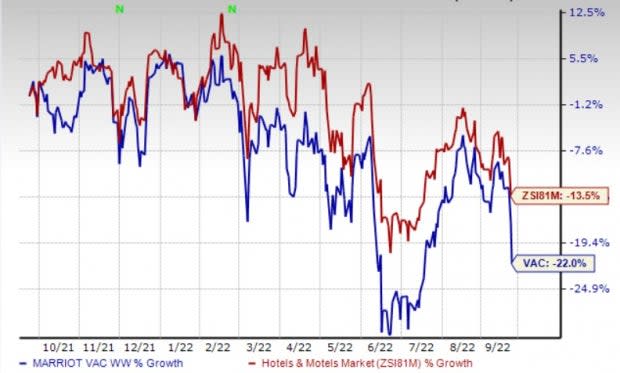

Marriott Vacations (VAC) Down 22% in a Year: Is the Worst Over?

Shares of Marriott Vacations Worldwide Corporation VAC have declined 22% in the past year compared with the industry’s decrease of 13.5%. The decline can be primarily attributed to the coronavirus pandemic.

Although the company’s shares have declined in the past year, the stock is likely to make a U-turn due to strong occupancy related to its Aqua-Aston business and solid contract sales. Also, focus on digitization initiatives bodes well. This Zacks Rank #1 (Strong Buy) company’s 2022 and 2023 earnings are likely to witness growth of 131.4% and 21.2%, respectively, year over year. You can see the complete list of today’s Zacks #1 Rank stocks here.

Growth Drivers

Marriott Vacations has been witnessing an improvement in occupancy rates, highlighting people’s willingness to go on vacations. During the second quarter of 2022, it reported solid occupancy with respect to its Aqua-Aston business. The company reported year-over-year growth in occupancies and RevPAR.

Image Source: Zacks Investment Research

The company also reported a solid recovery in domestic markets (Hawaii) and Asia-Pacific. Going forward, much optimism prevails as it noted increasing willingness among customers to resume travel. Meanwhile, the company stated that owner and preview reservations for the second half of 2022 were up 17% from 2019 levels.

Marriott Vacations continues to witness robust recovery during second-quarter 2022. While both occupancies and tours are witnessing growth in the second quarter, VPGs remain well above the 2019 levels. The company also reported benefits from its development and rental businesses.

VAC reported contract sales of $506 million in the second quarter of 2022, up 40% from the $362 million reported in the prior-year quarter. For the second half of 2022, VAC anticipates contract sales to grow double digits (on a year-over-year basis), backed by an increase in tours and strength in VPGs.

The company continues to make solid progress regarding the integration of Welk into its high vacation ownership business. In April 2022, the company rebranded Welk's points program as the Hyatt Vacation Club Platinum program and allowed the conversion of Welk sales centers to sell Hyatt-branded vacation ownership products.

The Platinum program includes expanded vacation benefits and access to a collection of upscale resorts. It stated that initiatives concerning Welk owners with the ability to trade their World of Hyatt points are in the pipeline.

During the second quarter of 2022, the company launched a new owner benefit and exchange program, Abound by Marriott Vacations. The program focuses on unifying Marriott branded vacation ownership products by providing access to more than 90 branded resorts (including Marriott Vacation Club, Sheraton Vacation Club and Westin Vacation Club) using a common points currency.

It also offers access to more than 8,000 Marriott Bonvoy hotels, 2,000 vacation homes and 2,000 unique experiences (cruises, guided and culinary tours, premiere events and outdoor adventures). The company intends to leverage the program with technological investments to drive growth in the upcoming periods.

Other Key Picks

Some other top-ranked stocks in the Zacks Consumer Discretionary sector are Hyatt Hotels Corporation H, Playa Hotels & Resorts N.V. PLYA and InterContinental Hotels Group PLC IHG.

Hyatt carries a Zacks Rank #2 (Buy). H has a trailing four-quarter earnings surprise of 798.8%, on average. The stock has increased 1.6% in the past year.

The Zacks Consensus Estimate for H’s current financial year sales and EPS indicates growth of 89.1% and 113%, respectively, from the year-ago period’s reported levels.

Playa Hotels & Resorts carries a Zacks Rank #2. PLYA has a trailing four-quarter negative earnings surprise of 8.8%, on average. The stock has declined 25.9% in the past year.

The Zacks Consensus Estimate for PLYA’s current financial year EPS indicates growth of 206.3% from the year-ago period’s reported levels.

InterContinental Hotels carries a Zacks Rank #2. IHG has a long-term earnings growth of 32.7%. The stock has declined 25.6% in the past year.

The Zacks Consensus Estimate for IHG’s current financial year sales and EPS indicates growth of 21.7% and 88.4%, respectively, from the year-ago period’s reported levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Intercontinental Hotels Group (IHG) : Free Stock Analysis Report

Hyatt Hotels Corporation (H) : Free Stock Analysis Report

Marriot Vacations Worldwide Corporation (VAC) : Free Stock Analysis Report

Playa Hotels & Resorts N.V. (PLYA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance