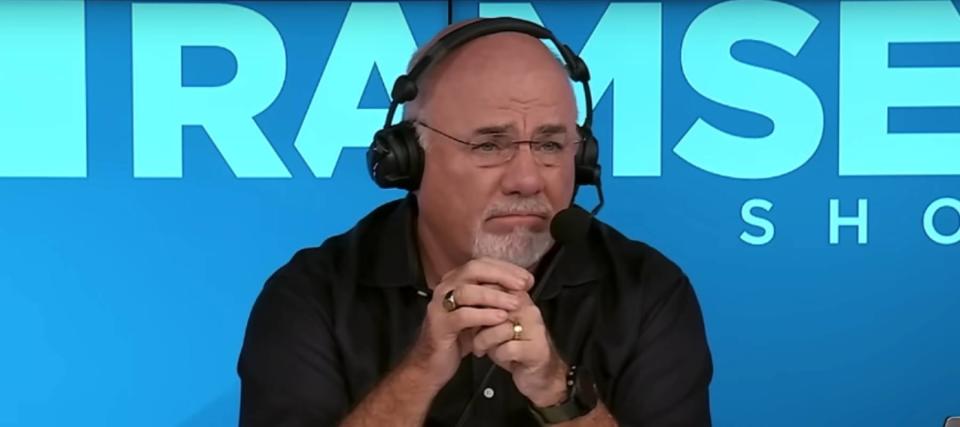

‘I’m 59 and do not have any money in retirement’: Dave Ramsey says this Floridian can still save her retirement

Despite the narrative that older Americans had it easy and are extremely wealthy, the data shows a wealth disparity within the baby boomer generation.

Some seniors own multiple properties and secure sources of cash flow, while others like Mary from Florida, face a bleak future.

Don't miss

Commercial real estate has beaten the stock market for 25 years — but only the super rich could buy in. Here's how even ordinary investors can become the landlord of Walmart, Whole Foods or Kroger

Cost-of-living in America is still out of control — use these 3 'real assets' to protect your wealth today, no matter what the US Fed does or says

These 5 magic money moves will boost you up America's net worth ladder in 2024 — and you can complete each step within minutes. Here's how

“I recently sold my home and paid off almost all of my debt,” she told Dave Ramsey on an episode of The Ramsey Show. “I’m 59 and I do not have any money in retirement.”

And Mary’s not the only older adult in America feeling squeezed, as they struggle to sort it out with modest incomes and assets.

A retirement crisis

A recent report — published by the U.S. Senate’s Health, Education, Labor, and Pensions committee — uncovered a growing retirement crisis across the nation. Roughly half of all Americans over the age of 55 had no retirement savings. Meanwhile, 1-in-4 Americans over the age of 65 were struggling to survive on less than $15,000 a year.

Leading causes for this crisis, according to the report, include the inadequacy of the Social Security safety net, the decline in defined benefit pension plans and the lack of access to any retirement plans for many Americans.

However, the rising cost of living is also a factor. Mary says she owned property just north of Palm Beach, Florida that she recently sold for $518,000. After paying off her debts with some of the proceeds from this sale, she’s left with $290,000.

Mary certainly benefited from rising home prices in recent years. Since 2020, the national average home price in the U.S. has jumped 29%. However, she now faces an expensive housing market that’s made it difficult for her to downsize.

Mary’s target is a home worth $300,000. She’s willing to put $200,000 down and apply for a $100,000 mortgage that she believes she can pay off in 10 years. However, that leaves little left to retire on, which is why Ramsey wasn’t keen on the idea. He had a different plan.

Read more: 'Baby boomers bust': Robert Kiyosaki warns that older Americans will get crushed in the 'biggest bubble in history' — 3 shockproof assets for instant insurance now

Avoid the mortgage

“You do not want to go into retirement with a mortgage,” Ramsey tells Mary. “That’s still $100,000 that’s not going to your nest egg.”

Aiming for a cheaper home could be the solution. Ramsey says he would buy a $200,000 house in cash, which means compromising with a less-than-ideal living situation. “[That] ain’t much of a house… it’s not a shack but it’s a pretty far step down from where you were living,” he says. “I understand that.”

However, without monthly mortgage payments Mary can accumulate more cash to invest in her retirement accounts such as a Roth IRA. Since she’s self-employed as a small business bookkeeper, Mary also has access to retirement accounts tailored for business owners, such as the SEP IRA. She could also consider taking on more clients for her accounting business and delaying retirement by a few years to boost her income beyond her current annual rate of $70,000.

Ramsey believes these simple steps could have her “nest egg roaring” in a few years. In fact, she could aim for $1 million within 14 years, based on his aggressive estimates. Other older adults could similarly salvage their retirements by pulling back on expenses and boosting income or simply delaying retirement by a few years.

What to read next

Jeff Bezos and Oprah Winfrey invest in this asset to keep their wealth safe — you may want to do the same in 2024

'It's not taxed at all': Warren Buffett shares the 'best investment' you can make when battling rising costs — take advantage today

Car insurance premiums in America are through the roof — and only getting worse. But 5 minutes could have you paying as little as $29/month

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.

Yahoo Finance

Yahoo Finance