Netflix Record Back in Sight on Push Into Sports and Live Events

(Bloomberg) -- After Netflix Inc.’s success with advertising-supported subscriptions, bulls are wagering the video-streaming giant’s efforts to foray into live events and sports will drive the next leg of stock-price gains.

Most Read from Bloomberg

Apple Hits Record After Unveiling ‘AI for the Rest of Us’ Plan

NYC Landlord to Sell Office Building at Roughly 67% Discount

It would be another example of how aping the traditional TV model is paying off for the $280 billion company. Moving into the kind of programming that has historically been the purview of linear television could well be the catalyst that drives the stock back to the record peaks of 2021.

“When you have the eyeballs, you control the pricing, and just think of the pricing power Netflix can exert for ads around sports and anything else people will want to watch as it happens,” said Eric Clark, portfolio manager at Accuvest Global Advisors. “We do see it as another growth lever.”

Shares fell 0.5% on Thursday.

Much of the rebound — up 33% year-to-date — reflects Netflix’s success in reassuring investors about its ability to keep growing, even in mature markets. A crackdown on password sharing contributed to a post-Covid rebound in subscribers, and the company is finding success with its ad tier. Netflix said last month it had 40 million monthly active users of its ad-supported plan, from 5 million a year ago.

Adding sports and more live events is part of this plan. Having already aired the popular The Roast of Tom Brady, Netflix will show a boxing event between Jake Paul and Mike Tyson. It will air two National Football League games this Christmas, and it has bought exclusive rights to Raw and other programming from World Wrestling Entertainment.

Sports have become a major area of investment for other streaming services too. Amazon.com Inc. is reportedly nearing a deal to add a mix of regular season and playoff games from the National Basketball Association to its Prime service. Bloomberg Intelligence has written that sports — including the Olympics — will help NBC’s Peacock stand out, and that Walt Disney Co. will spend at least $12.2 billion on sports in 2026.

Wall Street has embraced Netflix’s push. The Tyson-Paul event “could be the most watched boxing match ever, given ease of access and Netflix’s large global subscriber base,” JPMorgan Chase & Co. reckons, predicting the match will attract more advertising dollars.

JPMorgan analyst Doug Anmuth has an overweight recommendation on the stock, seeing the diverse range of offerings among the reasons why Netflix could become the “default choice” for viewers to consume TV, film and other content.

The consensus for the company’s net full-year earnings has risen 7.1% over the past three months, according to data compiled by Bloomberg, while revenue estimates are up just 0.5%.

There are reasons for caution, including the disappointing forecasts provided by the company when it reported in April. It also doesn’t screen as the bargain it did in its post-Covid low. At 32 times estimated earnings, the stock trades at a discount to its five-year average near 40 times, yet that’s more than double its 2022 low. The Nasdaq 100 Index trades at a multiple of nearly 26.

Fewer than 70% of the analysts tracked by Bloomberg recommend buying the stock, which is in line with the average price target.

Cotton Swindell, senior portfolio manager for Adams Diversified Equity Fund, owns the stock and sees “a lot of reasons to be comfortable with Netflix,” even though he does not expect live events and sports to result in immediate bumper growth.

“The question is whether growth is strong enough to support the valuation, and I say yes,” he said.

Tech Chart of the Day

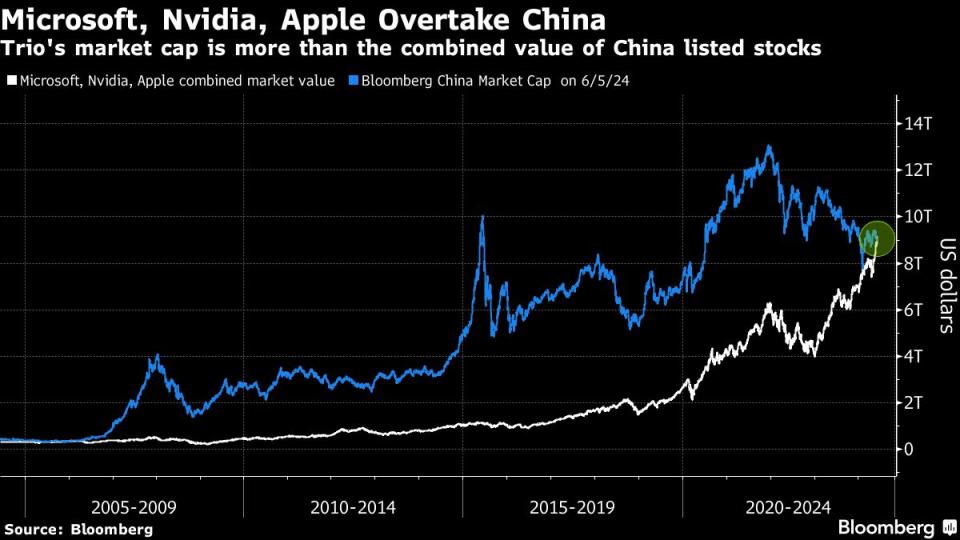

Microsoft Corp., Nvidia Corp. and Apple Inc. are now worth more combined than China’s stock market. With a total market capitalization of about $9.2 trillion, the three most valuable tech firms have overtaken all of the nearly $9 trillion worth of stocks actively traded on Chinese exchanges excluding Hong Kong, according to data compiled by Bloomberg.

Top Tech Stories

Nvidia Corp.’s Jensen Huang led an unprecedented cast of tech glitterati to the world’s biggest computing conference this week in Taiwan, where he effortlessly upstaged the likes of Intel Corp.’s Pat Gelsinger — without a single official keynote or session.

Cathie Wood said Ark Investment Management is well positioned in artificial intelligence assets, even after her company trimmed back on Nvidia shares before the rally last year.

Elon Musk’s xAI plans to develop a new facility in Memphis to house a giant supercomputer, a move by the artificial intelligence startup to boost its capacity in the race to build and offer chatbots and other AI-powered tools.

Gideon Yu, the former chief financial officer of YouTube and Facebook, is leading an effort to raise about $500 million for a fund affiliated with Alphabet Inc.’s moonshot lab, X, according to people with knowledge of the matter.

Boeing Co. finally launched its space taxi into orbit with NASA astronauts on board, and is on target to dock with the International Space Station on Thursday.

Earnings Due Thursday

Postmarket

Samsara

DocuSign

Braze

--With assistance from David Watkins and Subrat Patnaik.

(Updates to market open.)

Most Read from Bloomberg Businessweek

As Banking Moves Online, Branch Design Takes Cues From Starbucks

Food Companies Hope You Won’t Notice Shortages Are Raising Prices

Legacy Airlines Are Thriving With Ultracheap Fares, Crushing Budget Carriers

Sam Altman Was Bending the World to His Will Long Before OpenAI

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance