With Macron Distracted, Germany Shuts Down Push for Joint EU Debt

(Bloomberg) -- The German government and its allies are succeeding in their efforts to block plans for new joint borrowing to finance critical European Union projects like defense.

Most Read from Bloomberg

YouTuber Dr Disrespect Was Allegedly Kicked Off Twitch for Messaging Minor

Nvidia Rout Takes Breather as Traders Scour Charts for Support

BuzzFeed Struggles to Sell Owner of Hit YouTube Show ‘Hot Ones’

Israel Court Calls Ultra-Orthodox Men Into Army as Crisis Brews

Jain Global Raises $5.3 Billion, Secures Cash From Abu Dhabi

So-called defense bonds are likely to be off the table when European leaders gather Thursday to discuss their top priorities for the next five years, according to officials with knowledge of the preparations. The push to shut down debate on shared debt has been helped by the turmoil in France, said the officials, who asked not to be named discussing private conversations.

Heads of government are trying to agree a strategy to counter trade tensions with China and the US, Vladimir Putin’s expansionist war in Ukraine and the possibility of Donald Trump’s return to the White House. At the same time, they’re looking for ways to boost economic growth and support the bloc’s green deal — and joint debt issuance is one solution that’s been floated.

Those aspirations were dealt a blow in European elections this month which saw gains for far-right groups that have been friendly to Putin and skeptical of climate action.

At the summit, Ursula von der Leyen is expected to be nominated for a second term as president of the commission but the political backdrop is making her cautious about expending capital on the controversial idea of shared borrowing. Just days after the EU election, a decision by indexer MSCI Inc. not to include the bloc’s outstanding bonds in its sovereign gauges hit investor appetite for the debt.

A draft of the EU strategy document seen by Bloomberg says the bloc will use “innovative options” to finance an increase in defense spending and needs “a significant collective investment effort” to be able to compete with other nations. There’s no mention of joint borrowing.

Former Italian Prime Minister Mario Draghi has been a long-standing proponent of shared debt but there is a question mark over whether he too will include a reference to that instrument when he publishes a report on how to boost EU competitiveness in the next few weeks, according to a person familiar with his thinking.

Draghi was asked by von der Leyen to draw up options for accelerating the bloc’s industrial and technological development and beefing up its defense capabilities. Having led the European Central Bank through the sovereign debt crisis a decade ago, he has long favored joint bonds to increase the EU’s financial muscle.

The first major issuance of EU bonds was agreed in 2020 when leaders sealed the post-pandemic recovery fund, an €800 billion ($860 billion) pool designed to help member states recover from Covid and accelerate their economic development.

Many investors assumed that, with the taboo broken, collective issuance would gradually become a more common tool for the bloc to address its shared problems, and earlier this year were increasing their holdings of EU bonds.

Although the EU plans to sell €65 billion of bonds under existing programs in the second half of 2024 — more than many investors were predicting — progress toward fresh issuance was dealt a setback this month by MSCI decision on indexing.

The increase in support for the far right in this month’s EU elections and the sudden political turmoil in France have added further headwinds. The spread between 10-year EU bonds and equivalent German notes has widened almost 20 basis points over the past two weeks, practically erasing the tightening seen since the start of the year.

“Even if we’d had a more centrist outcome in EU elections, joint bonds would still have been a contentious topic,” said Matt Cairns, head of credit at Rabobank. “Now that things have gone far more right-of-center than predicted, this topic is going to get even more fractious.”

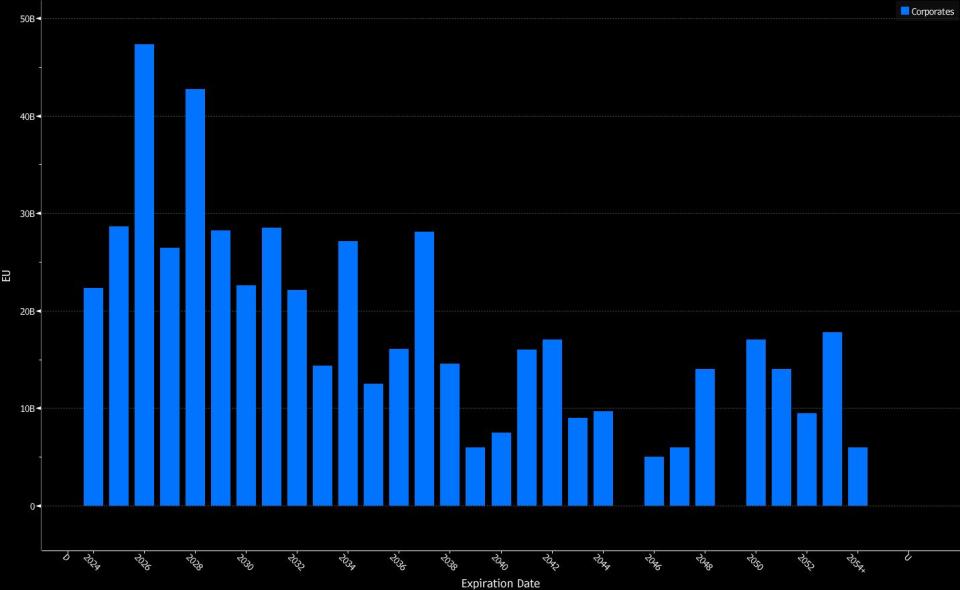

EU’s Debt Distribution

Cairns said that now it will take another black-swan type of event — like the Covid pandemic — to drive joint issuance forward.

President Emmanuel Macron’s decision to trigger legislative elections in which polls suggest he’ll suffer a heavy defeat potentially represents a black swan of a different type.

Even before the result, which could give control of the government to far-right leader Marine Le Pen, French officials — who might ordinarily argued in favor of bloc-wide borrowing — were distracted by the drama unfolding at home, and France’s hand has been fundamentally weakened, officials said.

Russia’s invasion of Ukraine changed the debate, with some eastern members such as the Baltic states, who’d been reluctant to back the recovery fund, turning in favor because of what they see as an existential threat to their security.

They are now aligned with longer-term fans of deeper fiscal integration such as France, Italy and Spain. Those countries still have one more opportunity to put down a marker, and there remains live discussion over whether to include eurobonds in a financing options paper being prepared for leaders in the coming days.

Polish Prime Minister Donald Tusk is seeking support for common financing for air defense capabilities along his country’s eastern border with Ukraine and Belarus, one diplomat said, as part of a push for more spending in this area across the board.

Tusk said last week that he thinks the rest of the EU is ready to put more money into fortifying its eastern border, though he didn’t comment on how it would be paid for.

One EU diplomat said shared borrowing was the subject of hard-held convictions for a number of member states on an issue that requires unanimity. So including it in the strategic agenda would create more problems than it solves.

Some of the biggest problems lie in Berlin. Olaf Scholz helped to push through the recovery fund deal when he was finance minister but now he’s struggling to keep his head above water as chancellor, and his successor in the ministry, Christian Lindner, is fiercely opposed to shared debt.

German officials argue that they have already gone a long way to increase their military budget, hitting the NATO target to keep defense spending at 2% of GDP this year for the first time since it was agreed a decade ago. A spokesperson for the German chancellery declined to comment.

Other EU member states coordinating their opposition to more joint borrowing include the Netherlands, Austria, Sweden and Denmark, according to people familiar with those countries’ positions.

One person involved in preparations for the EU summit said it wouldn’t be appropriate for leaders to discuss eurobonds because there hasn’t been enough technical preparation done on how they would actually work.

In a sign of how divisive the issue has become, the official said it was typical of Macron that his grand speeches aren’t backed up by proper work on policy details.

--With assistance from Natalia Ojewska, Alberto Nardelli, Aline Oyamada, Sujata Rao and Zoe Schneeweiss.

(Updates to show that a spokesperson for the German chancellery declined to comment.)

Most Read from Bloomberg Businessweek

How Jeff Yass Became One of the Most Influential Billionaires in the 2024 Election

Why BYD’s Wang Chuanfu Could Be China’s Version of Henry Ford

Independence Without Accountability: The Fed’s Great Inflation Fail

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance