Markets Crave Stability From Starmer After Years of Crises

(Bloomberg) -- After a historic election night for British politics, there was one word that investors in the City of London kept using to characterize their hope for the next era of UK markets: stability.

Most Read from Bloomberg

Biden Narrows Gap With Trump in Swing States Despite Debate Loss

Hedge Funds That Piled Into Big Tesla Short Stung by Huge Rally

Money managers said they expect the Labour Party under Keir Starmer will usher in calmer and more moderate policy, turning the page on years of turmoil marked by the gilt crisis, Brexit and the Scottish referendum. Asset prices reflected that mood on Friday, although with modest enthusiasm given the election result had long been expected.

The pound climbed for a seventh day, its longest winning streak in four years, to touch a three-week high and trade around $1.28. The FTSE 100 Index added 0.3%, with homebuilders among the best performers.

The UK now stands in contrast to France, where the political system has been thrown into chaos by the rapid rise of Marine Le Pen’s far-right party, and the US, where President Joe Biden faces intense pressure to give up his reelection campaign.

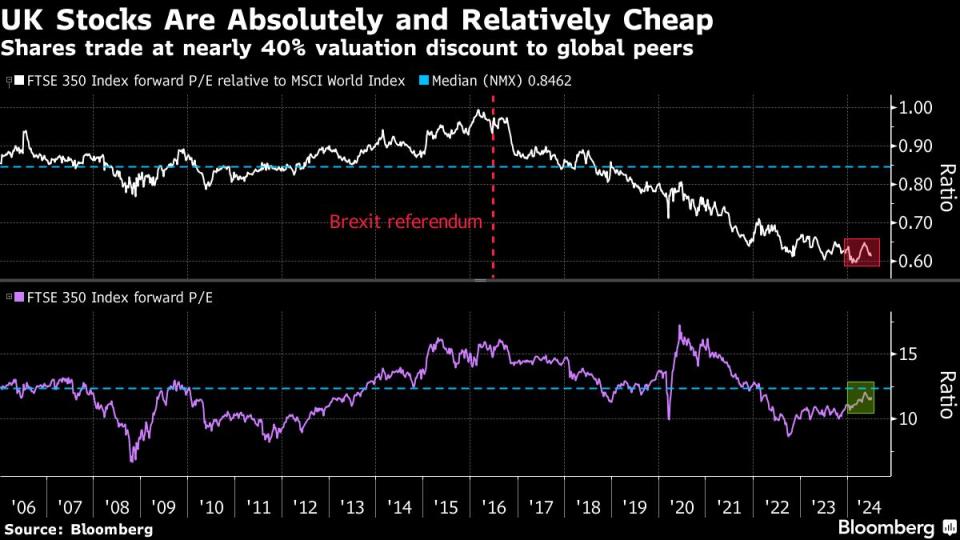

“I wouldn’t underestimate the benefit that UK assets are going to see from just having a period of stability in terms of government and policy making,” said Dean Turner, economist at UBS Global Wealth Management. “There’s always been a sense that there’s this discount around the UK given the high degree of political uncertainty. Now that’s been removed, investors can just focus on some of the more fundamental attractions.”

Read: UK Assets Are Back in Favor After Labour Victory, Investors Say

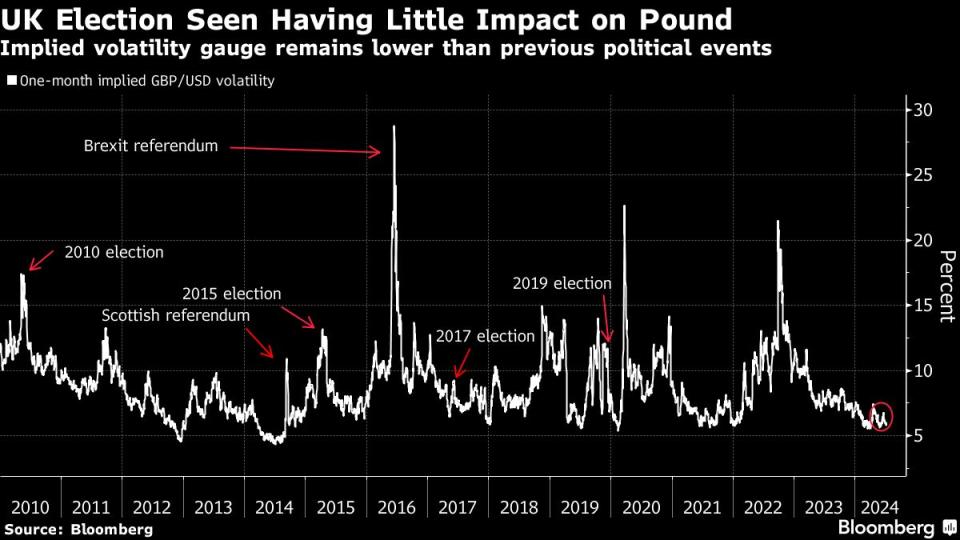

The UK’s transformation in the mind of investors can be most clearly seen in the pound. The currency has been the best performer across the Group-of-10 this year, bolstered by higher interest rates and the prospect of a slow and shallow easing cycle from the Bank of England. A gauge of expected price swings on sterling over the coming month fell to 5.76% this week, its lowest since May.

In addition, British government bonds are closer to becoming a safe-haven asset, according to Monica Defend, head of the Amundi Institute, who said the UK is scoring well on inflation and fiscal dynamics. In her view, gilts are a better bet for investors over US, German and French debt.

“A re-rating is merited and would be a big turnaround after the volatility seen during the years of UK political uncertainty,” she said.

The appeal of UK stocks is that they’re cheap and there’s a high weighting of energy and mining companies with steady earnings growth. Britain, alongside Spain, was named investors’ most favored European equity market in Bank of America Corp.’s recent fund manager survey.

Relentless messaging on fiscal discipline in the UK has left investors confident that Starmer and his Chancellor Rachel Reeves won’t do anything radical on spending or borrowing. Before the vote, Labour placed economic stability at the top of its manifesto and pledged to stick to tough spending rules.

Reeves, an ex-BOE staffer, has said that the administration would not raise three of the UK’s key taxes on wages and goods. Other promises included building more houses, creating a publicly-owned energy company and moving to “reset the relationship” with the EU — though Labour’s manifesto also ruled out a return to the single market or customs union.

“From a near-term perspective, stability is probably the one thing that investors can latch onto,” said James Athey, a portfolio manager at Marlborough Investment Management. “Looking further ahead, there’s still a minor concern about how far left their fiscal policies may shift over time.”

The incoming government is also inheriting a sluggish and fragile economy. While inflation has fallen back to the BOE’s 2% target, prices for services remain sticky. And a rebound from last year’s technical recession appears to be losing momentum, according to the most recent growth data.

For now, investors are counting on Labour to stick to their cautious policies, having learned the lessons from Liz Truss’s spending splurge that unleashed runaway selling in the bond market.

“With larger political uncertainty in France and the US, we may turn out to be the best looking pig in the sty,” said Craig Inches, the head of rates and cash at Royal London Asset Management.

--With assistance from Alice Gledhill and Michael Msika.

(Updates with latest market pricing in third paragraph.)

Most Read from Bloomberg Businessweek

Dragons and Sex Are Now a $610 Million Business Sweeping Publishing

The Fried Chicken Sandwich Wars Are More Cutthroat Than Ever Before

For Tesla, a Smaller Drop in Sales Is Something to Celebrate

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance