May 2024 Insight Into SEHK Growth Companies With High Insider Ownership

As global markets exhibit a mix of cautious optimism and strategic adjustments in response to fluctuating inflation and interest rates, the Hong Kong market has shown resilience, particularly highlighted by a notable gain in the Hang Seng Index. In this environment, growth companies with high insider ownership in Hong Kong may offer unique investment opportunities, as such ownership can signal confidence from those closest to the company's operations and future prospects.

Top 10 Growth Companies With High Insider Ownership In Hong Kong

Name | Insider Ownership | Earnings Growth |

iDreamSky Technology Holdings (SEHK:1119) | 20.1% | 104.1% |

New Horizon Health (SEHK:6606) | 16.6% | 61% |

Meitu (SEHK:1357) | 38% | 34.3% |

Adicon Holdings (SEHK:9860) | 22.3% | 29.6% |

DPC Dash (SEHK:1405) | 38.2% | 91.5% |

Zylox-Tonbridge Medical Technology (SEHK:2190) | 18.5% | 79.3% |

Beijing Airdoc Technology (SEHK:2251) | 26.7% | 83.9% |

Zhejiang Leapmotor Technology (SEHK:9863) | 14.2% | 72.2% |

Biocytogen Pharmaceuticals (Beijing) (SEHK:2315) | 15.7% | 100.1% |

Ocumension Therapeutics (SEHK:1477) | 17.7% | 93.7% |

Let's explore several standout options from the results in the screener.

Beijing Fourth Paradigm Technology

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Beijing Fourth Paradigm Technology Co., Ltd. is an investment holding company that offers platform-centric artificial intelligence solutions in the People's Republic of China, with a market capitalization of approximately HK$24.22 billion.

Operations: The company generates revenue through three primary segments: the Sage AI Platform (CN¥2.51 billion), SageGPT AIGS Services (CN¥415.50 million), and Shift Intelligent Solutions (CN¥1.28 billion).

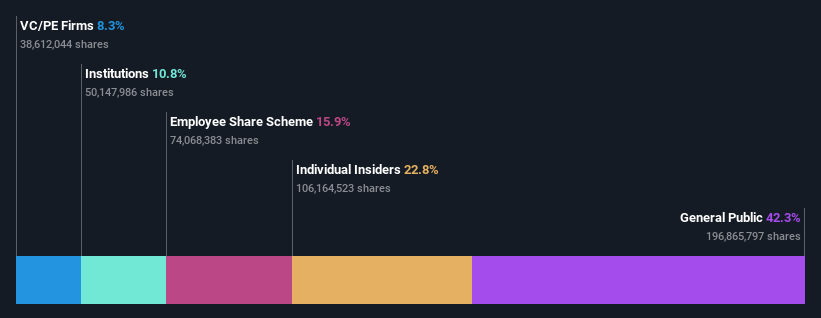

Insider Ownership: 22.8%

Revenue Growth Forecast: 19.3% p.a.

Beijing Fourth Paradigm Technology is anticipated to reach profitability within three years, with earnings expected to increase significantly at 95.97% annually. Despite a forecasted Return on Equity of only 6%, the company's revenue growth outpaces the Hong Kong market average, projected at 19.3% compared to the market's 8%. This growth follows a substantial revenue increase of 36.4% over the past year. However, share price volatility remains high, and insider trading activity has been minimal in recent months.

Angelalign Technology

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Angelalign Technology Inc. is an investment holding company that specializes in researching, developing, designing, manufacturing, and marketing clear aligner treatment solutions in the People's Republic of China, with a market capitalization of HK$12.91 billion.

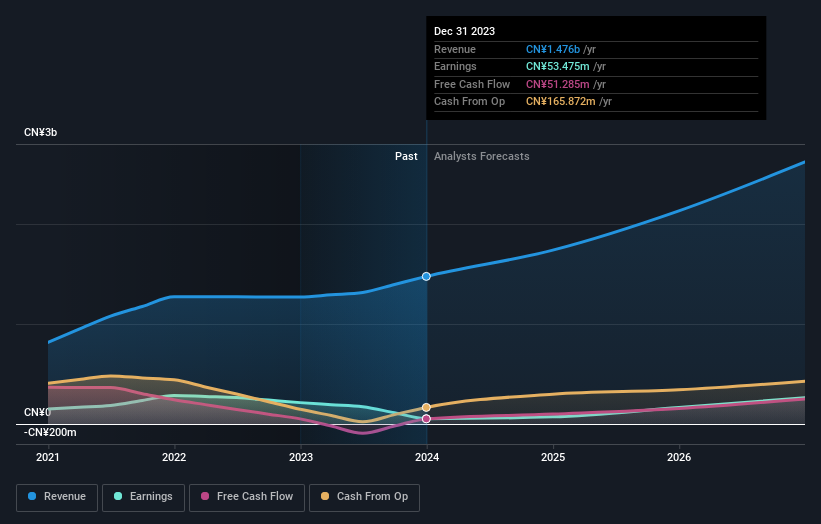

Operations: The company generates revenue primarily from its dental equipment and supplies segment, totaling CN¥1.48 billion.

Insider Ownership: 18.5%

Revenue Growth Forecast: 16% p.a.

Angelalign Technology Inc., while experiencing a decline in net profit margin from last year, is poised for substantial growth with earnings forecasted to increase by 50.29% annually over the next three years, outpacing the Hong Kong market's average. This growth is supported by recent expansions into the Canadian market and innovative product launches aimed at enhancing orthodontic treatment efficiency. However, a low forecasted return on equity of 7.4% tempers expectations slightly.

ClouDr Group

Simply Wall St Growth Rating: ★★★★☆☆

Overview: ClouDr Group Limited operates as an investment holding company, offering supplies and SaaS to hospitals and pharmacies, digital marketing services to pharmaceutical companies, and online consultation and prescriptions for chronic condition management, with a market cap of approximately HK$1.97 billion.

Operations: The company generates revenue primarily through its wholesale drug segment, which recorded CN¥3.69 billion in sales.

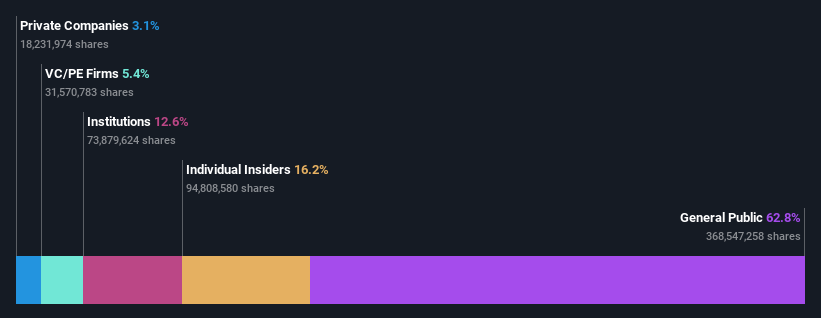

Insider Ownership: 16.2%

Revenue Growth Forecast: 19.7% p.a.

ClouDr Group, despite a highly volatile share price, is showing promising signs with its revenue forecast to grow at 19.7% annually, outstripping the Hong Kong market's average of 8%. The company's recent strategic moves, including launching Hetangjin Dapagliflozin Tablets and securing exclusive sales rights for Lixuwang® Xuesaitong Soft Capsules, are poised to bolster its market position. However, concerns linger due to a substantial net loss in 2023 and a low expected return on equity of 14.9% in three years.

Turning Ideas Into Actions

Dive into all 52 of the Fast Growing SEHK Companies With High Insider Ownership we have identified here.

Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Want To Explore Some Alternatives?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include SEHK:6682 SEHK:6699 and SEHK:9955.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance