Merck's (MRK) Lung Cancer Candidate Faces FDA Rejection

Merck MRK and its partner Daiichi Sankyo announced that the FDA has issued a complete response letter (“CRL”) to the biologics license application (BLA) seeking accelerated approval for patritumab deruxtecan for previously-treated EGFR-mutated non-small cell lung cancer (NSCLC).

The BLA seeks approval for patritumab deruxtecan, a specifically engineered potential first-in-class HER3-directed DXd antibody drug conjugate (ADC), to treat adult patients with locally advanced or metastatic EGFR-mutated NSCLC previously treated with two or more systemic therapies.

The FDA’s CRL was based on observations made after the inspection of a third-party manufacturing facility. The FDA has not requested any additional efficacy/safety studies, nor has it identified any issues related to the safety and efficacy of the candidate. Merck said it will work closely with the FDA and the third-party manufacturer to resolve the issue.

The BLA was supported by data from the HERTHENA-Lung01 pivotal phase II study. The study demonstrated an objective response rate of 29.8%, while the median duration of response (DoR) was 6.4 months.

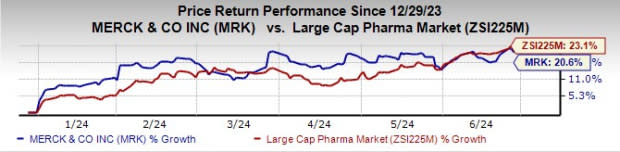

Merck’s stock has risen 20.6% so far this year compared with an increase of 23.1% for the industry.

Image Source: Zacks Investment Research

Merck acquired global co-development and co-commercialization rights to patritumab deruxtecan/MK-1022 and two other ADCs, raludotatug deruxtecan/MK-5909 and ifinatamab deruxtecan/MK-2400 from Daiichi Sankyo in October last year for a total potential consideration of up to $22 billion. While raludotatug deruxtecan is being developed in phase II/III study for ovarian cancer, ifinatamab deruxtecan is being studied for colorectal and small-cell lung cancer in phase II. Daiichi Sankyo has retained exclusive rights for the development of the candidates in Japan.

ADCs are being considered a disruptive innovation in the pharmaceutical industry as these will enable better treatment of cancer by harnessing the targeting power of antibodies to deliver cytotoxic molecule drugs to tumors.

Daiichi Sankyo has six ADCs in clinical development across multiple types of cancer. It markets Enhertu, a HER2-directed ADC for HER2-mutated breast, lung and gastric cancers, in partnership with AstraZeneca AZN. Daiichi Sankyo and AstraZeneca have also developed datopotamab deruxtecan (Dato-DXd), a TROP2-directed ADC. Dato-DXd is under FDA review for advanced nonsquamous NSCLC as well as previously treated metastatic HR-positive, HER2-negative breast cancer. The sixth ADC candidate is DS-3939, a TA-MUC1-directed ADC, which Daiichi Sankyo is developing on its own.

Pfizer also has a strong portfolio of ADC drugs, which were added with last year’s acquisition of Seagen. The December 2023 acquisition of Seagen added four ADCs — Adcetris, Padcev, Tukysa and Tivdak — to Pfizer’s portfolio. Adcetris, Padcev, Tukysa and Tivdak contributed $257 million, $341 million, $106 million and $28 million, respectively, to Pfizer’s oncology revenues in the first quarter of 2024.

On Jun 25, the FDA also issued a CRL to AbbVie’s ABBV new drug application seeking approval for pipeline candidate, ABBV-951, for the treatment of motor fluctuations in patients with advanced Parkinson's disease. This was the second CRL issued for ABBV-951 by the FDA. AbbVie received the first CRL in March last year.

Merck has a Zacks Rank #3 (Hold) currently. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Merck & Co., Inc. Price and Consensus

Merck & Co., Inc. price-consensus-chart | Merck & Co., Inc. Quote

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

AstraZeneca PLC (AZN) : Free Stock Analysis Report

Merck & Co., Inc. (MRK) : Free Stock Analysis Report

AbbVie Inc. (ABBV) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance