Market report: Dividend hopes spark Tullow interest

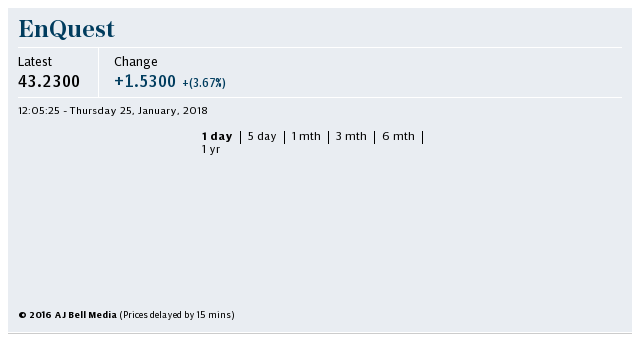

Hopes of a gush of bumper shareholder returns at mid-cap oil producers Tullow Oil and EnQuest boosted their shares towards the top of London’s leaderboard before a sudden crude price dip dampened their gains.

Oil explorers were forced to ramp up debt and cut dividends to survive the oil price crash when prices spiralled. But oil cartel Opec’s production cap boosting the price by 55pc in the last year has started to repair their battered balance sheets.

A long-established “truth” held by investors that European producers prefer to reinvest cash rather than hand out bumper returns is no longer valid, Barclays argued.

Tullow chief financial officer Les Wood hinted earlier this year that the FTSE 250 explorer could resume its dividend after a three-year hiatus.

Tullow debt concerns have been “addressed” and management is likely to balance accelerating production with rewarding investors, it told clients. Meanwhile, North Sea driller EnQuest ramping up production at its flagship Kraken field should have soothed concerns over missing previous guidance targets, Barclays added.

A double upgrade to “overweight” lifted EnQuest 1.2p to 34.9p but Tullow gave up a 4pc gain late on to close 0.7p lower at 229.2p, after crude prices suffered a sudden drop on a surprise increase in US crude stockpiles.

Elsewhere, mining giant Anglo American extended its rally to climb 47.2p to £17.22 as City analysts mulled over reports claiming that Vedanta Resources owner Anil Agarwal is plotting a swoop for the company’s South African assets. Jefferies warned the ambitious move could be difficult to pull off as other metal mammoths “surely have interest in parts of Anglo”, while Liberum admitted it struggles “with the logic” of a tie-up.

Market participants speculated that Countrywide’s 8.7p surge to 55.4p was underpinned by swirling merger talk following reports over the weekend linking the struggling estate agency with a tie-up with online rival Emoov.

RELX climbed 17.5p to £16.35 after HSBC initiated coverage of the analytics firm with a “buy” recommendation. Electronics distributor Electrocomponents inched 6.2p higher to 734.2p after maintaining double-digit revenue growth in the first quarter of its year. Retailer Next and water company Pennon slipped back 106p to £58.40 and 27.8p to 783.2p, respectively, after going ex-dividend.

European and US markets rallied on the eve of the introduction of tariffs on US and Chinese goods but the freefall in stocks in Shanghai continued.

The DAX outperformed its rivals amid a report in the German press claiming that the US ambassador to Germany has been asked to broker a deal that would eliminate tariffs on car imports on both sides of the Atlantic and remove other barriers.

The DAX, which includes automotive giants Daimler, Volkswagen and BMW, jumped 1.2pc, while Wall Street returned to trading on the front foot following Independence Day. The FTSE 100 lagged its peers on the Continent, climbing just 30.13 points to 7,603.22.

On currency markets, a rollercoaster day of trading for the pound ended in flat territory ahead of the Cabinet’s key Brexit meeting. Sterling pulled back to $1.3227 on a report claiming that Germany has deemed Theresa May’s new customs plan unworkable.

Yahoo Finance

Yahoo Finance