NRG Energy Shares Are Powered Up

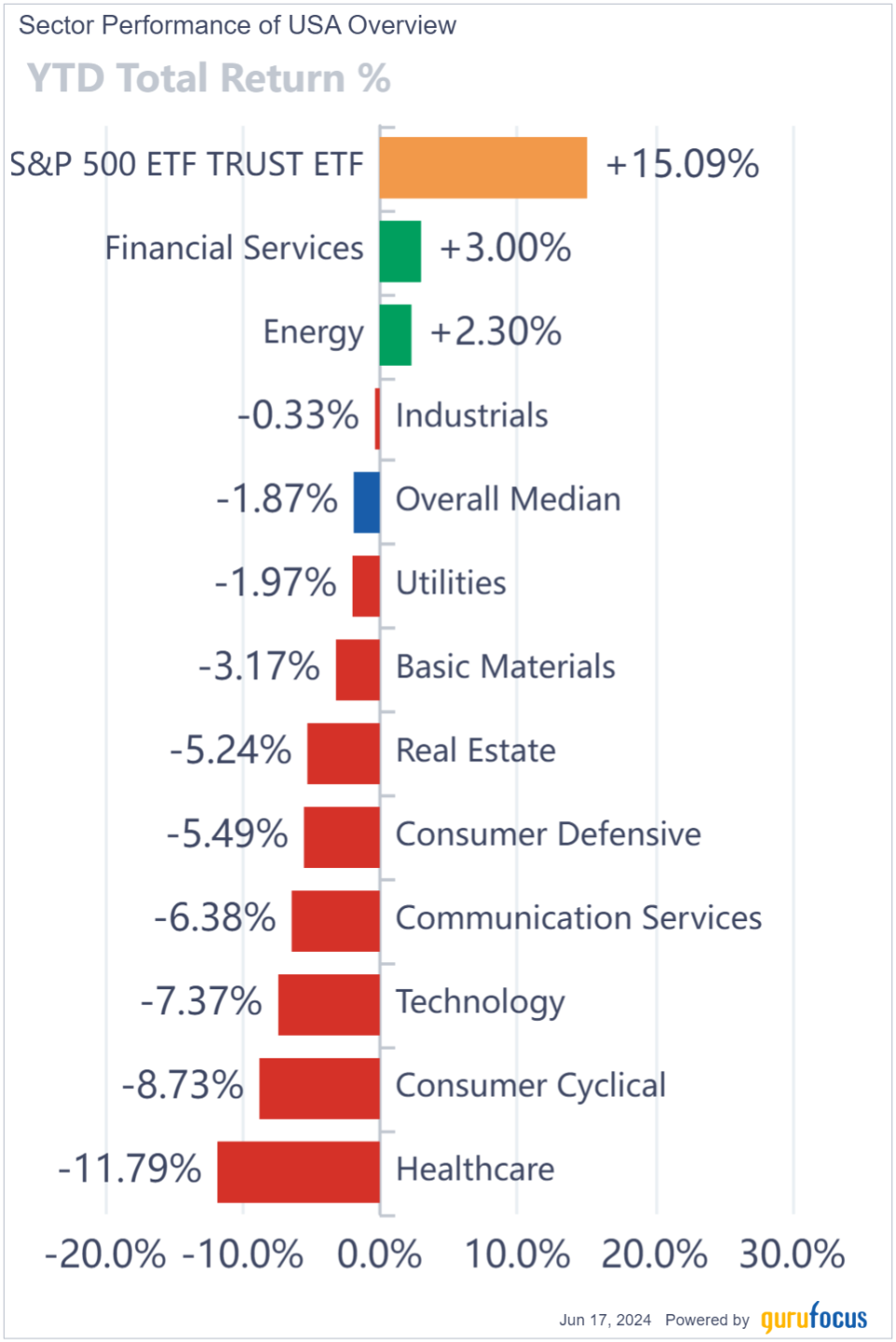

As 2024 prepares to mark its halfway point, investors may be curious to know what stocks have performed well year to date.

While the utilities sector has returned -1.97% so far this year, it has the fourth-best performance behind financial services, energy and industrials.

As such, the GuruFocus All-in-One Screener, a Premium feature, found some stocks within this space are outperforming the S&P 500, which has posted a gain of around 15% as of June 17. Additionally, these companies have a market cap greater than $5 billion, price-earnings ratios below 15 and predictability ranks of at least one out of five stars.

Based on these criteria, one utility company that has outperformed the benchmark index by at least 15% year to date is NRG Energy Inc. (NYSE:NRG). The stock has posted a return of approximately 53.27% year to date.

Business structure and expansion

Founded in 1989, the Houston-based company is one of the largest energy providers in the U.S., serving over 7 million customers. The company also has operations in Canada.

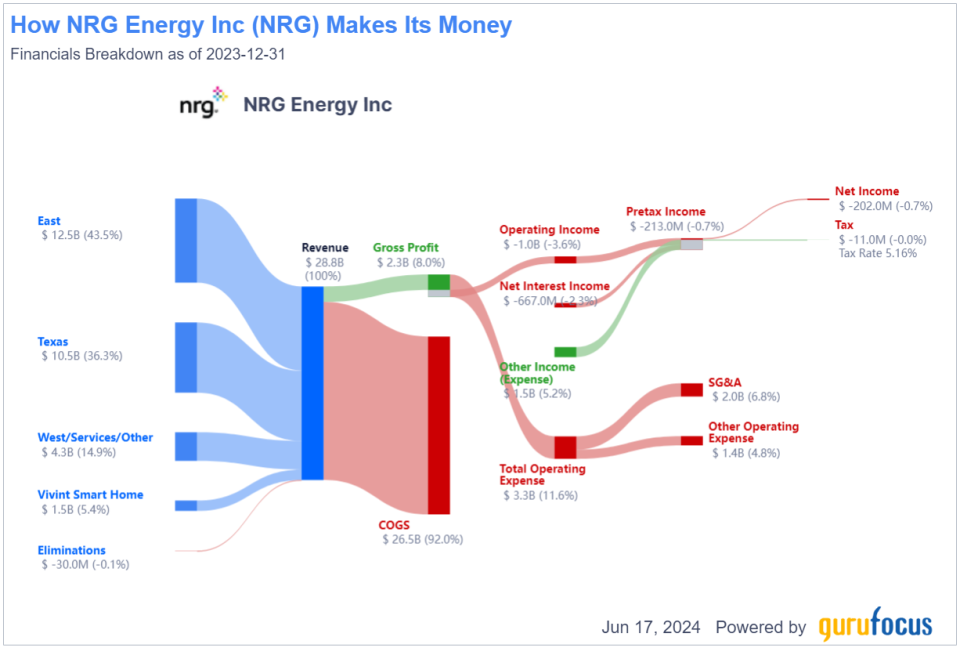

Its business is divided into six segments, the largest of which generated 43.50% of its total revenue in 2023.

In recent years, the company has grown primarily through acquisitions. Notable transactions include its 2022 purchase of Vivint Smart Home for $5.20 billion, which consisted of a combination of cash and debt. The year prior, it bought Direct Energy for $3.60 billion. Going back to before the pandemic, it acquired Stream Energy in 2019 for $300 million and XOOM Energy for $210 million in 2018.

Earnings review

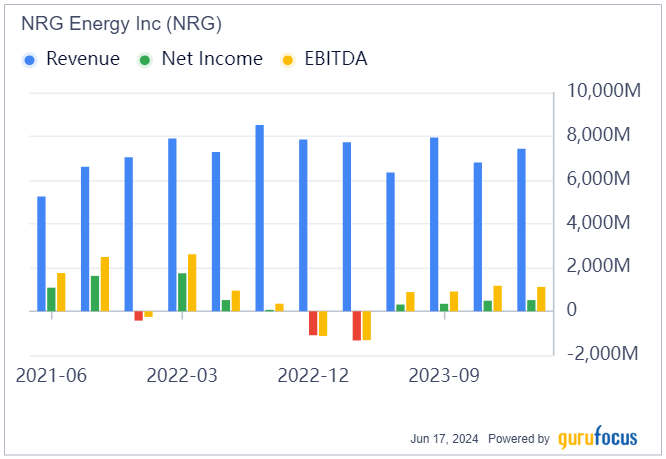

NRG reported its first-quarter financial results on May 7. It posted revenue of $7.43 billion, net income of $511 million, or earnings of $2.31 per share, and Ebitda of $849 million. While revenue was down slightly from the prior-year quarter, the other two metrics saw improvements.

In a statement, NRG Chair, Interim President and CEO Larry Coben noted the company delivered exceptional operating and financial results.

We are even more optimistic about the competitive energy market outlook and Smart Home adoption, and remain committed to executing our long-term strategy and capital allocation program, he said.

Based on these solid results, NRG Energy reaffirmed its guidance for 2024. It expects adjusted Ebitda of $3.30 million to $3.55 million, cash from operating activities between $1.83 million and $2.07 million and free cash flow before growth investments ranging from $1.83 million to $2.07 million.

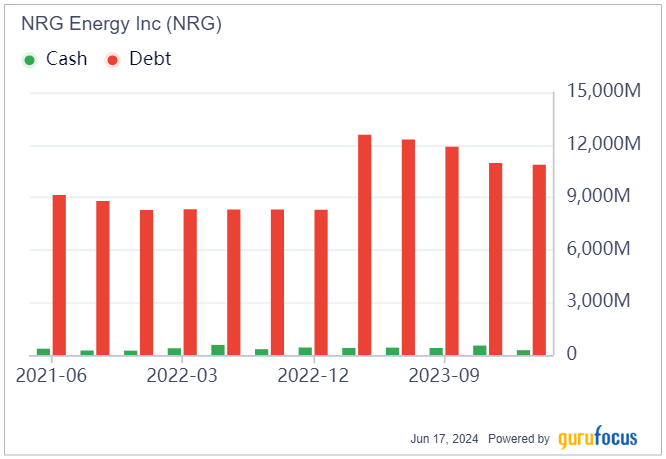

Despite the strong outlook, the company recorded $278 million in cash and $10.87 billion in debt on its balance sheet, which it likely took on during some of its acquisitions. As the cash-to-debt ratio of 0.03 is significantly below 1, it is not able to pay off its debt with cash on hand.

Regardless, NRG appears committed to creating value for shareholders. During the quarter, it completed its $950 million accelerated share repurchase program at an average price of $50.43 per share. It also reaffirmed its 2024 capital allocation commitment of $825 million in additional share repurchases.

Further, in April, the company noted the board approved a quarterly dividend of 40.75 cents per share, contributing to the annual dividend of $1.63. The payment was distributed on May 15 to shareholders of record as of May 1. Its dividend yield is 1.99%, while its payout ratio is 0.54.

Valuation

Having outperformed the benchmark index by nearly 40%, NRG Energy has a $16.38 billion market cap; its shares traded around $78.55 on Monday with a price-earnings ratio of 11.24, a price-book ratio of 6.18 and a price-sales ratio of 0.61.

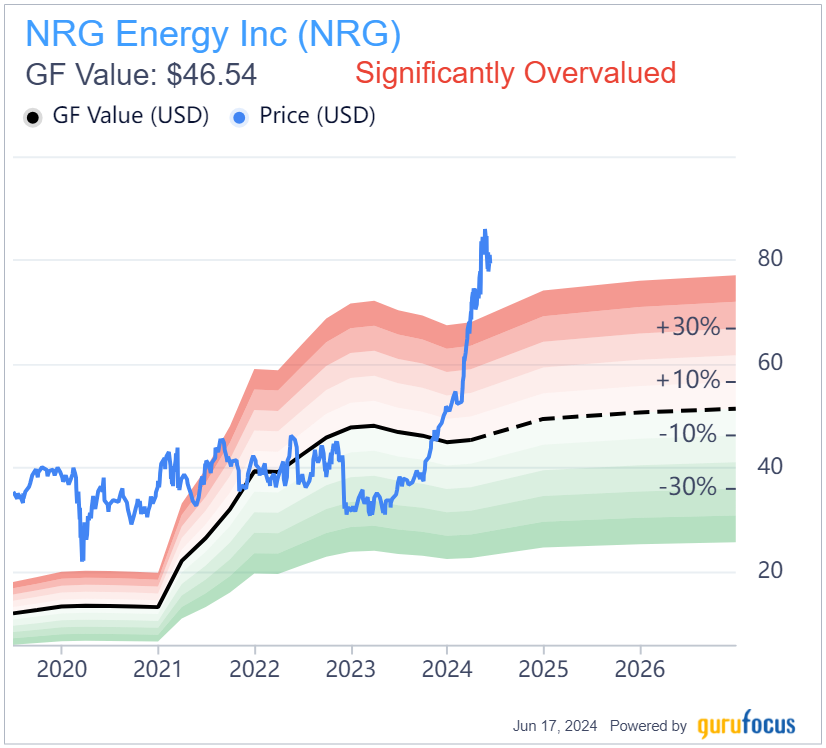

The GF Value Line suggests the stock is significantly overvalued currently based on its historical ratios, past financial performance and analysts' future earnings projections.

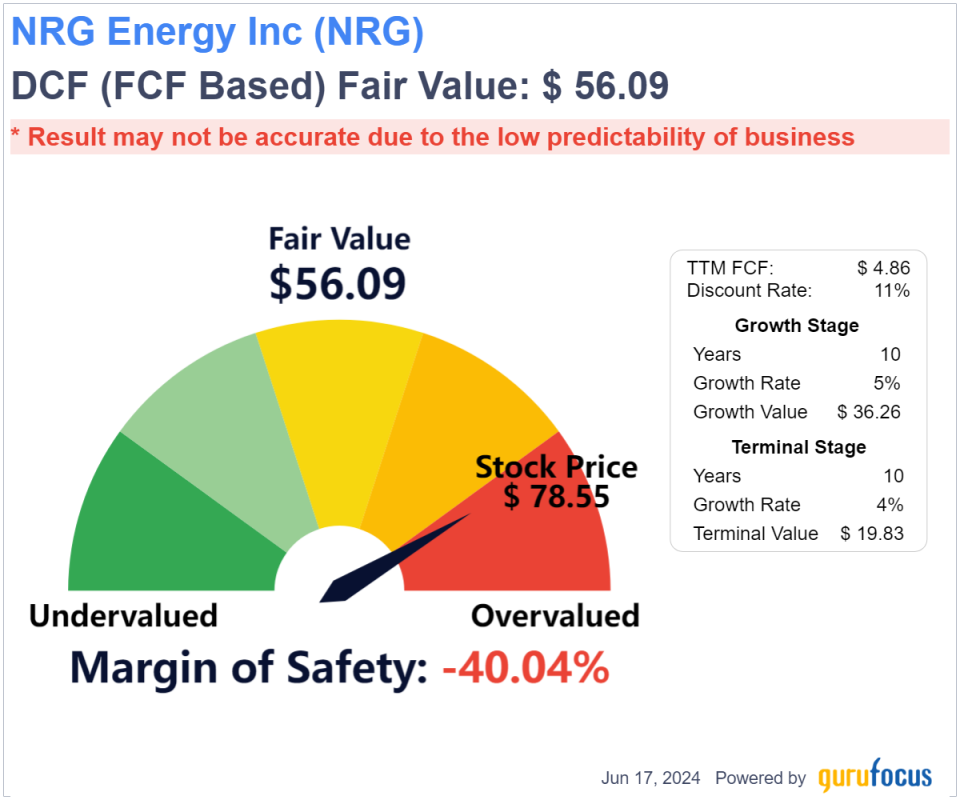

The discounted cash flow analysis also points to overvaluation.

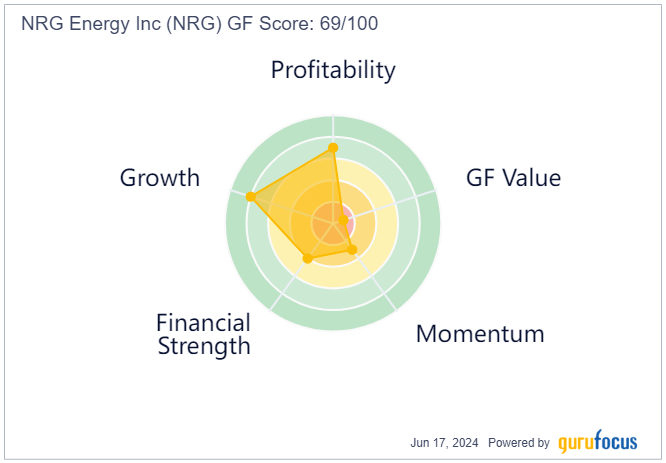

The GF Score of 69 out of 100 warns the company has poor outperformance potential going forward, however. While it received high ratings for profitability and growth, the financial strength rank is more moderate and its value and momentum are low.

Further, the Altman Z-Score of 2.01 suggests the company is under some financial pressure on the back of declining revenue per share. The return on invested capital is also eclipsed by the weighted average cost of capital, so it may not be capital efficient. However, the Piotroski F-Score of 7 out of 9 means the company's operations are healthy.

Guru and insider interest

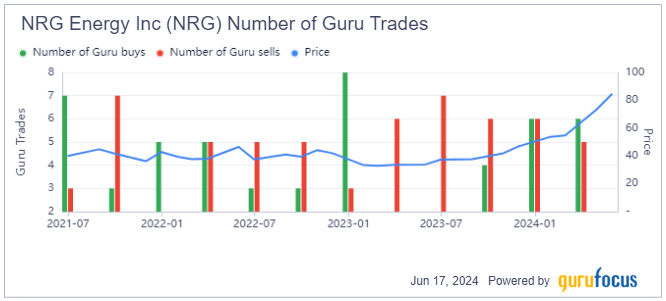

Along with its strong performance, several gurus have purchased the stock. According to 13F filings for the first quarter, Steven Cohen (Trades, Portfolio) and Stanley Druckenmiller (Trades, Portfolio) both entered new positions, while four other gurus added to their holdings. Others, like John Hussman (Trades, Portfolio) and Hothckis & Wiley, curbed their investments. Overall, sentiment toward the stock appears to have been fairly bullish over the past two quarters.

As for insider activity, only sells have been recorded in 2024. The most recent transaction, on May 17, consisted of 24,546 shares sold by President Rasesh M. Patel. There were also two sell transactions in March. The last buying activity recorded was in December of 2022.

The more bearish activity among insiders may not be too much of a concern, however, as they may simply be taking advantage of the gains the stock has had this year.

Final thoughts

While NRG Energy has outperformed so far this year, the stock may be too expensive to justify getting in now.

That being said, outside of its concerning debt load, the company operates in an area that is deemed a necessity as it provides power and other essential services to consumers throughout the U.S. As such, it would be worthwhile to keep an eye on NRG Energy.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance