Mettler-Toledo (MTD) Q1 Earnings & Sales Beat, Increase Y/Y

Mettler-Toledo International, Inc. MTD reported first-quarter 2023 adjusted earnings of $8.69 per share, which beat the Zacks Consensus Estimate by 0.9%. The bottom line also improved by 10% on a year-over-year basis.

Net sales of $928.74 million were up 3% on a reported basis and 7% on a currency-neutral basis from the year-ago quarter’s respective readings. The figure surpassed the Zacks Consensus Estimate of $907 million.

Solid momentum across all the segments, especially the Food Retail segment in the reported quarter, drove the top line. The strong performance delivered across the Americas, Europe and Asia/Rest of the World contributed well.

We believe portfolio strength, cost-cutting efforts, margin and productivity initiatives and robust sales and marketing strategies are expected to remain tailwinds for the company.

Top Line in Detail

By Segments: MTD reports revenues under three segments, namely Laboratory Instruments, Industrial Instruments and Food Retail, which accounted for 56%, 38% and 6% of net sales in the first quarter, respectively. The Laboratory, Industrial and Food Retail segments witnessed year-over-year improvements of 5%, 7% and 36%, respectively, in the quarter under review.

By Geography: Total sales from the Americas, Europe and Asia/Rest of the World contributed 40%, 27% and 33% to net sales in the first quarter, respectively. Sales in the Americas, Europe and Asia/Rest of the World went up 6%, 6% and 10%, respectively, on a year-over-year basis.

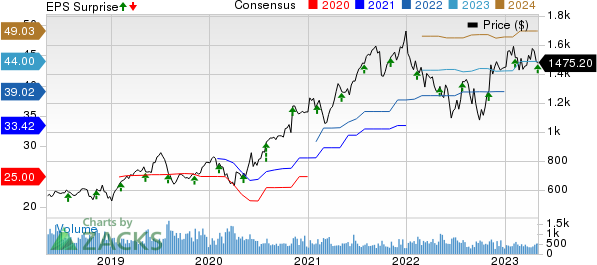

Mettler-Toledo International, Inc. Price, Consensus and EPS Surprise

Mettler-Toledo International, Inc. price-consensus-eps-surprise-chart | Mettler-Toledo International, Inc. Quote

Operating Results

The gross margin was 58.9%, expanding 100 basis points (bps) year over year.

Research & development (R&D) expenses were $45.5 million, up 5.7% from the year-ago quarter’s figure. Selling, general & administrative (SG&A) expenses decreased 0.3% year over year to $234.6 million.

As a percentage of sales, R&D expenses expanded by 10 bps year over year to 4.9%. SG&A expenses contracted 90 bps year over year to 25.3%.

The adjusted operating margin was 28.7%, which expanded 180 bps from the prior-year quarter’s level.

Balance Sheet & Cash Flow

As of Mar 31, 2023, Mettler-Toledo’s cash and cash equivalent balance was $89.1 million, down from $95.9 million as of Dec 31, 2022.

Long-term debt was $2.015 billion at the end of the first quarter compared with $1.908 billion at the end of the fourth quarter.

Mettler-Toledo generated $153.3 million in cash from operating activities in the reported quarter, down from $303.6 million in the previous quarter. Free cash flow was $135.3 million in the reported quarter.

Guidance

For second-quarter 2023, Mettler-Toledo projects sales growth of 3% in local currency from the year-ago quarter’s reported figure. The Zacks Consensus Estimate for second-quarter sales is pegged at $1 billion.

Adjusted second-quarter earnings are anticipated to be $9.90-$10.00 per share, implying a 5-7% rise from the year-ago quarter’s reported number, which includes a foreign-currency headwind of 6%. The Zacks Consensus Estimate for earnings is pegged at $10.44 per share.

For 2023, Mettler-Toledo expects sales growth in local currency of 5% from the year-earlier tally. The Zacks Consensus Estimate for 2023 sales is pegged at $4.1 billion.

Mettler-Toledo anticipates 2023 adjusted earnings within $43.65-$43.95 per share, suggesting growth of 10-11% from the year-ago reported number. The Zacks Consensus Estimate for the same is pegged at $44.00.

Zacks Rank & Other Stocks to Consider

Currently, Mettler-Toledo has a Zacks Rank #3 (Hold).

Investors interested in the broader technology sector can consider some better-ranked stocks like Agilent Technologies A, DigitalOcean DOCN and Paycor HCM PYCR, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Agilent Technologies is set to report second-quarter fiscal 2023 results on May 23. The Zacks Consensus Estimate for A’s earnings is pegged at $1.27 per share, implying growth of 12.4% from the year-ago quarter’s reported figure. A has lost 11.6% in the year-to-date period.

DigitalOcean is scheduled to release first-quarter 2023 results on May 9. The Zacks Consensus Estimate for DOCN’s earnings is pegged at 29 cents per share, suggesting a jump from 7 cents per share reported in the prior-year quarter. DOCN has gained 25.5% in the year-to-date period.

Paycor HCM is scheduled to report third-quarter fiscal 2023 results on May 10. The Zacks Consensus Estimate for PYCR’s earnings is pegged at 15 cents per share, suggesting an increase of 36.4% from the prior-year quarter’s reported figure. PYCR has gained 26% in the year-to-date period.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Agilent Technologies, Inc. (A) : Free Stock Analysis Report

Mettler-Toledo International, Inc. (MTD) : Free Stock Analysis Report

DigitalOcean Holdings, Inc. (DOCN) : Free Stock Analysis Report

Paycor HCM, Inc. (PYCR) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance