NetLink NBN Trust (SGX:CJLU) Will Pay A Dividend Of SGD0.0265

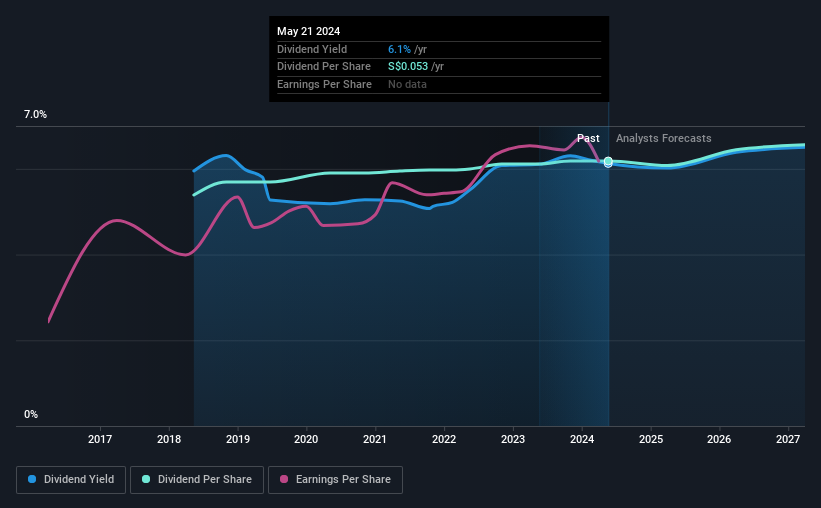

NetLink NBN Trust (SGX:CJLU) will pay a dividend of SGD0.0265 on the 12th of June. This will take the annual payment to 6.1% of the stock price, which is above what most companies in the industry pay.

See our latest analysis for NetLink NBN Trust

NetLink NBN Trust Is Paying Out More Than It Is Earning

Impressive dividend yields are good, but this doesn't matter much if the payments can't be sustained. Based on the last payment, the company wasn't making enough to cover what it was paying to shareholders. This situation certainly isn't ideal, and could place significant strain on the balance sheet if it continues.

The next 12 months is set to see EPS grow by 16.3%. However, if the dividend continues along recent trends, it could start putting pressure on the balance sheet with the payout ratio reaching 167% over the next year.

NetLink NBN Trust Is Still Building Its Track Record

It is great to see that NetLink NBN Trust has been paying a stable dividend for a number of years now, however we want to be a bit cautious about whether this will remain true through a full economic cycle. The annual payment during the last 6 years was SGD0.0462 in 2018, and the most recent fiscal year payment was SGD0.053. This works out to be a compound annual growth rate (CAGR) of approximately 2.3% a year over that time. NetLink NBN Trust hasn't been paying a dividend for very long, so we wouldn't get to excited about its record of growth just yet.

Dividend Growth May Be Hard To Achieve

Investors could be attracted to the stock based on the quality of its payment history. NetLink NBN Trust has seen EPS rising for the last five years, at 5.9% per annum. However, the payout ratio is very high, not leaving much room for growth of the dividend in the future.

The Dividend Could Prove To Be Unreliable

Overall, we always like to see the dividend being raised, but we don't think NetLink NBN Trust will make a great income stock. The track record isn't great, and the payments are a bit high to be considered sustainable. We would be a touch cautious of relying on this stock primarily for the dividend income.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. However, there are other things to consider for investors when analysing stock performance. For instance, we've picked out 1 warning sign for NetLink NBN Trust that investors should take into consideration. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance