May 2024 Insight Into High Insider Ownership Growth Companies On Chinese Exchange

As global markets navigate through varied economic signals, China's recent initiatives to stabilize its housing sector reflect proactive measures amidst broader market uncertainties. This strategic backdrop sets a pertinent stage for examining growth companies with high insider ownership on the Chinese exchange, where such alignment of interests between shareholders and management could signal resilience and potential growth in these turbulent times.

Top 10 Growth Companies With High Insider Ownership In China

Name | Insider Ownership | Earnings Growth |

KEBODA TECHNOLOGY (SHSE:603786) | 12.8% | 25.1% |

Zhejiang Songyuan Automotive Safety SystemsLtd (SZSE:300893) | 20% | 24.2% |

Suzhou Sunmun Technology (SZSE:300522) | 37.6% | 63.4% |

Sineng ElectricLtd (SZSE:300827) | 36.5% | 39.8% |

Arctech Solar Holding (SHSE:688408) | 38.7% | 24.5% |

Anhui Huaheng Biotechnology (SHSE:688639) | 31.5% | 28.4% |

Fujian Wanchen Biotechnology Group (SZSE:300972) | 15.3% | 75.9% |

UTour Group (SZSE:002707) | 24% | 33.1% |

Jilin University Zhengyuan Information Technologies (SZSE:003029) | 12.1% | 58.6% |

Offcn Education Technology (SZSE:002607) | 26.1% | 65.3% |

Here we highlight a subset of our preferred stocks from the screener.

Jiangsu LiXing General Steel BallLtd

Simply Wall St Growth Rating: ★★★★★☆

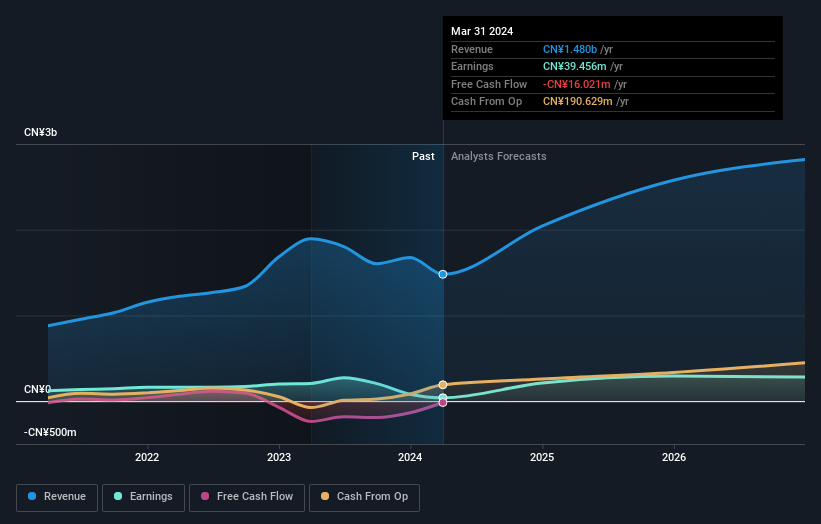

Overview: Jiangsu LiXing General Steel Ball Co., Ltd. specializes in the manufacture of steel balls used in various applications, with a market capitalization of approximately CN¥2.86 billion.

Operations: The company generates revenue primarily from its bearing manufacturing segment, totaling approximately CN¥975.24 million.

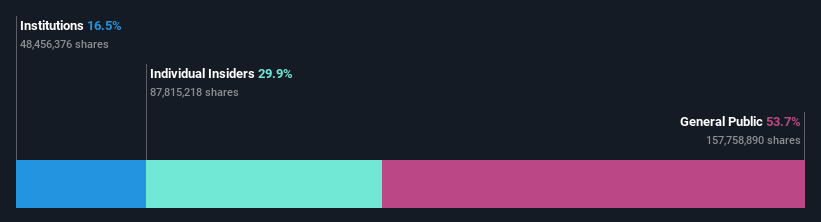

Insider Ownership: 29.9%

Jiangsu LiXing General Steel Ball Co.,Ltd., a Chinese firm with high insider ownership, shows promise with its substantial expected annual profit growth at 65.9% and revenue growth forecast of 39.6%, both outpacing the broader Chinese market significantly. However, its recent earnings report indicates a slight decline in net income and earnings per share compared to the previous year. Additionally, the company's dividend coverage is weak, suggesting potential cash flow concerns despite robust growth forecasts.

Broadex Technologies

Simply Wall St Growth Rating: ★★★★★☆

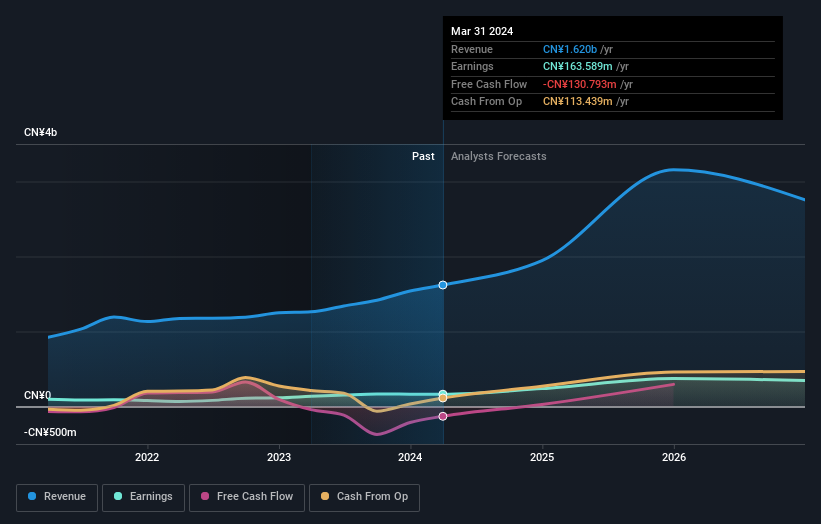

Overview: Broadex Technologies Co., Ltd. specializes in researching, developing, producing, and selling integrated optoelectronic devices for optical communications across both domestic and international markets, with a market capitalization of approximately CN¥6.77 billion.

Operations: The company generates revenue through the research, development, production, and sale of integrated optoelectronic devices for optical communications.

Insider Ownership: 15%

Broadex Technologies, despite a significant drop in Q1 earnings and revenue from the previous year, maintains a growth trajectory with expected annual earnings to increase by 47.42%. The company's revenue is also projected to grow at 22.7% per year, outstripping broader market expectations. However, challenges such as highly volatile share prices and recent shareholder dilution could temper investor enthusiasm. Upcoming corporate events might provide further insights into strategic directions and potential stabilization measures.

Jiangsu TongLin ElectricLtd

Simply Wall St Growth Rating: ★★★★★☆

Overview: Jiangsu TongLin Electric Co., Ltd. is a Chinese company involved in the research, development, and manufacturing of photovoltaic connection systems, PV power stations, electrical equipment, cables and wires, and industrial automation solutions with a market capitalization of approximately CN¥4.15 billion.

Operations: The company generates its revenue from the development and manufacturing of photovoltaic connection systems, PV power stations, electrical equipment, cables and wires, and industrial automation solutions.

Insider Ownership: 29.6%

Jiangsu TongLin Electric Ltd., currently trading at a significant discount to its estimated fair value, shows robust growth potential with earnings expected to increase by 34.5% annually. This growth surpasses the broader Chinese market's forecast of 23.2%. Additionally, revenue is also projected to rise significantly at 29.1% per year, outpacing the market expectation of 13.9%. Despite these positives, the company's return on equity is anticipated to remain low at 13.3% in three years' time, suggesting some efficiency challenges ahead.

Seize The Opportunity

Delve into our full catalog of 406 Fast Growing Chinese Companies With High Insider Ownership here.

Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include SZSE:300421 SZSE:300548SZSE:301168 and .

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance