What to Watch: Stocks slide on Iran tensions, Sirius Minerals takeover, and Topps Tiles hit by election

Here are the top business, market, and economic stories you should be watching today in the UK, Europe, and abroad:

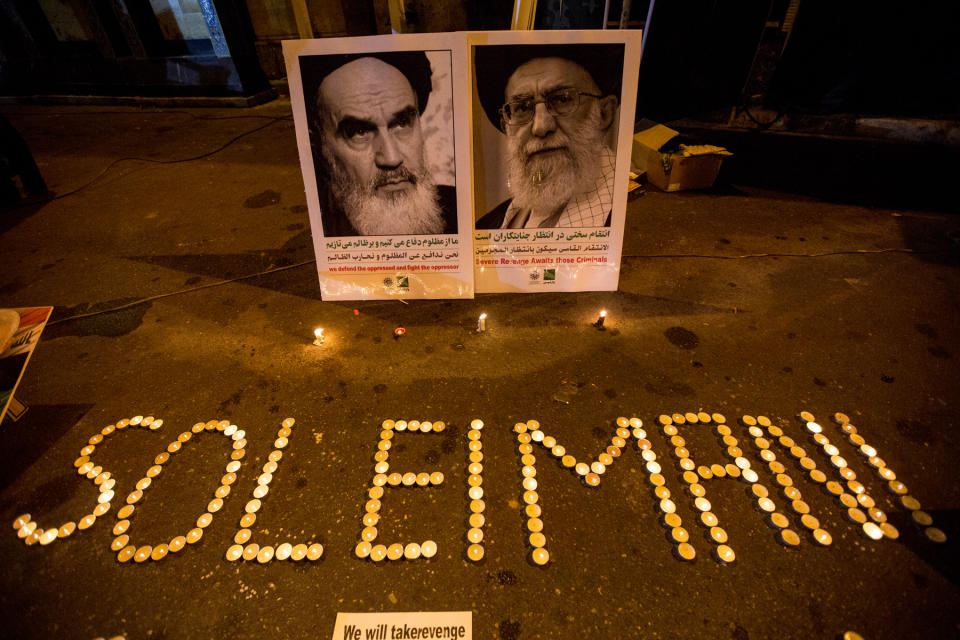

Stocks slide on Iran tensions

Shares sold off on Wednesday after Iran fired missiles at US-led forces in Iraq overnight.

The attacks came in retaliation for the killing of general Qasem Soleimani by the US last week.

By mid-morning, the FTSE 100 (^FTSE) was down 0.2%, Germany’s DAX (^GDAXI) was down 0.5%, France’s CAC 40 (^FCHI) dropped 0.4%, and the Euronext 100 (^N100) was down 0.3%.

Overnight in Asia, Japan’s Nikkei (^N225) closed down 1.5%, while the Hong Kong Hang Seng Index (^HSI) ended down 0.8%, and China’s Shanghai Composite (000001.SS) was off 1.2%.

While stocks were down, losses were limited by signs that the missile strikes by Iran could draw a line under tensions between the US and Iran. US President Donald Trump downplayed the attack on Twitter and the Iranians said they were willing to de-escalate tensions after their strike.

“President Trump refrained from making a statement right away after the attack and subsequently tweeted that ‘All is well!’ and ‘So far, so good!’ while adding that battle damage assessments continued,” Deutsche Bank strategists Jim Reid, Craig Nicol, and Henry Allen wrote in a morning note sent to clients.

“It’s also of note that in the past President Trump has shown restraint in previous attacks in the region blamed on Iran which didn’t kill any US citizens. This gives a glimmer of hope that this might not lead to an all-out escalation in the conflict.”

US stocks futures point to a slightly lower. S&P500 futures (ES=F) were down 0.1%, Dow Jones futures (YM=F) were down 0.2%, and Nasdaq futures (NQ=F) were down 0.1%.

The price of oil rose. Crude oil (CL=F) was up 0.3% to $62.91 a barrel, while the price of brent crude (BZ=F) rose 0.6% to $68.69.

Sirius Minerals up for sale

Troubled Sirius Minerals (SXX.L) is telling shareholder to back a potential £386m bid for the company from miner Anglo American, the firm announced on Wednesday.

Sirius is in late-stage talks with Anglo American over a potential offer of 5.5p per share. The company has been struggling to get its Yorkshire fertiliser mine off the ground and last September failed to raise enough money to unlock the bank loans needed to push ahead with the project. Shares in Sirius have fallen over 80% as the project has struggled.

Anglo American said in a statement it had been watching the project for some time and thought it would fit well in its portfolio “given the quality of the underlying asset in terms of scale, resource life, operating cost profile and the nature and quality of its product.”

The proposed 5.5p per share bid represents a premium of around 34% and shares in Sirius jumped 34% to meet the offer price.

Topps Tiles hit by election

Shares in Topps Tiles (TPT.L) slid over Christmas, with the flooring retailer blaming the general election for poor business.

Topps said sales in the 13 weeks to December 28 fell 5.4%. Chief executive Rob Parker said: “Our first-quarter performance reflects the full impact of the heightened political and economic uncertainty evident in the run up to December’s general election, which we first noted in our 2019 full-year results announcement.

“Trading conditions remained challenging throughout the period and, against this backdrop, we ensured that we continued to offer our customers excellent value for money”

Topps said trading improved after the election in mid-December, with a decline of just 1.4% in the final five weeks of the quarter compared to the same period a year earlier.

“As expected, the retail like-for-like sales decline began to return to its pre-election trend towards the end of the quarter,” Parker said.

Sainsbury's sales fall over Christmas after Argos slump

Sainsbury’s (SBRY.L) chief executive has insisted the supermarket group is heading in the right direction, despite a dip in sales over Christmas.

The supermarket, which also owns catalogue retailer Argos, said Wednesday that total sales fell by 0.7% in the 15 weeks to 4 January 2020. The performance was largely driven by a slump in sales at Argos.

Grocery sales at Sainsbury’s were stagnant over Christmas, growing by just 0.4%, although online grocery sales jumped by 7.3% in the period. Clothing sales of Sainsbury’s Tu range rose by 4.4%.

Sales of general merchandise, a proxy for Argos, dropped by 3.9%. Despite the fall, Sainsbury’s chief executive Mike Coupe said Argos “had its biggest digital Black Friday to date and record sales through mobile.”

Shares in Sainsbury’s fell 1.8% at the stock market open in London, before quickly rebounding to tradee up 0.2%. Analysts said the festive trading performance was better than forecast.

Greggs employees to get £7m bonus after ‘exceptional’ year

Greggs (GRG.L) on Wednesday said that full-year profits would come in slightly ahead of expectations and that it would pay employees a £7m ($9m) bonus after a “strong finish” to what it called an “exceptional” year for the company.

Total sales climbed by 13.5% in 2019, meaning that growth almost doubled last year, Greggs said in a trading update.

Greggs said the bumper growth was driven by strong demand across its traditional product range and the “huge popularity” of its vegan sausage roll.

The £7m payment to the company’s more than 20,000 employees will be made at the end of January “in recognition of their crucial contribution to business success”, Greggs said.

German industrial sector in ‘dire’ state

A drop in foreign demand caused a sharp drop in industrial orders in Germany in the month of November last year, keeping the sector mired in recession.

According to statistics released today by the Federal Economics Ministry, new orders contracted by 1.3% in November from the month before. Economists polled by Reuters had been expecting a rebound in November to 0.3% growth

“Despite some tentative positive signs from soft data that point to a bottoming out of the manufacturing slump, the hard reality looks completely different,” said Carsten Brzeski, chief economist at ING Germany. “Instead of a turnaround, the drought in order books and the manufacturing slump is getting worse.”

UK house prices leapt at fastest pace in a year on Tory victory

Property prices leapt at their fastest monthly rate in a year in December as the Conservative election victory helped “reignite” UK price growth, new figures suggest.

The latest monthly house price index from the bank Halifax shows prices rose 1.7% month-on-month in December, up from 1% in November.

It came as prime minister Boris Johnson’s decisive election victory in mid-December broke the Westminster deadlock over government efforts to pass key Brexit legislation, providing slight relief from political uncertainty.

The figures showed fairly rapid growth of 4% over the whole of 2019 despite political upheaval and weak UK economic growth, at the top of Halifax’s predicted range of between 2% and 4%.

Airline stocks drop as problems mount for Boeing and oil rises

Stocks in airlines and aerospace companies sold off on Wednesday morning, as another Boeing (BA) aircraft crashed, the plane manufacturer made concessions on its grounded 737 Max jet, and oil prices climbed.

A Boeing-737 plane with 176 people on board crashed in Tehran early on Wednesday morning. The plane was operated by a Ukrainian carrier and the Ukrainian embassy in Tehran said the crash was caused by an engine failure, according to the BBC. There were no survivors.

Separately on Tuesday, Boeing said it would bow to pressure and recommend pilots training to fly its 737-Max jets do so in a flight simulator. The manufacturer had resisted calls for simulator training as it would likely delay the roll-out of its new jet. The 737 Max has been grounded globally since March 2019, after two crashes that killed hundreds of passengers.

Elsewhere, rising tensions in the Middle East pushed oil prices higher, after Iran fired missiles at US bases in Iraq in retaliation for the killing of general Qasem Soleimani last week.

Shares in Ryanair (RYA.L) fell 1%, shares in British Airways-owner IAG (IAG.L) dropped 1.3%, and Norwegian Air (NAS.OL)’s stock fell 0.7%.

Engineering group Senior (SNR.L) dropped 0.7% in London. The company has previously warned that Boeing’s 737 Max issues would hit margins.

Rolls-Royce (RR.L), which builds engines for Boeing, was down 0.8%. Melrose Industries (MRO.L), which owns aerospace parts maker GKN, declined by 1.7%. In Paris, Safran (SAF.PA) lost 1%. The company makes landing gear and other components used in the 737 Max. In Frankfurt, MTU Aero Engines (MTX.F) lost 0.8%.

Yahoo Finance

Yahoo Finance