Mr Kipling sales momentum bolsters Premier Foods

Premier Foods (PFD.L) revealed in its half year results that its Mr Kipling brand — which makes an assortment of British cakes — has helped boost profits.

In the 26 weeks ended 28 September 2019, Mr Kipling brand sales rose by 8%, helping bolster overall revenue to £366.7m ($470.5m). Pretax profits jumped 5% to £31.7m for Premier Foods, which also owns Ambrosia and Oxo.

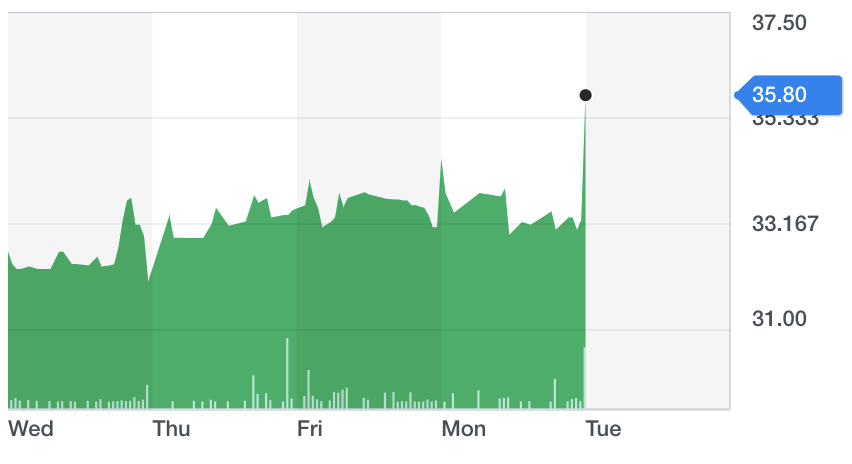

Shares moved to the upside on the rise in revenue and profit.

"We have launched a number of new product ranges including our new plant-based brand Plantastic and our International business returned to growth in Q2. Due to our strong cash generation, our Net debt11 has reduced by £38.8m compared to the same point last year,” added Alex Whitehouse, CEO Premier Foods, in the group’s results statement.

"I am also announcing a new Executive Leadership team structure which provides us with sharper consumer, customer and operational focus. Our operational strategy is unchanged, but we now have increased energy and impetus.

Whitehouse added that the group will be looking at “largely operational cost savings over the next two years” but the first half of the year outperformed expectations.

“We are confident in our expectations for progress in the full year. As we look a little further ahead, and in light of our disciplined and consistent track record of net debt reduction, we start to see options for our future deployment of cash,” he said.

Yahoo Finance

Yahoo Finance