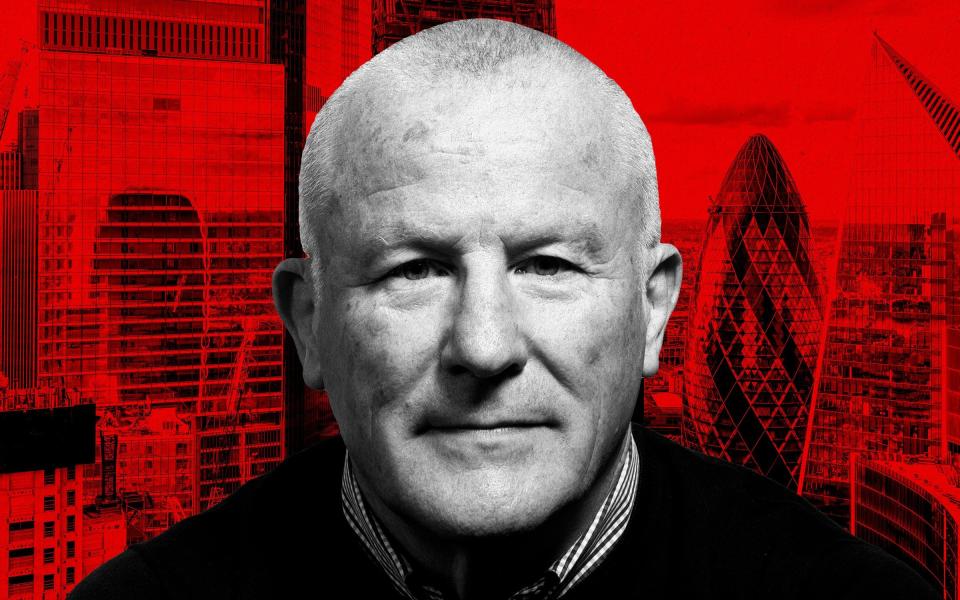

Neil Woodford accused of ‘gaslighting’ angry investors in new blog

Disgraced fund manager Neil Woodford has been accused of trying to “gaslight” investors over the collapse of his £3.7bn fund, after he announced his comeback in a new blog.

The 64-year-old wrote in the inaugural post of his new website that he was “neither hero nor villain” and said that he would be shedding light on what led to the collapse of his flagship Woodford Equity Investment Fund (WEIF) in future posts.

The former city hotshot’s relaunch as a financial influencer came just days after he was publicly rebuked by the Financial Conduct Authority (FCA), which said he had a “defective” understanding of his role. The city regulator confirmed that it would be taking enforcement action against him.

The Telegraph confirmed that the company that owns the new “Woodford Views” website is owned by known associates of the fund manager.

Angry investors, who are due payments from the controversial scheme of redress this month, said that no one should take advice from Mr Woodford.

Martin Farrimond, 59, said: “My immediate reaction is he must be trying to gaslight all of his “victims” by pretending what he has inflicted on us all was just an aberration.”

The investor added: “Neil Woodford should stand up and take his significant share of blame for what happened with the Woodford Equity Income Fund and should never be allowed to ever sell investment products anywhere again… or even be taken seriously advising on investing.”

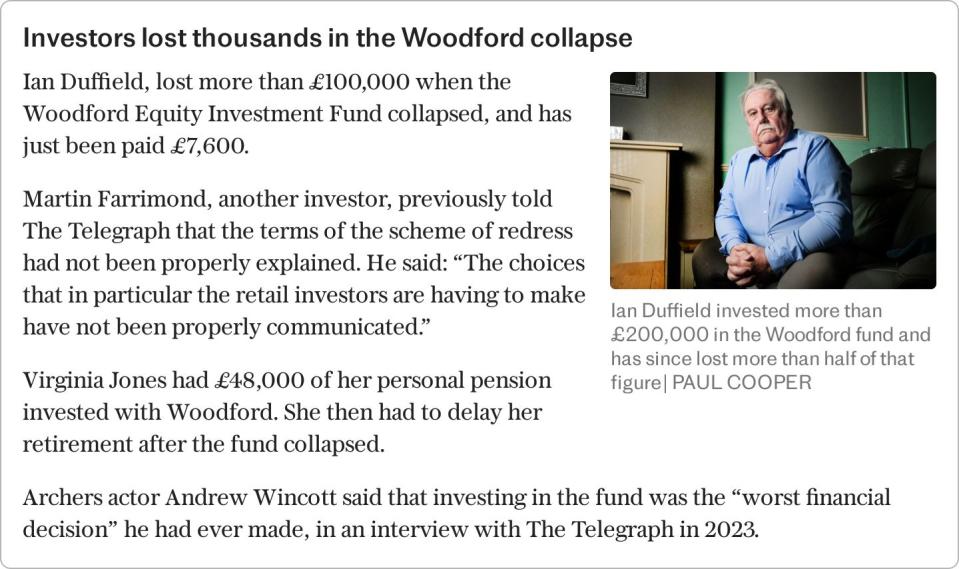

Ian Duffield, who was paid £7,600 two weeks ago under the £230m redress scheme which was approved by a High Court judge in February this year, lost more than £100,000 when the fund collapsed.

He said: “Woodford is going to attempt to try and say that the collapse is not his fault and, while he may have made a few ‘mistakes’, all would have been well in the end but it was taken out of his hands.

“None of this scandal would have happened if he had done things properly and followed the rules and I expect he will now try and blame others for not stopping him. That’s a bit like a criminal criticising the police for not catching them. I think this is his ego talking,” Mr Duffield said.

More than 300,000 investors lost out when the doomed Woodford Equity Investment Fund collapsed in 2019 following severe liquidity issues. Wrangling over the fund, which had been worth more than £10bn at its peak in 2017, continues.

Andrew Wincott, a voice actor for long-running Radio 4 drama The Archers, described investing in the Woodford Fund as the worst decision he ever made.

He told The Telegraph that he had bought into the fund as part of a SIPP, and added: “Never a dull moment.”

Another investor, Virginia Jones, told The Telegraph last year that she had been forced to postpone her retirement after putting £48,000 of her personal pension into the fund.

Ms Jones said: “Fortunately I love my job as a counsellor, but with the economic climate at the moment, being divorced and losing out when the retirement age changed it has been very hard keeping my head above water.

“It has really affected my life having lost this money through mismanagement of the Woodford funds.”

Mr Woodford has been reluctant to speak out on the collapse publicly since a disastrous interview with The Telegraph in 2019.

In a teary interview, he denied claims that the failure of the fund was caused by machismo and “yes men”, and defended the culture at Woodford Investment Management.

He apologised to ordinary investors and added: “I’m very sorry for what I did wrong”.

“What I was responsible for was two years of underperformance – I was the fund manager, the investment strategy was mine, I owned it, and it delivered a period of underperformance.”

But he was furious at the company’s “corporate director” Link Fund Solutions for closing Woodford Investment Management and insisted that he would have been proven right if it had been allowed to remain in operation.

His blog is not the first time that Mr Woodford has sought to reinvent himself since the collapse of the WEIF.

He was reported to have travelled to China in 2019 for conversations with investors about new ventures. In 2021, the Jersey financial regulator dashed his plans to relaunch himself from the island, saying that it would not be used as a “back door” to return to the UK market.

After years of wrangling between the regulator and the authorised corporate directors, Link Fund Solutions, a High Court judge approved a £230m scheme of redress in February this year.

Around £183m is due to be paid into victims’ accounts this month, with the remainder of the £230m to come later.

But while 90pc of the 54,000 investors who voted decided to accept the scheme, campaigners said that it prevented them from pursuing further legal action or taking their case to the Financial Services Compensation Scheme.

The FCA said that investors had overwhelmingly voted in favour of the scheme but declined to comment on Mr Woodford’s new blog.

Mr Woodford was contacted for comment.

Recommended

'I lost £100,000 to the Woodford collapse – and the nightmare isn't over'

Yahoo Finance

Yahoo Finance