UK COVID-19 vaccine rollout won't stop oil prices sliding

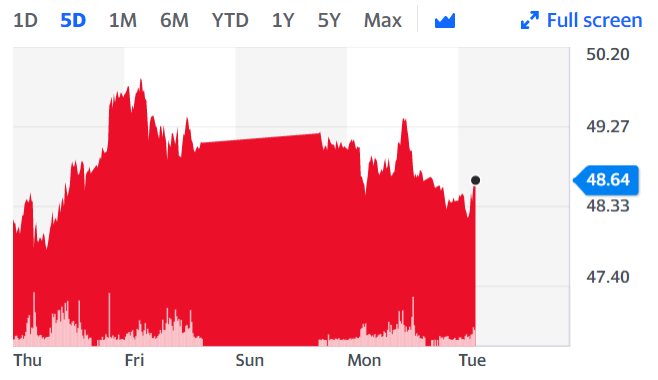

Oil prices fell for a second consecutive day as investors become increasingly concerned that rising COVID-19 cases could undermine global demand.

The US’ stalled stimulus plans have also weighed on the commodity amid hopes for the world’s largest economy to begin recovering from the pandemic.

Benchmark Brent (BZ=F) crude is down 0.5% at around 8.45am in London at $48.54 ($36.95) a barrel.

Oil prices fall when coronavirus cases rise due to the impact on demand. If coronavirus cases continue to rise, it means further restrictions may be placed on economies, including areas like travel.

According to the latest oil market report by International Energy Agency (IEA) “weak historical data and the resurgence of COVID-19 in Europe and the United States” led the group to revise down near-term global demand outlook by 1.2 million barrels per day (b/d) in in the fourth quarter of 2020.

It said “vaccines are unlikely to significantly boost demand until well into next year.”

The UK became the first Western country to administer a coronavirus vaccination as part of its national campaign on Tuesday.

WATCH: The moment Matt Hancock tears up over coronavirus vaccines

However, COVID-19 cases numbers are growing in various parts of the world.

On Monday, 102,148 patients were in the hospital with the virus, according to the Covid Tracking Project as reported by CNN — the sixth consecutive day the US surpassed 100,000 hospitalisations. Denmark also announced a partial lockdown from 9 December following a surge in cases there. France is still far from its goal of reducing the number of COVID-19 cases to 5,000 a day.

Adding further pressure to oil prices is progress on the US $908bn pandemic relief plan. Lawmakers are set to postpone a Friday night deadline for passing the bill. Other countries are also revealing stimulus plans, notably, Japan’s package of more than $700bn.

READ MORE: European markets open lower amid rising COVID-19 cases and US stimulus concerns

“I think it safe to say the OPEC bounce was yesterday’s news as traders turn to focus on the pace of the vaccine rollouts versus the merciless spread over the short term,” said Stephen Innes, chief global market strategist at Axi. “While the increased probability of stretched or fresh lockdowns cloud the near-term horizon.”

The commodity’s outlook remains negative for him. An additional supply risk may enter the market in the near term as Iran said it will prepare to boost its oil exports, which is a sign that it expects the US government under president-elect Joe Biden will ease sanctions against the country.

“The heightened risk around global trade tension is just another obstacle in the way to Oil price Nirvana + WTI $50 and could prove to be a significant rally killer into the new year,” said Innes.

The FTSE (^FTSE) is also lower on Tuesday, partly dragged down by oil giant Royal Dutch Shell (RDSB.L), which fell by 0.9%. The pandemic has hit oil companies hard this year as demand slumped in the face of recurring lockdowns. Shell announced it was planning to cut up to 9,000 jobs in the wake of the pandemic as it shifts to a green energy programme.

WATCH: OPEC sees even slower oil demand recovery

Yahoo Finance

Yahoo Finance