Murray Stahl's Recent Transaction in Associated Capital Group Inc

Overview of Murray Stahl (Trades, Portfolio)'s Stock Transaction

On December 31, 2023, Murray Stahl (Trades, Portfolio)'s firm Horizon Kinetics made a notable adjustment to its investment portfolio by reducing its stake in Associated Capital Group Inc (NYSE:AC). The transaction involved the sale of 37,852 shares at a price of $35.71 each, resulting in a total holding of 1,142,514 shares. This move had a minor impact of -0.03% on the firm's portfolio, with the position in AC now representing 0.81% of the total investments and accounting for 43.30% of the company's outstanding shares.

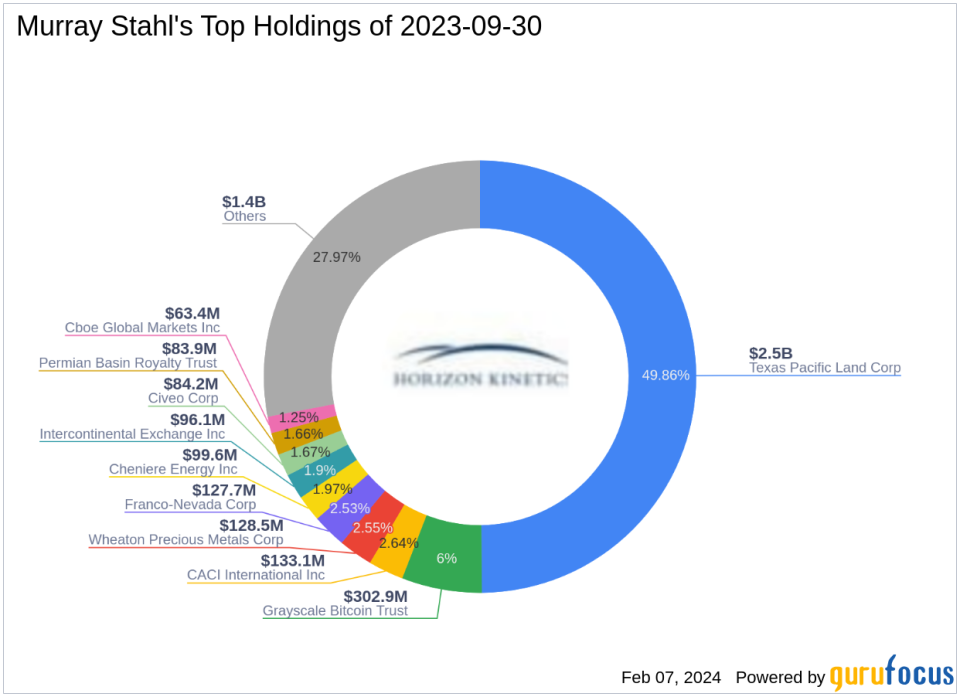

Profile of Murray Stahl (Trades, Portfolio)

Murray Stahl (Trades, Portfolio) stands as the CEO and Chairman of Horizon Kinetics, a firm he co-founded, bringing over three decades of investment expertise to the table. Stahl's role extends to Chief Investment Officer and head of the Investment Committee, influencing key portfolio management decisions. His investment philosophy is rooted in value and contrarian principles, emphasizing long-term investment horizons over short-term market trends. Horizon Kinetics is known for its independent, fundamental research and contrarian investment strategies that often diverge from the market's short-term focus.

Associated Capital Group Inc Overview

Associated Capital Group Inc, trading under the symbol AC in the USA, is a diversified financial services entity specializing in alternative investment management and institutional research services. Since its IPO on November 9, 2015, the company has been engaged in delivering research notes and reports based on its private market value with a catalyst methodology. With a market capitalization of $700.636 million and segments in investment advisory and incentive fees, AC has established a presence in the asset management industry. However, the company's stock is currently considered modestly overvalued with a GF Value of $27.64 and a price to GF Value ratio of 1.17.

Analysis of the Trade Impact

The recent reduction in shares of Associated Capital Group by Murray Stahl (Trades, Portfolio)'s firm reflects a minor adjustment in the portfolio, with a trade impact of just -0.03%. Despite this, the firm maintains a significant position in the company, holding 43.30% of AC's shares. This trade action aligns with Stahl's investment philosophy, which may indicate a strategic move based on the firm's long-term value assessment of AC.

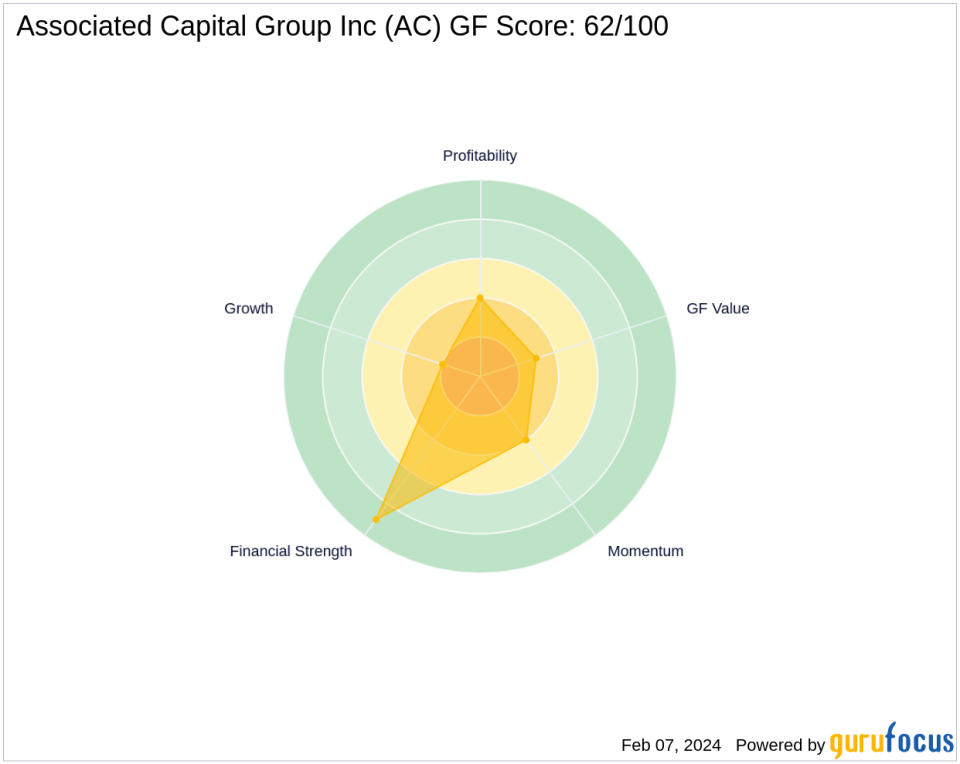

Market Performance of Associated Capital Group Inc

Associated Capital Group's stock price has seen a decline to $32.45, representing a -9.13% change since the trade date and a -7.29% change year-to-date. The stock has experienced a 48.38% increase since its IPO, but its current valuation suggests a modest overvaluation. The GF Score of 62/100 indicates a potential for poor future performance, with the stock's Profitability Rank at 4/10 and Growth Rank at 2/10.

Sector and Portfolio Context

Murray Stahl (Trades, Portfolio)'s top holdings include companies like CACI International Inc (NYSE:CACI) and Franco-Nevada Corp (NYSE:FNV), with a strong preference for the Energy and Financial Services sectors. The firm's equity stands at $5.05 billion, and the recent trade in AC seems to be a tactical decision within the context of the firm's broader investment strategy.

Comparative Insight

While specific data on the largest guru shareholder in Associated Capital Group Inc is not provided, it is known that GAMCO Investors holds a significant position in the company. Comparatively, Murray Stahl (Trades, Portfolio)'s firm holds a substantial share, indicating a strong conviction in the potential of AC within the asset management industry.

Final Assessment

For value investors, Murray Stahl (Trades, Portfolio)'s recent transaction in Associated Capital Group Inc may signal a nuanced shift in the firm's investment strategy. Considering the stock's current GF Score and valuation metrics, investors should weigh the long-term potential of AC against the broader market trends and Horizon Kinetics' investment philosophy. The trade's implications, alongside the stock's GF Value Rank and other performance metrics, suggest a cautious approach to this asset management player.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance