Malaysia Set to Hold Key Rate as Risks From Subsidy Cuts Emerge

(Bloomberg) -- Malaysia is expected to keep its benchmark interest rate unchanged on Thursday, with policymakers mindful of potential price pressures from the government’s plans to further reduce fuel subsidies.

Most Read from Bloomberg

Saudis Warned G-7 Over Russia Seizures With Debt Sale Threat

Archegos’ Bill Hwang Convicted of Fraud, Market Manipulation

NATO Singles Out China Over Its Support for Russia in Ukraine

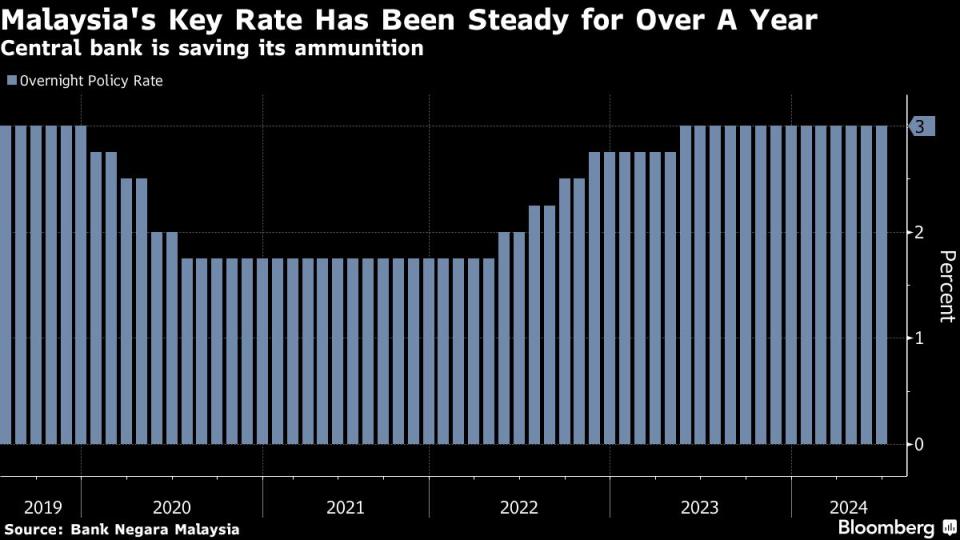

Bank Negara Malaysia will maintain the overnight policy rate at 3%, according to all 22 economists in a Bloomberg News survey. The central bank last adjusted borrowing costs in May 2023, with a 25-basis-point hike.

Consumer prices that rose just 2% in May from a year earlier are at risk of accelerating after the cost of diesel jumped 56% last month. That’s due to the government’s move to replace blanket diesel subsidies with targeted assistance. Prime Minister Anwar Ibrahim’s administration has announced a similar plan for RON95 — Malaysia’s most widely-used gasoline — later this year.

BNM will probably weigh the impact of the subsidy reform on inflation before making any moves. At the same time, Anwar is aiming to narrow the budget deficit to 4.3% of gross domestic product this year from 5% last year, in a move closely-watched by investors.

But the clock is ticking for the government if it wants to meet its budget deficit target for 2024, according to analysts. It must roll back the subsidies for RON95 this year.

Here’s what to watch out for in Thursday’s statement at 3 p.m. in Kuala Lumpur.

Inflation Guidance

The central bank may update its inflation outlook on Thursday. At its May 9 meeting, BNM had forecast a 2%-3.5% average consumer price increase this year that already considered the impact of a “gradual and sequential” removal of fuel subsidies.

Since then, the government has allowed diesel prices to rise.

Any guidance would be helpful to markets. The June price print — which will reflect the impact of higher diesel costs — will only be available later this month.

For now, the timing and size of adjustments to RON95 “remain a black box,” while the knock-on effect of the diesel reforms on prices of other goods and services is a “wild card,” according to analysts at Malayan Banking Bhd.

Ringgit Measures

BNM said last month it’s exploring more measures to ensure that the ringgit remains stable after the currency dipped to a 26-year low in February. Malaysia’s key rate remains at a record differential to the Federal Reserve’s.

The central bank’s intervention so far has borne fruit. Malaysia’s currency was among the few in Asia that didn’t weaken last quarter and is seen to extend gains into the remainder of the year.

“The ringgit has been relatively resilient to dollar gains this year. That should allow BNM to keep its policy rate steady for the rest of 2024,” said Bloomberg economist Tamara Henderson.

Growth Outlook

Malaysia’s growth story is looking positive. Its economic recovery accelerated in the first quarter, and exports continued to grow for a second straight month in May.

The country is set to benefit from a more resilient global economy, largely due to a more bullish outlook for its key trading partner, the US, according to BMI Research. Recent agreements signed between Malaysia and China may boost 2024 GDP growth above BMI’s 4.4% estimate, Fitch Solutions’ research unit said.

Malaysia should also continue to outperform its neighbors in tourism recovery, helped by easier visa requirements and improved passenger seat capacity, according to Wei Zheng Kit, an economist at Citigroup Inc. Electronics exports are also expected to strengthen in the second half of the year, he added.

--With assistance from Shinjini Datta and Ditas Lopez.

Most Read from Bloomberg Businessweek

At SpaceX, Elon Musk’s Own Brand of Cancel Culture Is Thriving

Ukraine Is Fighting Russia With Toy Drones and Duct-Taped Bombs

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance