National Bank to Buy Western Canada Rival for $3.6 Billion

(Bloomberg) -- National Bank of Canada agreed to buy Canadian Western Bank for about C$5 billion ($3.6 billion) in stock in a tie-up of two of the country’s regional lenders.

Most Read from Bloomberg

US Inflation Broadly Cools in Encouraging Sign for Fed Officials

Blinken Casts Doubt on Cease-Fire Hopes After Hamas Responds

Hunter Biden Was Convicted. His Dad’s Reaction Was Remarkable.

Stock Bull Run Breaks Record on Fed Decision Day: Markets Wrap

The acquirer will pay the equivalent of C$52.24 a share for Canadian Western, a premium of 110% over the target’s closing price on Tuesday, according to a statement. The purchase requires the approval of the Canadian government and two-thirds of CWB’s shareholders, who are poised to vote on the proposal at a special meeting in September. The deal is expected to be completed by the end of next year.

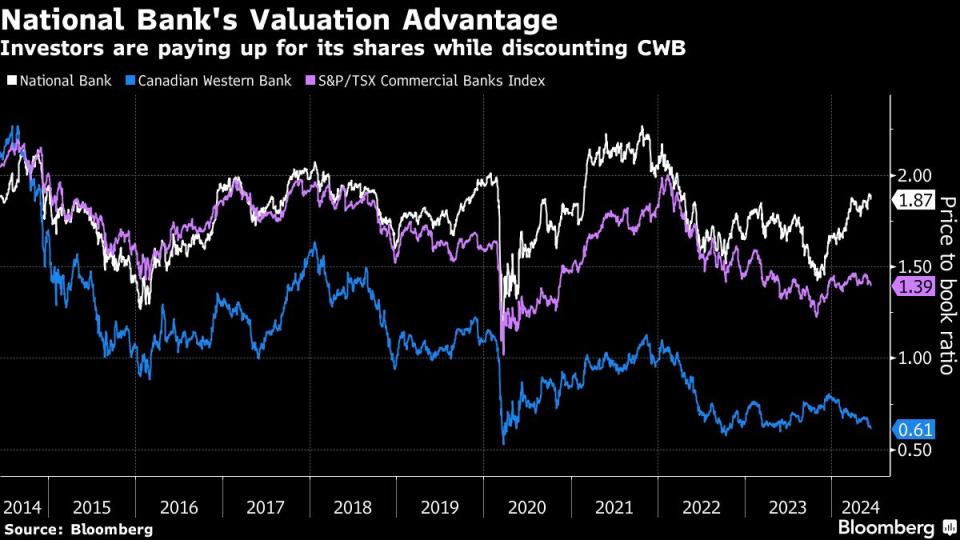

For National Bank, Canada’s sixth-largest lender with C$442 billion of assets, the agreement represents an opportunity to diversify its earnings away from Quebec, where it’s one of the most dominant financial firms. Its stability has made it one of Canada’s top-performing banks, with its stock rising 21% over the past year, as of Tuesday’s close.

Now it’s using that equity to acquire a weaker rival.

Five large lenders in Toronto and Montreal-based National Bank dominate the field in Canada. And while bank merger opportunities in the country are rare, the agreement comes just months after Royal Bank of Canada completed its C$13.5-billion deal for HSBC Holdings Plc’s Canadian assets after overcoming regulatory scrutiny. Smaller player Laurentian Bank of Canada failed to find a buyer last year after conducting a strategic review.

National Bank already has “roots and a longstanding presence,” in Western Canada, which is a “priority growth market” for the company, Chief Executive Officer Laurent Ferreira said on a conference call after the deal was announced. “We have a strong team in place of commercial bankers, private bankers and wealth advisers, as well as a financial-markets team including global markets and corporate and investment banking.”

The deal will give National Bank a bigger retail footprint in the western provinces of Alberta and British Columbia, home to most of Canadian Western’s 39 branches, 65,000 clients and C$37 billion of loans.

Edmonton, Alberta-based CWB also has worked to diversify from its home province, which is prone to the boom-and-bust cycles of the oil business. The firm opened its first branch in Ontario in 2020, launched a banking center in Toronto earlier this year and has also bulked up in other areas including equipment-leasing and wealth management.

But shares of CWB have languished, trading at less than 70% of book value before the bid. Rising loan losses are a concern — the key reason the bank missed analyst expectations for earnings in the fiscal second quarter — and it has struggled with slow loan growth.

‘Steep Premium’

The deal is “expensive” but consistent with RBC’s recent acquisition of HSBC’s Canadian assets, according to Bloomberg Intelligence analysts Paul Gulberg and Ethan Kaye.

“A steep premium and three-year road to EPS accretion after an expected late 2025 close is rather long,” they wrote in a research note.

National shares were down 5.3% to C$110.15 as of 9:51 a.m. in Toronto on Wednesday. Canadian Western shares soared 72% to C$42.81.

National Bank said it has identified C$270 million of annual pretax cost and funding synergies that it expects to achieve three years after completing the deal, while estimating it will spend about C$400 million on pretax integration costs over two years.

The lender already owns about 6% of Canadian Western stock and the total value of the transaction excluding those shares is about C$4.7 billion. The deal will see it exchange 0.45 of a National Bank common share for each Canadian Western share.

National Bank plans to issue C$1 billion of new equity, and Quebec’s largest pension fund, Caisse de Depot et Placement du Quebec, said it will help finance the deal by investing C$500 million in National Bank via subscription receipts, a move that will make it the lender’s second-largest shareholder.

“CDPQ is proud to continue its longstanding commitment to National Bank by taking part in this transformative acquisition that will enable it to execute a new facet of its expansion plan,” Vincent Delisle, the fund’s head of liquid markets, said in a statement.

The other C$500 million will come through a public offering of subscription receipts that’s being underwritten on a bought-deal basis, and both offerings are expected to occur “on or about” June 17.

--With assistance from Stephanie Hughes.

(Updates with Wednesday’s share price movement in the 12th paragraph.)

Most Read from Bloomberg Businessweek

China’s Economic Powerhouse Is Feeling the Brunt of Its Slowdown

The World’s Most Online Male Gymnast Prepares for the Paris Olympics

As Banking Moves Online, Branch Design Takes Cues From Starbucks

Food Companies Hope You Won’t Notice Shortages Are Raising Prices

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance