I’m a Financial Expert: Here’s the Most You Should Spend on a Monthly Utility Bill

You’ve got a lot of significant expenses in your budget. Most of your money likely pays for the big three: housing, transportation and food.

Read More: Here’s How Much the Definition of Middle Class Has Changed in Every State

See Next: How To Get $340 Per Year in Cash Back on Gas and Other Things You Already Buy

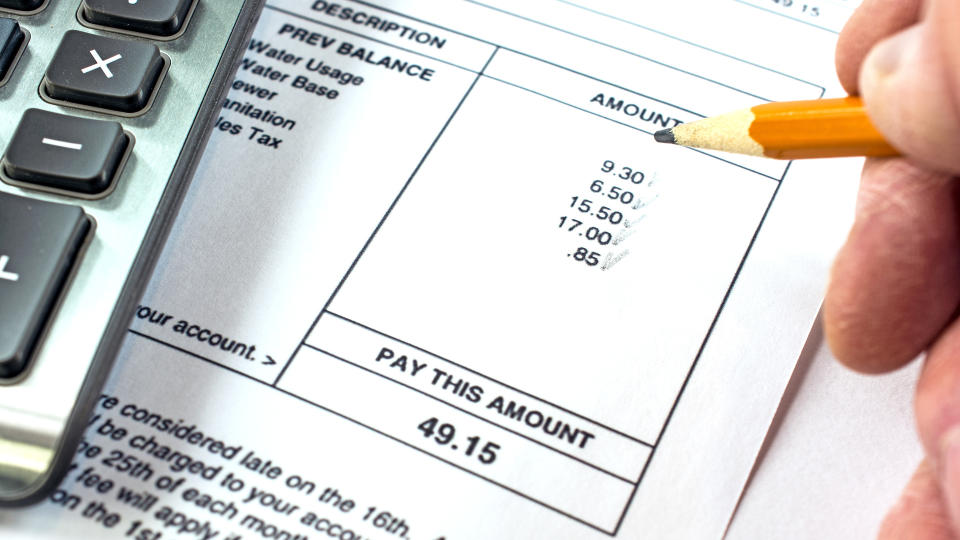

But the cost of other goods and services is also creeping up, requiring more of your dollars to cover. You may have experienced sticker shock when you opened your latest utility bill.

Don’t worry. We’ll explain how much you should spend on utilities and offer strategies to save. That way, you have more cash to put toward your financial goals (or to have fun).

Also here are the current average costs of utilities by state.

How Much Should You Spend on Utility Bills?

Jeff Rose, founder of Good Financial Cents, said, “A good rule of thumb is to keep your utility costs between 5% and 10% of your monthly income.” So, if you earn $3,000 per month, you should spend $300 or less on utilities. Let’s see how that figure stacks up against the average American’s bill.

Try This: 5 Unnecessary Bills You Should Stop Paying in 2024

Average Utility Bill Costs

GoBankingRates recently surveyed more than 1,000 Americans about their monthly electricity, water and gas or heat spending. We found that most participants (about 60%) pay $300 or less.

Rose offered some figures that align with our findings. “For electricity, most families spend around $115 a month. Water bills can vary a lot, but they usually run between $15 to $77. Gas costs average about $61 each month, although it goes up when you need to heat your house in the winter.”

However, the survey also revealed that nearly 12% of participants pay at least $500 monthly. You may fall into this category if you live in one of the states with the highest utility bills, such as Alaska, Hawaii or Connecticut.

How To Save on Utility Bills

Your cost of living may be increasing. Fortunately, there are ways to lower your utility bills:

Compare Providers

You can shop around for a better deal if you have multiple providers in your area. “Every household should shop for natural gas at least every two years,” said Cecil Staton, certified financial planner (CFP) and president of Arch Financial Planning.

“Most contracts are paid ‘per therm,’ a unit of natural gas measurement,” he said. “While we don’t have a crystal ball, I recommend locking in your rate at least yearly, if not longer. A less competitive variable rate will apply if you don’t shop current thermal rates and renew your contract.”

Ask About Budget Billing

Your utility company may offer a special payment plan that spreads your cost evenly throughout the year. So, instead of paying $100 a month for electricity during the cooler months and $350 a month during the summer (thanks, air conditioning), you’ll pay somewhere in the middle for every bill. While you may not pay less, per se, budget billing can help you better plan for the expense and improve your cash flow during the pricier months.

Get an Energy Audit

An energy audit will show you how energy efficient (or inefficient) your house is. You can then use the results to decide which home improvements to make.

For example, you may discover that a lot of heat escapes through your attic, prompting you to install insulation. That move could result in a significant drop in heating costs.

Seal Up Your Home

Do you feel a draft? That means your climate-controlled air (and dollars) are literally going out the window (or door). You can pick up window insulation kits at your local home improvement store or in the hardware section of your favorite big-box retailer.

Make Your House More Energy Efficient

Apart from sealing up the leaks, you can do a lot more to make your house more energy efficient. Consider buying an energy-efficient appliance when it’s time to replace an existing unit.

A new refrigerator can be pricey, but conserving energy (and lowering your utility bills) doesn’t have to cost a lot. In fact, you can purchase several helpful items for under $100, such as LED lightbulbs, high-efficiency shower heads and a water heater blanket.

Unplug Your Electronics

Did you know that electronics draw power even when not in use? You should unplug these items to reduce your home’s energy consumption. While idle equipment won’t cause you to go bankrupt, unplugging it could save you real money over time.

More From GOBankingRates

This article originally appeared on GOBankingRates.com: I’m a Financial Expert: Here’s the Most You Should Spend on a Monthly Utility Bill

Yahoo Finance

Yahoo Finance