Nike (NYSE:NKE) Misses Q2 Sales Targets, Stock Drops

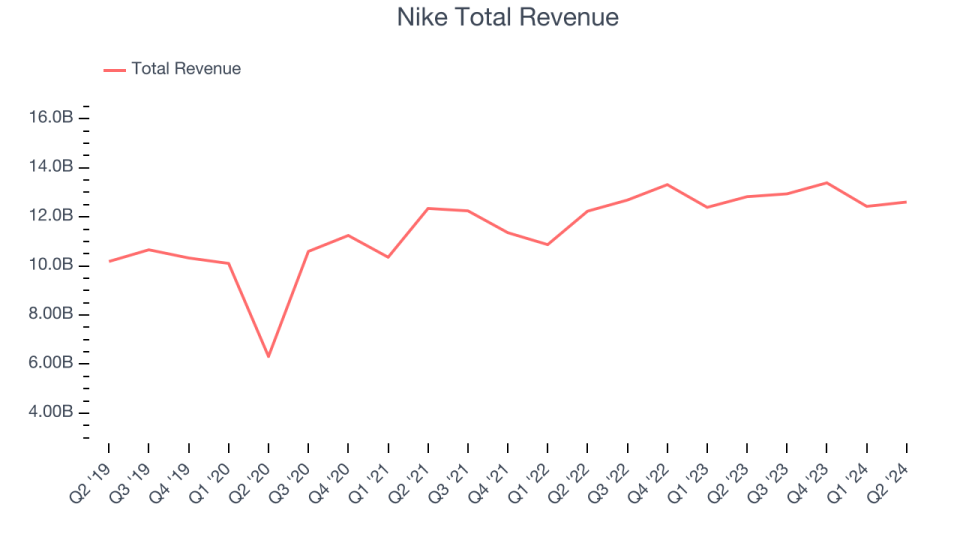

Athletic apparel brand Nike (NYSE:NKE) missed analysts' expectations in Q2 CY2024, with revenue down 1.7% year on year to $12.61 billion. It made a non-GAAP profit of $1.01 per share, improving from its profit of $0.66 per share in the same quarter last year.

Is now the time to buy Nike? Find out in our full research report.

Nike (NKE) Q2 CY2024 Highlights:

Revenue: $12.61 billion vs analyst estimates of $12.86 billion (1.9% miss)

EPS (non-GAAP): $1.01 vs analyst estimates of $0.84 (20.6% beat)

Gross Margin (GAAP): 44.7%, up from 43.6% in the same quarter last year

Constant Currency Revenue was flat year on year (compared to 8% in the same quarter last year)

Market Capitalization: $142 billion

"We are taking our near-term challenges head-on, while making continued progress in the areas that matter most to NIKE's future – serving the athlete through performance innovation, moving at the pace of the consumer and growing the complete marketplace," said John Donahoe, President & CEO, NIKE, Inc.

Originally selling Japanese Onitsuka Tiger sneakers as Blue Ribbon Sports, Nike (NYSE:NKE) is a global titan in athletic footwear, apparel, equipment, and accessories.

Footwear

Before the advent of the internet, styles changed, but consumers mainly bought shoes by visiting local brick-and-mortar shoe, department, and specialty stores. Today, not only do styles change more frequently as fads travel through social media and the internet but consumers are also shifting the way they buy their goods, favoring omnichannel and e-commerce experiences. Some footwear companies have made concerted efforts to adapt while those who are slower to move may fall behind.

Sales Growth

A company’s long-term performance can give signals about its business quality. Even a bad business can shine for one or two quarters, but a top-tier one tends to grow for years. Unfortunately, Nike's 5.6% annualized revenue growth over the last five years was weak. This shows it failed to expand its business in any major way.

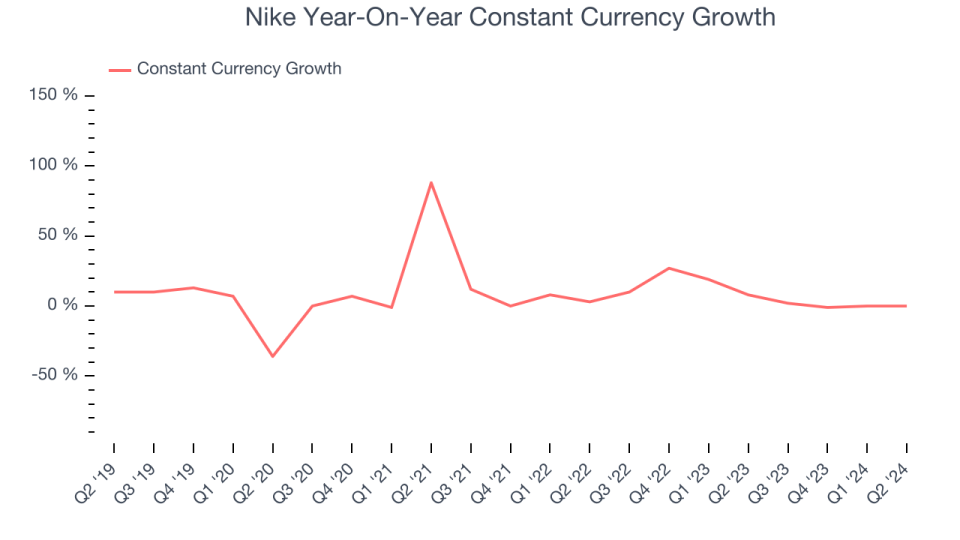

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. Nike's annualized revenue growth of 4.9% over the last two years aligns with its five-year trend, suggesting its demand was consistently weak.

We can dig further into the company's sales dynamics by analyzing its constant currency revenue, which exclude currency movements that are outside the company’s control and not indicative of demand. Over the last two years, its constant currency sales averaged 8.1% year-on-year growth. Because this number is better than its normal revenue growth, we can see that foreign exchange rates have been a headwind for Nike.

This quarter, Nike missed Wall Street's estimates and reported a rather uninspiring 1.7% year-on-year revenue decline, generating $12.61 billion of revenue. Looking ahead, Wall Street expects revenue to remain flat over the next 12 months.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

Operating Margin

Nike has done a decent job managing its expenses over the last two years. The company has produced an average operating margin of 11.9%, higher than the broader consumer discretionary sector.

This quarter, Nike generated an operating profit margin of 12.3%, up 2.7 percentage points year on year. Looking ahead, Wall Street expects Nike to maintain its trailing 12 month operating margin of 12.3% in the coming year.

Key Takeaways from Nike's Q2 Results

We enjoyed seeing Nike exceed analysts' EPS expectations this quarter. On the other hand, its constant currency revenue unfortunately missed and management noted "near-term challenges", causing it to revise its outlook. Overall, this was a bad quarter for Nike. The stock traded down 5.4% to $89.13 immediately following the results.

So should you invest in Nike right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

Yahoo Finance

Yahoo Finance