MasterCraft (NASDAQ:MCFT) Beats Q1 Sales Targets But Stock Drops

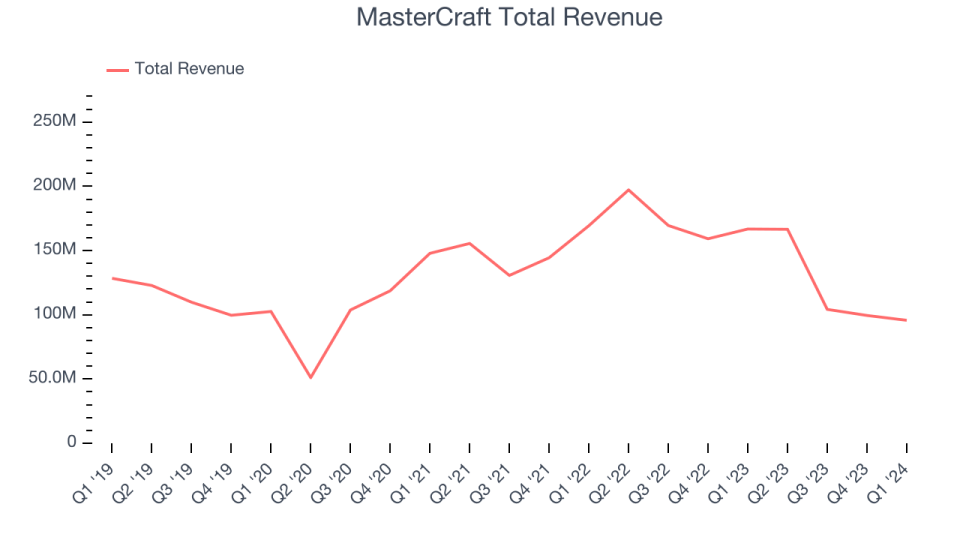

Sport boat manufacturer MasterCraft (NASDAQ:MCFT) announced better-than-expected results in Q1 CY2024, with revenue down 42.6% year on year to $95.71 million. On the other hand, the company's full-year revenue guidance of $362.5 million at the midpoint came in 10.6% below analysts' estimates. It made a non-GAAP profit of $0.37 per share, down from its profit of $1.36 per share in the same quarter last year.

Is now the time to buy MasterCraft? Find out in our full research report.

MasterCraft (MCFT) Q1 CY2024 Highlights:

Revenue: $95.71 million vs analyst estimates of $92.83 million (3.1% beat)

EPS (non-GAAP): $0.37 vs analyst estimates of $0.23 ($0.14 beat)

Gross Margin (GAAP): 19.2%, down from 25.5% in the same quarter last year

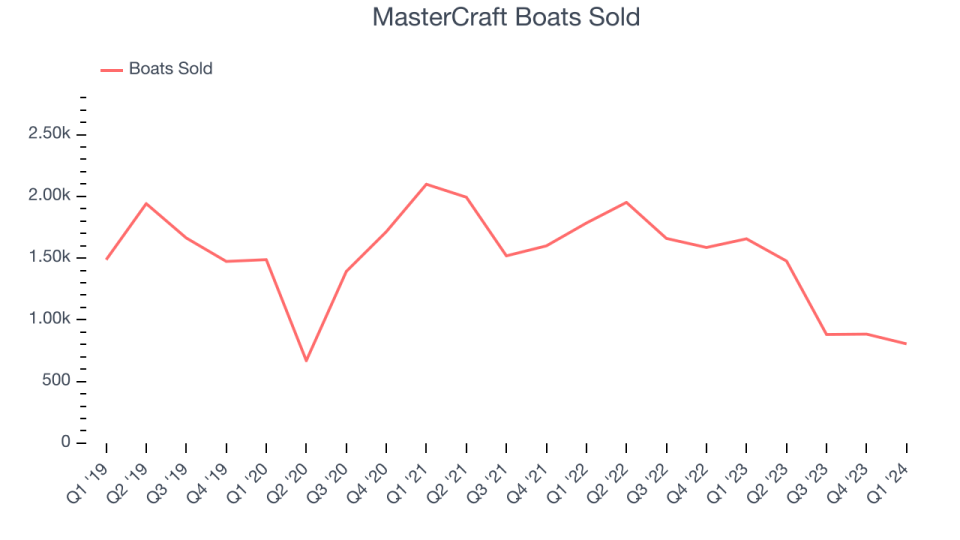

Boats Sold: 805

Market Capitalization: $342 million

Brad Nelson, Chief Executive Officer, commented, “We delivered results ahead of our expectations in what remains a dynamic and challenging environment for the marine industry. My first six weeks with our team has been energizing, and it is clear to me that our capabilities and opportunities are even greater than I anticipated. Since I joined the Company, I have been on the road meeting with and getting to know our team, our customers, dealers and business partners. The headline takeaways, are highly encouraging - the foundation of the business is strong, MasterCraft is home to iconic and leading brands, customers and dealers love our products, and the long-term outlook for the industry is bright. We are laser focused on and well-positioned to navigate the near-term challenges in our industry as we evolve our long-term growth strategy.”

Started by a waterskiing instructor, MasterCraft (NASDAQ:MCFT) specializes in designing, manufacturing, and selling sport boats.

Leisure Products

Leisure products cover a wide range of goods in the consumer discretionary sector. Maintaining a strong brand is key to success, and those who differentiate themselves will enjoy customer loyalty and pricing power while those who don’t may find themselves in precarious positions due to the non-essential nature of their offerings.

Sales Growth

A company’s long-term performance can give signals about its business quality. Even a bad business can shine for one or two quarters, but a top-tier one may grow for years. MasterCraft's annualized revenue growth rate of 1.2% over the last five years was weak for a consumer discretionary business.

Within consumer discretionary, a long-term historical view may miss a company riding a successful new product or emerging trend. That's why we also follow short-term performance. MasterCraft's recent history shows a reversal from its already weak five-year trend as its revenue has shown annualized declines of 11.9% over the last two years.

We can better understand the company's revenue dynamics by analyzing its number of boats sold, which reached 805 in the latest quarter. Over the last two years, MasterCraft's boats sold averaged 21% year-on-year declines. Because this number is lower than its revenue growth during the same period, we can see the company's monetization of its consumers has risen.

This quarter, MasterCraft's revenue fell 42.6% year on year to $95.71 million but beat Wall Street's estimates by 3.1%. Looking ahead, Wall Street expects revenue to decline 3.8% over the next 12 months.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

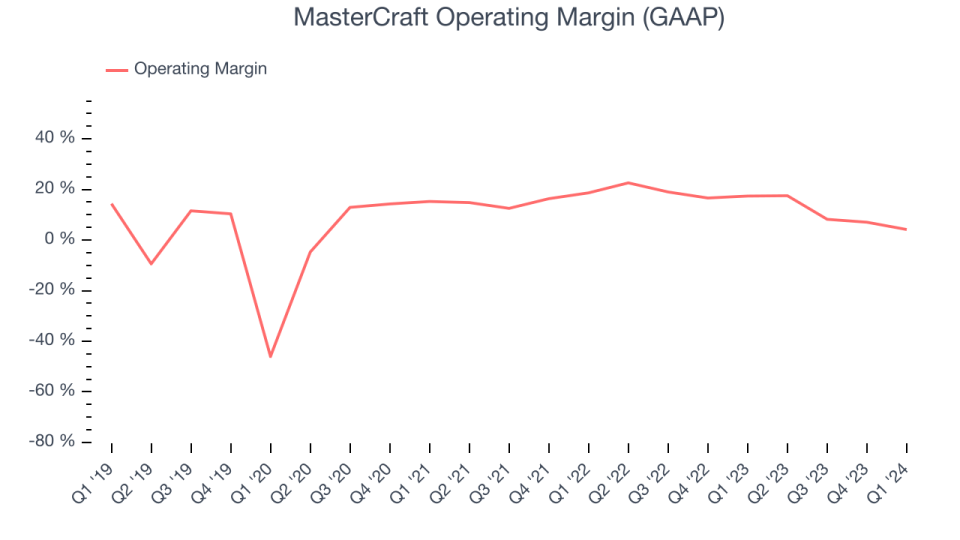

Operating Margin

Operating margin is an important measure of profitability. It’s the portion of revenue left after accounting for all core expenses–everything from the cost of goods sold to advertising and wages. Operating margin is also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

MasterCraft has managed its expenses well over the last two years. It's demonstrated solid profitability for a consumer discretionary business, producing an average operating margin of 15.6%.

In Q1, MasterCraft generated an operating profit margin of 4.2%, down 13.2 percentage points year on year.

Over the next 12 months, Wall Street expects MasterCraft to become less profitable. Analysts are expecting the company’s LTM operating margin of 10.5% to decline to 9%.

Key Takeaways from MasterCraft's Q1 Results

We were impressed by how significantly MasterCraft blew past analysts' EPS expectations this quarter. We were also glad its revenue outperformed Wall Street's estimates. On the other hand, its full-year revenue and EPS guidance fell short of Wall Street's estimates. Overall, this was a bad quarter for MasterCraft. The company is down 5.7% on the results and currently trades at $18.94 per share.

MasterCraft may have had a tough quarter, but does that actually create an opportunity to invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

Yahoo Finance

Yahoo Finance