Nucor's (NUE) Earnings and Revenues Surpass Estimates in Q1

Nucor Corporation NUE logged earnings of $4.45 per share in first-quarter 2023, down from earnings of $7.67 per share in the year-ago quarter. Earnings per share, however, topped the Zacks Consensus Estimate of $3.81.

The company recorded net sales of $8,710 million, down around 17% year over year. The figure beat the Zacks Consensus Estimate of $8,502 million.

The company benefited from higher demand for steel at its mills in the reported quarter. NUE witnessed sustained strong demand from non-residential construction, its biggest end market, on strength in infrastructure and manufacturing investment.

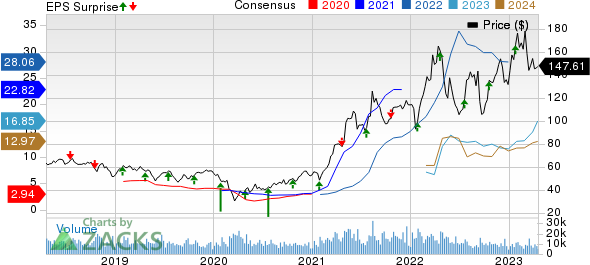

Nucor Corporation Price, Consensus and EPS Surprise

Nucor Corporation price-consensus-eps-surprise-chart | Nucor Corporation Quote

Operating Figures

Total steel mills shipments in the first quarter were 6,035,000 tons, up 4% year over year. Total tons shipped to outside customers were up 1% year over year to 6,443,000 tons. Average sales price fell 18% year over year and were also down 11% sequentially.

Steel mill operating rates were 79% in the quarter, up from 77% in the year-ago quarter.

Segment Highlights

Earnings of the company’s steel mills unit rose on a sequential comparison basis in the reported quarter on higher volumes and margins.

Earnings in the steel products division were lower sequentially in the first quarter due to reduced realized prices.

The raw materials segment’s earnings were up sequentially in the quarter on higher volumes at the company’s direct reduced iron (“DRI)” facilities and scrap recycling and brokerage operations.

Financial Position

Cash and cash equivalents rose roughly 2% year over year to $3,800 million at the end of the quarter. Long-term debt was $6,616.5 million, up around 8% year over year.

The company repurchased roughly 2.7 million shares of its common stock during the quarter.

Outlook

Moving ahead, the company envisions earnings to rise sequentially in the second quarter of 2023.

Nucor expects earnings in the steel mills segment to be higher sequentially in the second quarter mainly due to higher margins at its sheet mills.

The steel products segment’s profitability is projected to be lower sequentially in the second quarter as lower average selling prices are expected to offset increased volumes. The company also sees raw materials segment earnings to rise in the second quarter from the first quarter due to increased profitability at DRI facilities.

Price Performance

Shares of Nucor have lost 15.9% over a year compared with the industry’s 1.4% decline.

Image Source: Zacks Investment Research

Zacks Rank & Other Key Picks

Nucor currently carries a Zacks Rank #1 (Strong Buy).

Other top-ranked stocks worth considering in the basic materials space include Steel Dynamics, Inc. STLD, Olympic Steel, Inc. ZEUS and Linde plc LIN.

Steel Dynamics currently sports a Zacks Rank #1. The Zacks Consensus Estimate for STLD's current-year earnings has been revised 36.5% upward in the past 60 days. You can see the complete list of today’s Zacks #1 Rank stocks here.

Steel Dynamics’ earnings beat the Zacks Consensus Estimate in each of the last four quarters. It has a trailing four-quarter earnings surprise of roughly 10.7%, on average. STLD has gained around 14% in a year.

Olympic Steel currently sports a Zacks Rank #1. The Zacks Consensus Estimate for ZEUS's current-year earnings has been revised 33.1% upward in the past 60 days.

Olympic Steel’s earnings beat the Zacks Consensus Estimate in each of the last four quarters. It has a trailing four-quarter earnings surprise of roughly 26.2%, on average. ZEUS has rallied around 30% in a year.

Linde currently carries a Zacks Rank #2 (Buy). The Zacks Consensus Estimate for LIN’s current-year earnings has been revised 0.9% upward in the past 60 days.

Linde beat Zacks Consensus Estimate in each of the last four quarters. It delivered a trailing four-quarter earnings surprise of 5.9% on average. LIN’s shares have gained roughly 13% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Steel Dynamics, Inc. (STLD) : Free Stock Analysis Report

Nucor Corporation (NUE) : Free Stock Analysis Report

Olympic Steel, Inc. (ZEUS) : Free Stock Analysis Report

Linde PLC (LIN) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance