How the Major Streamers Stack Up in Subscribers and Revenue | Charts

The first quarter of 2024 was another big win for Netflix, but starting in 2025 the game will change.

After building a steady lead over its legacy media competitors for the past several quarters, Netflix revealed it will no longer disclose its quarterly subscriber or average revenue per paid member starting in the first quarter of 2025 as it shifts its focus to revenue, operating margins and engagement.

The decision comes as two of its major competitors — Warner Bros. Discovery and Disney — have made significant strides in streaming profitability.

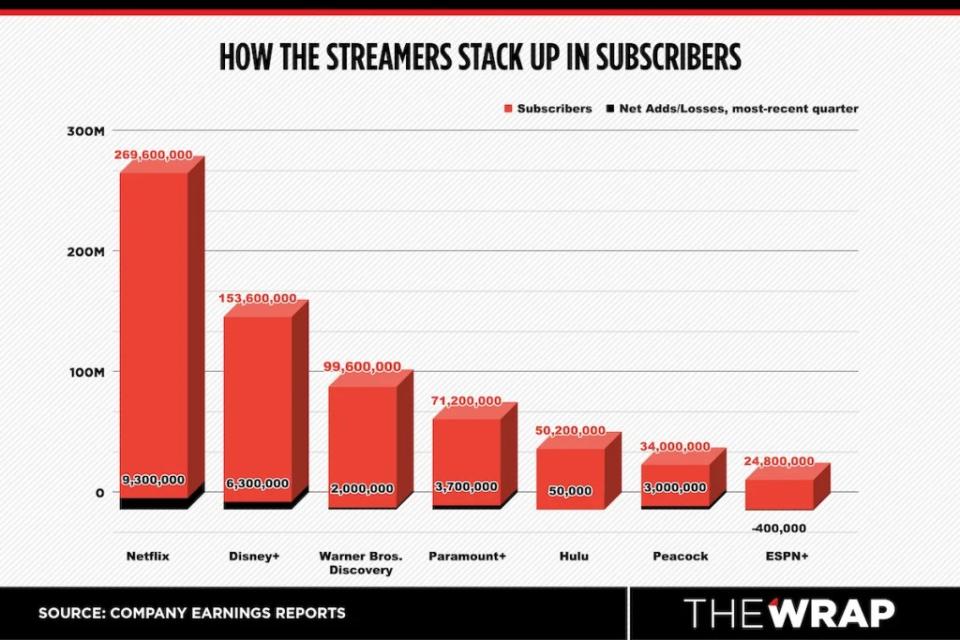

With the exception of ESPN+, all of the major streamers saw subscriber increases during the quarter.

In unsurprising news, Netflix finished the quarter on top on the subscriber front. Disney continued to hold the second place spot when looking at both Disney+ on its own and its three streaming services on a combined basis.

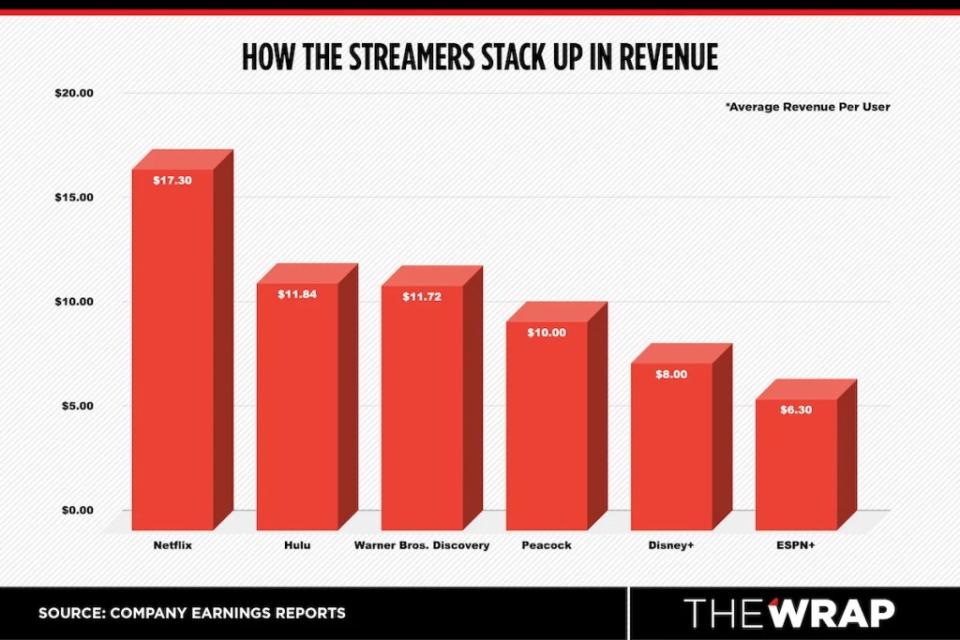

In average revenue per user, Netflix has continued to extend its lead over its legacy media competitors. Warner Bros. Discovery is closing the ARPU gap with Hulu as it looks to take over the second place spot, while Disney+ slipped slightly compared to the previous quarter.

This analysis does not include Apple TV+ and Amazon’s Prime Video, which do not disclose quarterly subscriber and ARPU figures. Following the launch of its ad-supported offering in January, Prime Video revealed that brands can reach 200 million monthly viewers, including 115 million in the United States.

Netflix

Netflix added 9.3 million subscribers during the first quarter of 2024 for a total of 269.6 million subscribers globally. The streamer added 2.53 million subscribers in the U.S. and Canada for a total of 82.66 million; 2.9 million in the Europe, Middle East and Africa (EMEA) region for a total of 91.73 million; 1.72 million in Latin America for a total of 47.72 million and 2.16 million in the Asia-Pacific region for a total of 47.5 million.

Average revenue per paid member (ARM), which grew 7% year over year to $17.30 in the U.S. and Canada, was flat at $10.92 in EMEA, fell 4% to $8.29 in Latin America and fell 8% to $7.35 in the Asia-Pacific region during the quarter.

Though it will stop reporting quarterly subscriber and ARM figures starting in the first quarter of 2025, Netflix said it would continue to provide a breakout of total revenue by region, as well as the impact of foreign exchange. It will also announce major subscriber milestones as it crosses them. Future guidance will consist of annual revenue guidance, annual operating margin and forecasts for free cash flow, quarterly revenue, operating income, net income and earnings per share.

After unveiling the first biannual report in December 2023, Sarandos revealed that the viewing report — which tallied some 18,000 titles that were watched for over 50,000 hours — would become even more “granular” over time.

“Our current report covers about 99% of the viewing on Netflix, but we’ll look at the regularity in different ways that we can make it even easier to track our progress on engagement,” he said. “Why we focus on engagement is because we believe it’s the single best indicator of member satisfaction with our offering, and it is a leading indicator for retention and acquisition over time. So, happy members watch more. They stick around longer. They tell friends, which all grows engagement, revenue, and profit, our North Stars.”

At its upfront presentation to advertisers earlier in May, Netflix also said its ad tier has surpassed 40 million monthly active users, up from 5 million a year ago, with over 40% of the streamer’s new sign-ups coming from the plan in the countries where it’s available. Over 70% of the company’s ad-supported members watch content for more than 10 hours per month. The company will bring its ad tech in-house with the launch of a new platform by the end of 2025.

Disney+, Hulu and ESPN+

In a milestone for Disney, the company’s entertainment direct-to-consumer business, which includes Disney+ and Hulu, turned an operating profit of $47 million, compared to a loss of $587 million in the prior-year quarter. But when including ESPN+, the DTC division reported a loss of $18 million, narrowing 97% from $659 million a year ago.

“We’ve said all along our path to profitability will not be linear,” Disney CEO Bob Iger told analysts. “While we’re anticipating a softer third quarter, due in large part to the seasonality of our Indian sports offerings, we fully expect streaming to be a growth driver for the company in the future and we have prioritized the steps necessary to achieve this.”

Disney warned that it does not expect to turn a profit in the entertainment streaming business in Q3 nor grow its core Disney+ subscribers. But it continues to anticipate that its combined streaming businesses will reach profitability in the fourth quarter, with further improvements in fiscal 2025.

In its second quarter of 2024, Disney+ reported a total of 153.6 million subscribers. The figure consisted of 117.6 million core subscribers, including 54 million subscribers in the U.S. and Canada and 63.6 million international subscribers excluding Disney+ Hotstar, which reported 36 million subscribers. The service has a total of 22.5 million ad tier subscribers globally.

Disney+’s domestic ARPU fell 2% to $8 due to a higher mix of wholesale subscribers, partially offset by increases in retail pricing. Disney+ core ARPU grew 6% to 44 cents due to price increases for the domestic premium tier and international ARPU growth. That was partially offset by lower ad supported ARPU domestically driven by dilution from entitlements from its carriage deal with Charter Communications. International Disney+ (excluding Disney+ Hotstar) ARPU grew 13% to $6.66 due to increases in retail pricing and a lower mix of subscribers to promotional offerings. Disney+ Hotstar ARPU fell 45% to 70 cents due to lower advertising revenue.

Hulu reported a total of 50.2 million subscribers, up 1% quarter over quarter. SVOD-only subscribers increased 2% to 45.8 million and SVOD and Live TV subscribers fell 2% to 4.5 million. Hulu’s SVOD-only ARPU fell 4% to $11.84 due to lower advertising revenue, partially offset by increases in retail pricing. Hulu Live TV + SVOD ARPU grew 1% to $95.01 due to increases in retail pricing and a lower mix of subscribers to promotional offerings, partially offset by lower advertising revenue.

ESPN+ subscribers fell 2% to 24.8 million, while ARPU for the streamer rose 3% from to $6.30 due to increases in retail pricing and higher advertising revenue.

Disney plans to begin rolling out its password-sharing crackdown in June, with a broader rollout in September. It will also bundle Disney+ and Hulu with Max in a new offering expected to launch this summer.

Warner Bros. Discovery

Warner Bros. Discovery’s direct-to-consumer division, which includes traditional HBO cable subscriptions and the Max and Discovery+ streaming services, reported a profit of $86 million, up 72% year over year.

WBD added 2 million subscribers during the quarter for a total of 99.6 million globally, ending the period with 52.7 million subscribers in the U.S. and Canada and 46.9 million internationally. Average revenue per user was $11.72 domestically, $3.75 internationally and $7.83 globally.

Warner’s CEO David Zaslav warned that U.S. subscriber growth would be impacted by some seasonality during the second quarter, particularly related to sports, but said the company is on track for “continued robust international growth” as it rolls out out Max to 29 countries across Europe. DTC revenue in the second quarter will be impacted by the timing of output deals renewed last year and the availability of content.

“Despite the heavy launch investments, I remain fully confident in our path to achieve our $1 billion+ EBIT target for 2025 and our growth ambitions thereafter,” WBD CFO Gunnar Wiedenfels added.

Max will begin cracking down on password-sharing later this year, with a broader rollout in 2025. In addition to the bundle with Disney+ and Hulu, Warner is teaming up with Disney and Fox on a sports streaming joint venture slated to launch this fall called Venu.

Paramount Global

Despite the uncertainty surrounding Paramount Global’s future, the media conglomerate’s direct-to-consumer division, which includes Paramount+ and Pluto TV, continued to progress towards profitability after narrowing its losses 44% to $286 million in its first quarter of 2024. Paramount previously said it would hit domestic streaming profitability in 2025.

The DTC division added 3.7 million subscribers for a total of 71.2 million. Paramount does not disclose its ARPU figures.

Ahead of the earnings call, Paramount revealed that CEO Bob Bakish would resign from his position and be replaced with an Office of the CEO comprised of CBS CEO and President George Cheeks, Showtime/MTV Entertainment Studios and Paramount Media Networks CEO Chris McCarthy and Paramount Pictures CEO Brian Robbins.

Executives declined to take questions or provide guidance during the earnings call. McCarthy said the trio is finalizing a strategic plan to position the company based on three pillars: making the most of hit content, strengthening its balance sheet and optimizing its streaming strategy.

Peacock

Peacock added 3 million paid subscribers in the first quarter of 2024 for a total of 34 million paid subscribers, a 55% increase compared to the prior year’s period. The NBCUniversal-owned streamer narrowed its adjusted EBITDA loss to $639 million in the first quarter of 2024, compared to $704 million in the prior year period. Its average revenue per user sits at around $10.

Executives touted the streaming release of the Oscar-winning “Oppenheimer” in February, which was the most-watched movie in the streamer’s history, and its exclusive NFL Wildcard game streamed during the quarter.

“We added and then retained even more new Peacock subscribers than we expected,” Comcast president Mike Cavanagh told analysts. “Overall, people are staying with us to engage in a broad range of content, spending 90% of their time on the platform viewing non-sports programming.”

Executives said they would continue to focus on subscriber retention, particularly in the second quarter. They added that Peacock’s content offering “provides such a great value proposition that we should have some real pricing power over time.”

The post How the Major Streamers Stack Up in Subscribers and Revenue | Charts appeared first on TheWrap.

Yahoo Finance

Yahoo Finance