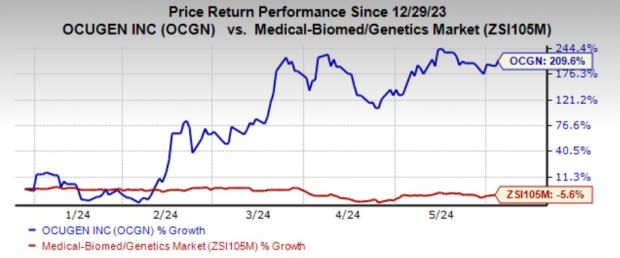

Ocugen (OCGN) Skyrockets 209.6% Year to Date: Heres Why

Ocugen, Inc. OCGN is having a phenomenal run in the year so far. Shares of the company have skyrocketed 209.6% year to date against the industry’s decline of 5.6%.

The significant surge can be attributed to its encouraging pipeline progress.

Ocugen is a biotechnology company focused on discovering, developing, and commercializing novel gene and cell therapies and vaccines.

Image Source: Zacks Investment Research

The company is developing a modifier gene therapy platform designed to fulfill the significant medical needs related to retinal diseases, including inherited retinal diseases, such as retinitis pigmentosa ("RP") and Leber congenital amaurosis ("LCA"), Stargardt disease and multifactorial diseases, such as dry age-related macular degeneration (dAMD).

The company believes that its modifier gene therapy platform has the potential to address these diseases with a gene-agnostic approach.

Its lead modifier gene therapy candidate, OCU400, is being evaluated for the treatment of RP. The company received clearance from the FDA to initiate a phase III trial on OCU400 for the treatment of RP.

Ocugen expects to begin dosing patients in the phase III study in the ongoing quarter.

This RP market represents significant potential. Per the company, there is only a single marketed product to treat one of the 100 gene mutations associated with RP, and the gene-agnostic mechanism of action for OCU400 provides hope for a much larger RP patient population.

The company also plans to expand the phase III OCU400 clinical trial in the second half of 2024 to include patients with LCA, subject to favorable results from the phase I/II study and the study’s alignment with the FDA.

Ocugen is also developing OCU410 as a one-time gene therapy for the treatment of geographic atrophy (GA), an advanced stage of dAMD. OCU410ST is being developed as a one-time gene therapy for the treatment of Stargardt disease.

The company recently announced a positive outcome from the Data and Safety Monitoring Board’s (“DSMB”) review of its phase I/II ArMaDa clinical study on OCU410 for the treatment of GA.

Among the six subjects dosed in the phase I/II study date, three were dosed with the low dose and the remaining three with the medium dose. An additional three patients will be dosed with the high dose of OCU410 in the dose-escalation phase.

The DSMB recommended Ocugen to proceed dosing with the high dose of OCU410 in the dose-expansion phase of the study in subsequent subjects. It also recommended the company to initiate a phase II study simultaneously.

This positive recommendation marks a critical step toward determining the maximum tolerated dose of OCU410.

Dosing is complete in the second cohort of its phase I/II GARDian study on OCU410ST for the treatment of Stargardt disease. An update on the clinical study is expected in the third quarter of 2024.

Apart from these, Ocugen’s phase III-ready regenerative medicine cell therapy platform technology, which includes NeoCart (autologous chondrocyte-derived neocartilage), is being developed for the repair of knee cartilage injuries in adults. Ocugen received concurrence from the FDA on the confirmatory phase III study design.

The successful development of any of these candidates should be a great boost for the company.

While the recent share price trajectory looks attractive, there are a few concerns as well.

Ocugen’s cash balance of $26.4 million is a major cause of concern as it will need funds to run these clinical studies. This indicates that the company may raise funds soon.

Moreover, pipeline and regulatory setbacks might dent its prospects. OCGN had earlier suffered a setback with OCU200.

The candidate is a novel fusion protein, consisting of two human proteins — tumstatin and transferrin. It is designed to treat vascular complications of diabetic macular edema (DME), diabetic retinopathy, and wet AMD.

In April 2023, the FDA placed a clinical hold on the company’s investigational new drug application to initiate a phase I study targeting DME. The FDA requested additional information related to Chemistry Manufacturing and Controls. Ocugen submitted a response to the FDA with additional information and continues to work with the regulatory agency to address comments to lift the clinical hold.

Zacks Rank & Other Stocks to Consider

Ocugen currently carries a Zacks Rank #2 (Buy).

Some other top-ranked stocks in the healthcare sector are Krystal Biotech, Inc. KRYS, ALX Oncology Holdings ALXO and Minerva Neurosciences, Inc. NERV, each carrying a Zacks Rank of 2 at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

In the past 30 days, the Zacks Consensus Estimate for KRYS’ earnings per share has increased 24 cents to $2.06. KRYS beat on earnings in two of the trailing four quarters and missed the mark in the other two, delivering an average negative surprise of 21.46%. Shares of Krystal Biotech have surged 29.9% year to date.

In the past 30 days, the Zacks Consensus Estimate for ALX Oncology’s 2024 loss per share has narrowed from $3.33 to $2.89. During the same period, the consensus estimate for 2025 loss per share has narrowed from $2.85 to $2.73.

ALX Oncology beat on earnings in two of the trailing four quarters and missed the mark in the other two, delivering an average negative surprise of 8.83%.

In the past 60 days, estimates for Minerva Neurosciences’ 2024 loss per share have narrowed from $3.57 to $1.89. The loss per share estimate for 2025 has narrowed from $4.54 to $3.60. Year to date, shares of NERV have lost 53%.

NERV’s earnings beat estimates in one of the trailing four quarters and missed the same in the other three, the average negative surprise being 54.43%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Minerva Neurosciences, Inc (NERV) : Free Stock Analysis Report

Krystal Biotech, Inc. (KRYS) : Free Stock Analysis Report

Ocugen, Inc. (OCGN) : Free Stock Analysis Report

ALX Oncology Holdings Inc. (ALXO) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance