MegazoneCloud Picks JPMorgan, Banks for IPO as AI Interest Grows

(Bloomberg) -- MegazoneCloud Corp. has selected firms including a unit of JPMorgan Chase & Co. to help it kickstart an initial public offering that could value one of Asia’s biggest cloud and AI services companies at several billion dollars.

Most Read from Bloomberg

Kamala Harris Is Having a Surprise Resurgence as Biden’s Campaign Unravels

Singapore Couples Are Marrying Earlier to Buy Homes, Leading Some to Regret

Biden’s Fourth of July Shrouded by Pressure to Drop 2024 Bid

Nasdaq 100 Up 1% as US Yields Tumble on Fed Wagers: Markets Wrap

The Korean cloud management company selected JPMorgan Securities, Samsung Securities Co. and Korea Investment & Securities Co. as lead underwriters for a public market float, according to people familiar with the matter. It gave secondary arranger roles to Bank of America Corp., Citigroup Global Markets Korea Securities Ltd. and KB Securities Co., the people said, asking not to be named discussing a private deal.

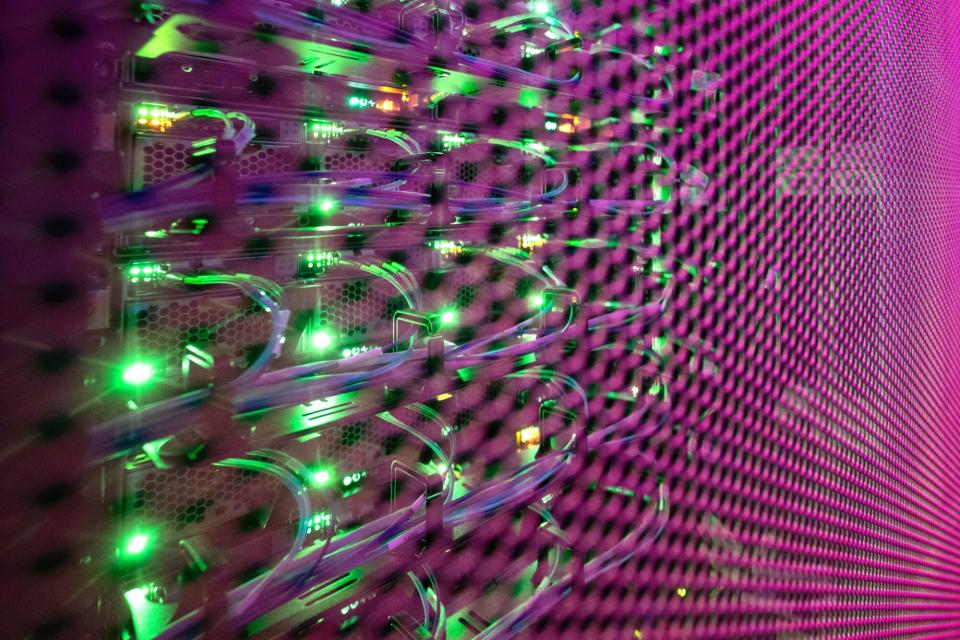

Backed by MBK Partners Ltd., MegazoneCloud is one of the biggest cloud service providers, helping link corporations to Amazon Web Services and other premium platforms. The startup aims to tap mounting investor interest in companies that provide the infrastructure to support AI development, from chipmakers to datacenter and online services providers.

The Seoul-based startup posted revenue of $1.2 billion in 2023 according to its website, and was valued at 2.4 trillion won ($1.7 billion) in 2022 when it secured capital from MBK Partners and IMM Private Equity Inc.

Representatives for the company and Citigroup declined to comment. Spokespeople for JPMorgan and Bank of America didn’t immediately respond to requests for comment. Samsung Securities, Korea Investment and KB Securities representatives weren’t immediately available for comment.

MegazoneCloud currently provides services such as cloud hosting, data analysis and generative AI services to over 7,000 clients, according to the company. It joins a growing pipeline of Asian IPOs this year.

South Korea has become one of the busiest spots for equity sales in Asia amid efforts by local authorities to enhance corporate governance. About $1.9 billion of Korean IPOs have priced so far this year, up 72% from a year ago as investors flocked to deals. Among the more anticipated debuts this year is that of Korean gaming studio Shift Up, which lists next week.

Korean Game Maker Shift Up’s IPO Draws Big Attention: ECM Watch

--With assistance from Filipe Pacheco.

Most Read from Bloomberg Businessweek

Dragons and Sex Are Now a $610 Million Business Sweeping Publishing

For Tesla, a Smaller Drop in Sales Is Something to Celebrate

The Fried Chicken Sandwich Wars Are More Cutthroat Than Ever Before

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance