Myriad Genetics (MYGN) Banks on Innovation Amid Macro Woes

Myriad Genetics’ MYGN strong product portfolio raises our optimism. The company’s impressive growth strategy also encourages us. However, macroeconomic issues impede growth. The stock carries a Zacks Rank #3 (Hold) currently.

Myriad Genetics has so far made significant progress with its three strategic imperatives. First, the company is developing best-in-class quality products, services and accessibility to accelerate growth and reach more patients across diverse backgrounds. Second, the company is building new enterprise capabilities to accelerate growth, leverage its scope and scale, and capture market opportunities, including M&A. Third, the company is committed to disciplined execution on the key set of initiatives to fulfill its mission and drive long-term growth and profitability.

Going by the first strategy, Myriad Genetics continues to gain share in the hereditary cancer market, with volumes rising 9% year over year in the first quarter of 2024, driven by competitive account wins and increased adoption by providers of myRisk. The company continues to enhance its customer targeting, digital marketing and overall operating model to drive commercial leverage in 2024 and beyond.

In terms of the second strategy, of late, Myriad Genetics announced several new exciting strategic partnerships, including an expanded collaboration with Illumina to combine its unique diagnostic development and commercial capabilities to expand its emerging biopharma business and broaden access to HRD testing in the United States.

The company also entered into a research collaboration with the National Cancer Center Hospital East in Japan to study the prognostic and predictive value of molecular residual disease (MRD) testing.

In line with the third strategy, the company maintains a disciplined approach to cost management and expects to sustain strong gross margins. Moreover, the company is also committed to effective capital deployment in key areas that will improve customer experience, including new tech-enabled tools and capabilities, innovation, commercial capabilities and labs of the future.

In the first quarter, reflecting the impact of these initiatives, MYGN’s gross margin expanded 72 basis points (bps) to 68.1%.

Myriad Genetics continues to gain customer acceptance, banking on its slew of products.

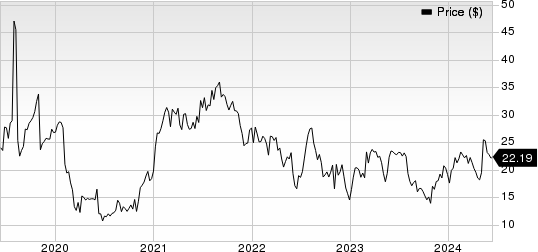

Myriad Genetics, Inc. Price

Myriad Genetics, Inc. price | Myriad Genetics, Inc. Quote

In March 2024, Myriad Genetics announced the issuance of a patent by the United States Patent and Trademark Office, which will strengthen its ability to deliver a tumor-informed, high-definition MRD assay to the market.

During the first quarter, management noted that it is expected to launch the Foresight Universal Plus expanded carrier screening test in the context of anticipated ACOG expanded guidelines. This new test will feature an expanded panel as well as more efficient and cost-effective workflows. These guideline expansions would also support its multiple prenatal screening tests like FirstGene, which the company plans to launch later in 2024.

On the flip side, Myriad Genetics has been grappling with escalated expenses for a while. Deteriorating international trade and global inflationary pressure leading to a tough situation related to raw material and labor costs, as well as freight charges and rising interest rates, have put the medical device space in a tight spot. All these are creating significant pressure on the company’s profitability.

Myriad Genetics incurred an adjusted operating loss of $27.9 million in the first quarter compared with $52.2 million in the year-ago quarter.

Myriad Genetics receives a considerable portion of its revenues and pays a portion of its expenses in foreign currencies. As a result, the company remains at risk of exchange rate fluctuations between foreign currencies and the U.S. dollar. If the dollar strengthens against foreign currencies, the translation of these foreign currency-denominated transactions will result in decreased revenues, operating expenses and net income. Management fears the declines may not be significantly outweighed by increased revenues.

Moreover, management does not currently utilize hedging strategies to mitigate foreign currency risk. This is also worrying given that currently the dollar has strengthened, affecting many U.S. companies trading in foreign currencies in some of the previous quarters.

In the year ended Dec 31, 2023, the company recognized a loss related to foreign currency of $(3.4) million.

Key Picks

Some better-ranked stocks in the broader medical space are Hims & Hers Health HIMS, Medpace MEDP and ResMed RMD, each presently sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks Rank #1 stocks here.

Hims & Hers Heath stock has surged 131.3% in the past year. Estimates for the company’s earnings have remained constant at 18 cents for 2024 and increased 3.1% to 33 cents for 2025 in the past 30 days.

HIMS’ earnings beat estimates in three of the trailing four quarters and missed in one, delivering an average surprise of 79.2%. In the last reported quarter, it posted an earnings surprise of a staggering 150%.

Estimates for Medpace’s 2024 earnings per share have moved up to $11.29 from $11.23 in the past 30 days. Shares of the company have surged 84% in the past year compared with the industry’s 4.7% growth.

MEDP’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 12.8%. In the last reported quarter, it delivered an earnings surprise of 30.6%.

Estimates for ResMed’s fiscal 2024 earnings per share have moved to $7.70 from $7.64 in the past 30 days. Shares of the company have declined 1.8% in the past year against the industry’s rise of 4.9%.

RMD’s earnings surpassed estimates in three of the trailing four quarters and missed in one, the average surprise being 2.8%. In the last reported quarter, it delivered an earnings surprise of 10.9%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

ResMed Inc. (RMD) : Free Stock Analysis Report

Myriad Genetics, Inc. (MYGN) : Free Stock Analysis Report

Medpace Holdings, Inc. (MEDP) : Free Stock Analysis Report

Hims & Hers Health, Inc. (HIMS) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance