in the broader technology space are Dropbox DBX, Badger Meter BMI and Blackbaud BLKB. Dropbox presently sports a Zacks Rank #1 (Strong Buy), whereas Blackbaud and Badger Meter currently hold a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Dropbox’s 2023 earnings has increased 10.1% in the past 60 days to $1.85 per share. The long-term earnings growth rate is anticipated to be 12.3%.

Dropbox’s earnings beat the Zacks Consensus Estimate in the last four quarters, the average being 10.4%. Shares of DBX have gained 3.2% in the past year.

The Zacks Consensus Estimate for Badger Meter’s 2023 earnings has increased 4.7% in the past 60 days to $2.69 per share.

Badger Meter’s earnings beat the Zacks Consensus Estimate in all the last four quarters, the average being 5.3%. Shares of BMI have surged 75.5% in the past year.

The Zacks Consensus Estimate for Blackbaud’s 2023 earnings has increased 9.3% in the past 60 days to $3.75 per share.

Blackbaud’s earnings beat the Zacks Consensus Estimate in the last four quarters, the average surprise being 10.4%. Shares of the company have jumped 15.1% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Badger Meter, Inc. (BMI) : Free Stock Analysis Report

Blackbaud, Inc. (BLKB) : Free Stock Analysis Report

Dropbox, Inc. (DBX) : Free Stock Analysis Report

Lumen Technologies, Inc. (LUMN) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance