Momentum Alert: 3 Top Ranked Stocks Leading the Market (APP, STEP, VST)

If you're wondering why I always talk about momentum, take a look at the chart below. It shows how the momentum factor has clearly been the winner this year compared to several other factor investing methods.

The blue line represents the S&P 500, which has delivered a 16% year-to-date return. The orange line depicts the momentum factor (MTUM), which has outperformed the S&P 500 by 10% so far this year. Notably, both high-dividend (IWD) and value (VYM) strategies have significantly underperformed the market, as shown below the index line. In yellow, we can see that the growth factor (IWF) has also been a winner this year.

Image Source: TradingView

One Problem with Momentum and How to Avoid it

Sometimes, when you screen for momentum stocks, you find companies that are rocketing higher, but have one minor problem – they’re just too expensive.

One of the stocks that originally showed up on this screener was Cava Group, Inc. (CAVA). The stock and company are on fire and has been of the best performing stocks in the market. However, it carries an uber premium valuation around 270x forward earnings and 10x forward sales.

I am not saying you shouldn’t buy it, but for me that leaves too large a margin for error. I would rather screen for stocks that enjoy reasonable valuations, that are bolstered by strong growth in sales and earnings.

Today, I filtered for stocks with a forward earnings multiple below 30x, that way there is less risk of a painful correction as a reasonable earnings multiple can limit the downside risk.

AppLovin: The Stock that Has it All

AppLovin (APP) is a mobile technology company that acts as a hub for app developers. It provides a variety of tools to assist developers in growing their apps and businesses. This includes helping developers make money through in-app advertising, offering marketing and user acquisition solutions to find new users, and supplying analytics tools to track app performance.

Essentially, AppLovin equips developers with everything they need to succeed in the competitive mobile app market.

AppLovin has everything I look for in a stock. The business model is rock solid, being asset-light with high margins. Additionally, the business has huge long-term tailwinds as online ad sales are growing every year, positioning it perfectly industry-wise. The digital advertising market is forecast to grow at a CAGR of 15.5% through 2030.

The company not only has high sales and earnings forecasts, with EPS projected to grow 20% annually over the next three to five years, but it also boasts a very reasonable valuation. Moreover, it has held a Zacks Rank #1 (Strong Buy) rating for much of the last 18 months and has tremendous momentum behind it.

Finally, AppLovin has been conducting share buybacks, reducing shares outstanding by more than 10% in the last three years.

The technical setup stands out to me as well. APP stock has been building out this bull flag over the last two months, and if the price can trade through the $82.70 level, would signal a breakout.

Image Source: TradingView

StepStone Group: Leader in Private Market Investments

StepStone Group (STEP) is a global private markets investment firm specializing in providing customized investment solutions and advisory services. Established in 2007 and headquartered in New York City, StepStone serves a diverse client base, including public and private pension funds, sovereign wealth funds, insurance companies and endowments. The firm's expertise spans a wide array of asset classes, including private equity, private debt, real estate, and infrastructure.

With the explosion in popularity of private market investments, and the general trend of many leading companies forgoing an IPO, StepStone Group has been extremely well positioned. Today, the company is managing $156 billion in assets, and has grown the AUM 21% annually over the last five years.

StepStone Group also boasts a Zacks Rank #1 (Strong Buy) rating. Earnings estimates have been nearly unanimously upgraded across timeframes.

The company is anticipating strong growth in both sales and earnings as well. Current year sales are expected to climb 18.4% YoY and EPS by 40.5%, while next year’s sales are expected to grow 17.2% YoY and EPS by 22%.

StepStone enjoys a reasonable valuation, currently trading at 26.7x forward earnings and pays a tidy dividend yield of 1.85%.

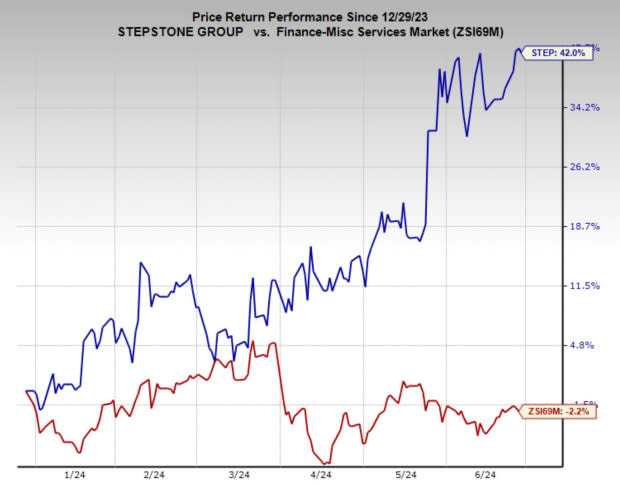

Finally, the company shows impressive momentum, outperforming the broad market and respective industry by huge margins.

Image Source: Zacks Investment Research

Vistra: Powering the AI Boom

Until last year, Vistra (VST) was like other utility companies, a sleepy, albeit steady earner that paid shareholders a nice dividend. But the AI revolution has changed that dramatically, positioning Vistra as one of the primary energy providers for the explosion in compute power for AI.

Because Vistra is a large producer of nuclear energy as well as low-to-no-CO2-emitting renewable assets, it has been an obvious choice for tech companies looking to power their now overworked data centers.

Vistra is also a shareholder friendly company, reducing shares outstanding by 28% in the last three years, and paying a steady and rising dividend over that time.

Analysts have been steadily raising earnings estimates over the last year and more recently giving the stock a Zacks Rank #1 (Strong Buy) rating. EPS are forecast to grow 10% this year and 36.2% next year, while sales are projected to climb 15% this year and 11% next year.

The price of the stock along with the earnings revision trend has skyrocketed in the last 18 months, and momentum is still behind it. Yet even with all that price appreciation, Vistra still trades with a forward earnings multiple of 21.7x.

Image Source: Zacks Investment Research

Final Thoughts

Reasonable valuations, growing profits, top Zacks Ranks, and huge momentum – what else can you ask for in a stock.

For investors looking to add some high-flying stocks to their portfolio’s, Vistra, StepStone Group and AppLovin are worthy considerations.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

AppLovin Corporation (APP) : Free Stock Analysis Report

Vistra Corp. (VST) : Free Stock Analysis Report

StepStone Group Inc. (STEP) : Free Stock Analysis Report

CAVA Group, Inc. (CAVA) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance