Neogen (NEOG) Expands in Food Safety With Petrifilm Feeder Launch

Neogen Corporation NEOG recently announced the launch of the Petrifilm Automated Feeder to help labs efficiently process microbial tests and meet food safety standards. The Petrifilm Automated Feeder works with existing Petrifilm Plate Reader Advanced equipment.

The latest development is expected to keep Neogen at the frontline of investments in microbiology and food safety to transform modern labs.

About Petrifilm Automated Feeder

Neogens’ Petrifilm Automated Feeder can conduct more than 100,000 quality indicator tests per year. It delivers consistent colony counting and enhances lab productivity by automatically feeding and enumerating up to 300 Petrifilm Plates in 33 minutes while integrating with existing lab workflows and systems.

Significance of the Launch

Petrifilm Automated Feeder is designed for high-volume food safety testing labs processing. The system comes with integrated software that helps directly export test results to the labs' information management system. With this, the labs’ capacity is increased, which allows more time for data analysis.

Additionally, this automated system does not require technicians to manually load plates into the reader or count and record initial results. The feeder, combined with Petrifilm Plate Reader Advanced, allows the labs to overcome problems such as technician turnover, human error, and time-intensive training for new staff.

Preliminary trials conducted on the feeder showed a high return on investment and seamless integration.

Image Source: Zacks Investment Research

Industry Prospects

Per a report by Markets and Markets, the global food safety testing market was valued at $21.1 billion in 2022 and is expected to reach $31.1 billion by 2029, at a CAGR of 8.1%. The rise in public concern over food contamination and food-borne illness, along with the advancement in testing technologies, is the primary reason behind the market surge.

Looking at the market potential, Neogen’s latest development is well-timed.

Other Recent Developments

Earlier this month, Neogen announced the launch of the new CelluSmart technology from Megazyme for the measurement of cellulosic ethanol from biofuel production. With this industry-first technology, the company improved the previous National Renewable Energy Laboratory procedure, introducing a yeast-degrading cocktail.

Additionally, in the same month, the U.S. Department of Agriculture Food Safety and Inspection Service named the Neogen Molecular Detection System as its primary method to be used for the detection of Salmonella and Listeria monocytogenes testing for meat, poultry, and egg products.

In April 2024, the company launched Molecular Detection Assay 2 – Salmonella Enteritidis/Salmonella Typhimurium (MDA2SEST) to help its customers enhance their food safety program and address a challenging need in the poultry industry.

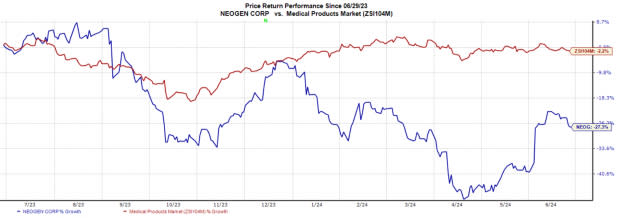

Price Performance

In the past year, NEOG’s shares have lost 20.7% against the industry’s 2.5% growth.

Zacks Rank and Key Picks

Neogen currently carries a Zacks Rank #4 (Sell).

Some better-ranked stocks in the broader medical space are Hims & Hers Health, Inc. HIMS, The Joint Corp. JYNT, and Medpace Holdings MEDP. While Hims & Hers and The Joint currently sport a Zacks Rank #1 (Strong Buy) each, Medpace Holdings carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Hims & Hers Heath stock has surged 120.4% in the past year. Estimates for the company’s 2024 earnings have moved north by 5.6% to 19 cents per share in the past 30 days.

HIMS’ earnings beat estimates in three of the trailing four quarters and missed in one, delivering an average surprise of 79.2%. In the last reported quarter, it posted an earnings surprise of a staggering 150%.

Estimates for The Joint’s 2024 earnings per share (EPS) have remained constant at 21 cents in the past 30 days. Shares of JYNT have surged 42.3% year to date against the industry’s 6.8% decline.

In the last reported quarter, JYNT delivered an earnings surprise of 300%. It has a trailing four-quarter average earnings surprise of 18.75%.

Estimates for Medpace’s 2024 EPS have remained unchanged at $11.29 in the past 30 days. Shares of the company have surged 80.7% in the past year compared with the industry’s 4.4% growth.

MEDP’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 12.8%. In the last reported quarter, it delivered an earnings surprise of 30.6%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Neogen Corporation (NEOG) : Free Stock Analysis Report

The Joint Corp. (JYNT) : Free Stock Analysis Report

Medpace Holdings, Inc. (MEDP) : Free Stock Analysis Report

Hims & Hers Health, Inc. (HIMS) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance