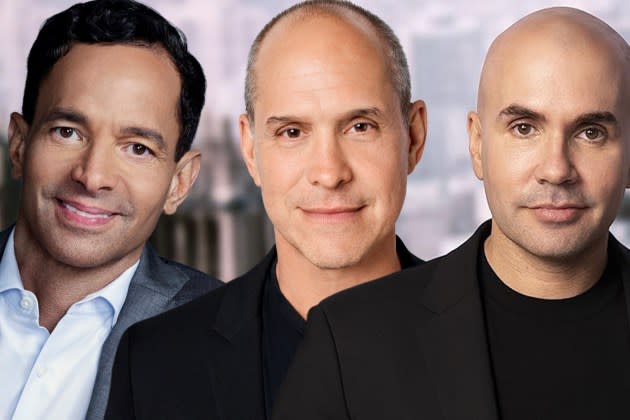

Is The Mission Possible For Paramount’s Crowded Corner Office? CEO Troika Settles In As Layoffs And Asset Sales Loom

Paramount Global’s unorthodox Office of the CEO, which started as a presumed placeholder, is turning into a longer-term fixture poised to once again reshape the tempest-tossed company.

Consisting of three top Paramount execs – George Cheeks, Chris McCarthy and Brian Robbins – the Office replaced Bob Bakish when the former CEO was ousted in late April.

More from Deadline

Rather than shepherding the legacy company through a regulatory process with Skydance Media, Cheeks, McCarthy and Robbins must now turn to implementing their strategic plan. Core elements include layoffs, non-content cost reductions, asset sales and potential streaming partnerships. A number of levers will be pulled in an effort to pay down the company’s debt load of $14 billion and otherwise improve the balance sheet.

The trio will be given time – from six months to a year or even 18 months, per various estimates by those close to the situation – to improve Paramount’s financial standing before Redstone entertains another sale, sources tell Deadline.

The turnover at the top coincided with the final stretch of the exclusive merger talks with Skydance, which Bakish opposed. With the combination regaining momentum and mere hours from gaining final board approval, Paramount’s controlling shareholder Shari Redstone last week abruptly pulled out of the talks. She instead signed off on the strategy developed by the Troika, as the three execs are commonly known.

In a presentation to shareholders at the company’s annual meeting on June 4, Redstone acknowledged that the three-way scheme is “not a traditional management structure.” But she said it would enable the three execs to “move quickly to implement best practices throughout the company and to drive improved performance.”

More Cuts

At the meeting, Cheeks revealed that $500 million in cost reductions have been identified. That means more layoffs at a company that has already been through considerable de-layering, restructuring and staffing cuts since the 2019 close of the Viacom-CBS merger. Workforce reductions could begin later this summer, sources tell Deadline. Priority rankings have been developed by various departments. Layoffs are expected to reach all corners of the company, with corporate and marketing among the impacted areas. Cheeks said he sees the end result being “a leaner, more nimble company that’s better positioned to win.”

In a possible harbinger, General Counsel Christa D’Alimonte, the third-highest-paid Paramount executive in 2023 with nearly $5.8 million in total pay, told colleagues Tuesday she will exit at the end of the month.

Corporate triumvirate

Multiple insiders tell Deadline the waters have been relatively calm as the Troika has settled in, with some seeing the lack of new ownership as a reason to feel relieved despite all the uncertainty. Yet many outside the Melrose gates or Times Square tower see a potential storm brewing.

Charles Elson, a retired professor of finance at the University of Delaware and founding director of the Weinberg Center for Corporate Governance, emphasized the uniqueness of the Paramount setup in an interview. “I have never heard of a CEO troika,” he said. “I have also always felt that even having co-CEOs doesn’t work because ultimately one of them ends of dominating.”

A similar skepticism has arisen on Wall Street, and during their annual meeting presentation Cheeks, McCarthy and Robbins even teased the company’s second-quarter earnings call, buying some additional time. “Details remain sparse” about how the company will evolve, complained analyst Robert Fishman of MoffettNathanson in a recent note to clients.

While the belief is widespread that the three execs were placed into the scenario as a “bake-off” designed to identify which of them (if any) is suited to ultimately be solo CEO, colleagues note that the three have spent years in close contact. After Cheeks arrived in 2020 to lead CBS, he, McCarthy, then head of ViacomCBS’ Entertainment & Youth division, and Robbins, at the time head of Nickelodeon before adding Paramount Pictures oversight in 2021, started a text chain and have maintained it ever since.

People who have interacted with the three in meetings and other settings say they show no outward sign of friction or competition. They have operated “in complete lock-down mode,” as one source put it, without leaks or deviations from the plan, knowing they are under scrutiny by Redstone and the financial community, a newly prominent perch for the three show business lifers. If they wind up exiting in the coming quarters – multiple offers for National Amusements, the family entity led by Redstone that holds nearly 80% control of voting shares, remain on the table – it won’t hurt their career prospects to have a buttoned-up run in the corner office under their belts.

For Sale

Asset sales will now be another key priority. During Bakish’s tenure, the company netted about $3 billion from the sale of Simon & Schuster and signature real estate holdings like New York’s “Black Rock” CBS home base and L.A.’s Radford studio lot. Even so, two ripe opportunities for new revenue did not come to pass. BET Media (which includes the legacy cable network, streaming service BET+ and a production studio) was put on the market and then ultimately pulled back after the company said offers were not sufficient. The company also fielded multiple bids for Showtime, ranging from $3 billion to $6 billion, but wound up passing.

While BET will likely go back on the market, the door may have closed on Showtime. Paramount opted to use it to help fuel the growth of streaming flagship Paramount+. The decision did bring in new subscribers, but it left a hole where a nearly half-century-old entertainment brand used to be. The Showtime linear network is officially now called Paramount+ with Showtime and its original programming roster has been pared down almost entirely to extensions of Dexter, Billions and other franchises, leaving little to sell.

Other pieces of the empire on the way out include MaxPreps. Deadline sister publication Sportico reported last week that the high school sports digital brand acquired by CBS for $43 million in 2007 is on the block. A number of other units, especially digital outfits acquired by CBS Interactive before the reunion with Viacom, could be shaken loose depending on their assessed value.

A potential sale of Pluto, the streaming service acquired by Viacom in 2018 and now worth several billion dollars, has also been discussed internally, sources tell Deadline, though it’s not officially on the block. Pluto’s free, ad-supported model has been a good fit with that of CBS and the outlet has grown into a billion-dollar business during the Viacom-Paramount years. Even so, continuing to operate it could stretch the bandwidth needed for Paramount+, which has lost billions in the race against better-funded rivals like Netflix and Disney.

The struggle to reduce losses at Paramount+ are a key reason for the company’s financial woes and the recent decline of its stock price, which has dropped below $10 this week, its lowest level since the 2019 close of the merger. Unveiled in 2021 as a rebrand and expansion of CBS All Access, Paramount+ has grown to 71 million subscribers. Losses are diminishing but remain steep – the figure was $286 million in the first quarter, down 44% year-over-year.

People familiar with Skydance’s strategic plan for Paramount indicated it would have maintained Paramount+ as a stand-alone. But few sources familiar with leadership’s current thinking envision that being the most likely path. McCarthy alluded during the annual meeting to “a great deal of inbound interest” in a potential team-up. Earlier this year, Comcast and NBCUniversal execs held talks with Paramount about a potential combo of Peacock and Par+, though the discussions didn’t bear fruit. Observers believe that duo would still make sense, with Amazon’s Prime Video also among suitable potential partners.

Joint ventures, as the ultimate case study of Hulu attests, can be complicated, of course, with dueling priorities and shared proceeds. But they do substantially lower operating costs.

As Cheeks, McCarthy and Robbins set off to lead Paramount through major obstacles and painful cuts over the coming months in their roles as CEOs, Redstone’s shadow will continue to loom large. Like is the case with many family-run companies, her control is absolute.

“Whether you have one CEO or 10 CEOs, it’s still Shari’s show,” Elson said.

Best of Deadline

2024 Premiere Dates For New & Returning Series On Broadcast, Cable & Streaming

All the Surprise Songs Taylor Swift Has Played On The Eras Tour So Far

Sign up for Deadline's Newsletter. For the latest news, follow us on Facebook, Twitter, and Instagram.

Yahoo Finance

Yahoo Finance