Octopus is the UK’s top home electricity supplier – what powers its success?

Ofgem recently confirmed that Octopus Energy has edged out British Gas to become the nation’s largest domestic energy supplier. The news follows the company’s takeover of Shell Energy (and its 1.3m customers) in 2023.

But the last two years have been a fraught time for energy firms in terms of public opinion: if they’ve earned higher profits these have, in some cases, been accompanied by reputational damage. So what is making customers choose Octopus over its competitors?

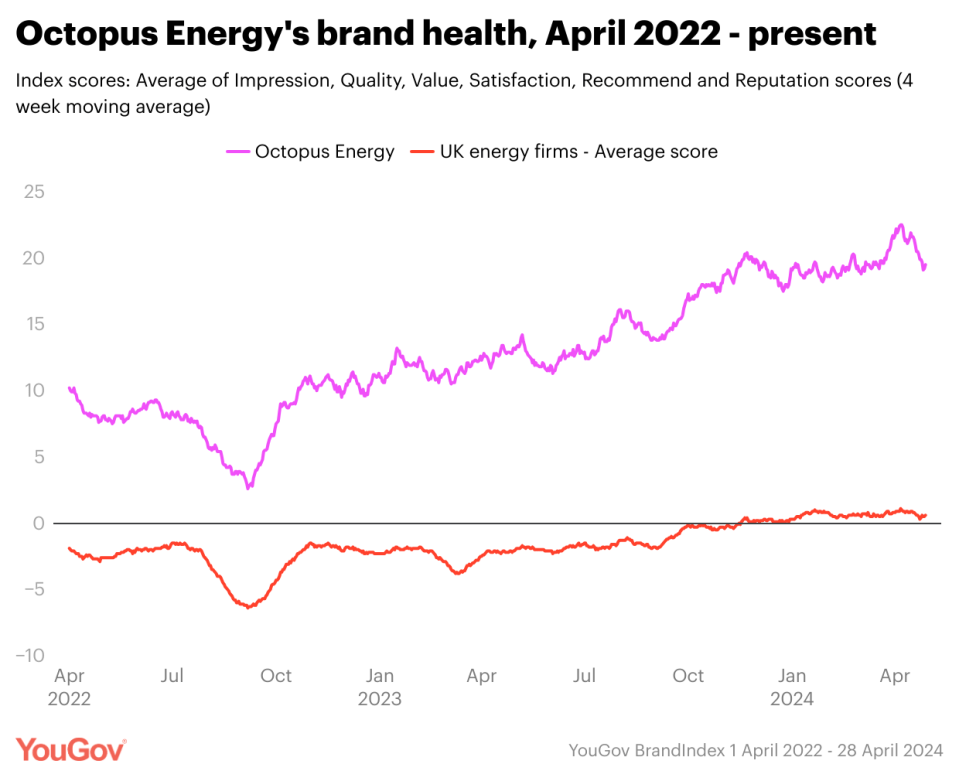

Let’s use 1 April 2022, when the energy price cap rose by 54 per cent, as our starting point. YouGov BrandIndex shows that Index scores for the sector, which measure overall brand health, fell from -1.9 to a nadir of -6.4, recovering to 0.6 as of our most recent data (28 April 2024).

Octopus Energy, however, has seen a different story. Raising the price cap in April 2022 also affected perceptions of the firm, yetits brand health metrics have not entered negative territory once in the past two years. In fact, beyond simply mitigating the initial reputational damage, Octopus Energy’s brand perceptions have improved: our latest data has Index scores at 19.5 compared to sector scores of 0.6.

It compares favourably when we dig into other metrics as well. For the Impression metric, which covers overall sentiment, industry average scores are at 1.1. Octopus Energy’s have reached 25.9.

Our data suggests that positive perceptions of the firm’s level of service may have something to do with this: Customer Satisfaction scores for the sector sit at 2.5; for Octopus they are at 19.6. Recommend scores for Octopus are similarly positive (22.7) compared to the wider industry (0.8).

If energy firms are becoming more profitable, then, this does not necessarily have to be at the cost of their general esteem. Even as other providers have struggled with public opinion, positive perceptions of Octopus look to have helped the brand wrap its tentacles further around the energy market over the past couple of years.

Yahoo Finance

Yahoo Finance