Mastercard (MA), Thought Machine Partner for Banking Innovation

Mastercard Incorporated MA recently solidified ties with Thought Machine, a company specializing in cloud native banking technology, in a bid to provide superior payment and core banking solutions for financial institutions.

The collective expertise built as a result of the latest collaboration involves combining Mastercard’s widespread global network and cutting-edge digital solutions with the advanced core banking and payments platform of Thought Machine. This, in turn, will empower financial institutions to swiftly transition from outdated core banking and payment technologies to modern cloud-native systems and therefore, extend hassle-free banking experiences to their customers.

These enhancements aim to support financial institutions in modernizing their technology infrastructure, focusing on critical back-end operations for product and account management, as well as the customer ledger.

In addition to this, the tie-up will focus on boosting efficiency, reducing costs and facilitating the rapid deployment of more integrated, personalized and customer-focused services. It will also enable banks to offer more advancements in pay-now solutions, especially through the digitization of debit cards linked to current accounts.

Therefore, the recent partnership is expected to lead to increased utilization of Mastercard’s solutions and fetch higher revenues for the company. The tech giant holds plans to expand the reach of its combined capabilities developed through the recent Thought Machine partnership in the days ahead. Thought Machine presently stands as the first strategic, end-to-end partner of MA in the core banking space. Meanwhile, the latest tie-up is likely to bolster the reach of Thought Machine’s core banking and payment platforms to various banks across the globe.

Additionally, such tie-ups bear testament to the continuous efforts of Mastercard to occupy a significant share of the global digital payments market and substantiate the trust that governments, businesses and consumers place in the tech giant for safer payments. MA remains steadfast in launching a diverse range of flexible payment solutions and resorting to partnerships with financial service providers to capture growth prospects in digitally booming countries.

Before the recent move, Mastercard and Thought Machine also joined forces in 2022, when the latter unveiled a cloud-native, payments processing platform, Vault Payments. MA played a crucial role by providing the necessary infrastructure and network support to enable Vault Payments to process virtual, physical and tokenized card transactions.

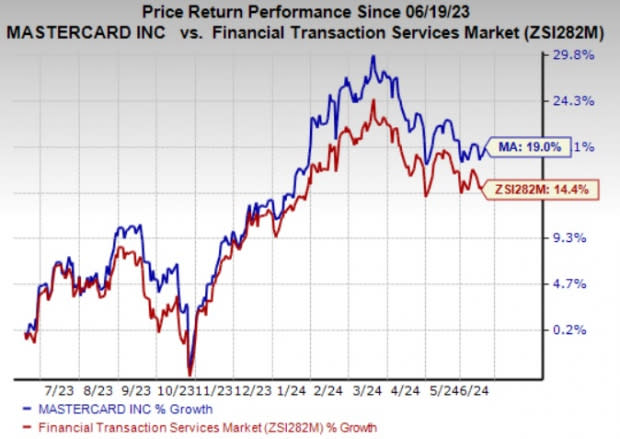

Shares of Mastercard have gained 19% in the past year compared with the industry’s 14.4% growth. MA currently carries a Zacks Rank #3 (Hold).

Image Source: Zacks Investment Research

Stocks to Consider

Some better-ranked stocks in the Business Services space are RB Global, Inc. RBA, Huron Consulting Group Inc. HURN and Global Payments Inc. GPN. While RB Global sports a Zacks Rank #1 (Strong Buy), Huron Consulting and Global Payments carry a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

The bottom line of RB Global outpaced estimates in each of the last four quarters, the average beat being 23.18%. The Zacks Consensus Estimate for RBA’s 2024 earnings indicates an improvement of 10% from the year-ago reported figure. The consensus mark for revenues implies growth of 16.8% from the year-ago reported number. The consensus mark for RBA’s earnings has moved 3.1% north in the past 30 days.

Huron Consulting’s earnings outpaced estimates in each of the trailing four quarters, the average surprise being 28.39%. The Zacks Consensus Estimate for HURN’s 2024 earnings indicates an improvement of 18.7% from the year-ago reported figure. The same for revenues implies growth of 10.2% from the year-ago reported number. The consensus mark for HURN’s earnings has moved 3.4% north in the past 60 days.

The bottom line of Global Payments outpaced estimates in each of the last four quarters, the average beat being 1.14%. The Zacks Consensus Estimate for GPN’s 2024 earnings indicates an improvement of 11.7% from the year-ago reported figure. The same for revenues implies growth of 6.4% from the year-ago reported number. The consensus mark for GPN’s earnings has moved 0.2% north in the past 60 days.

Shares of RB Global and Huron Consulting have gained 42.3% and 13.8%, respectively, in the past year. However, the Global Payments stock has declined 7.4% in the same time frame.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Mastercard Incorporated (MA) : Free Stock Analysis Report

Huron Consulting Group Inc. (HURN) : Free Stock Analysis Report

Global Payments Inc. (GPN) : Free Stock Analysis Report

RB Global, Inc. (RBA) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance