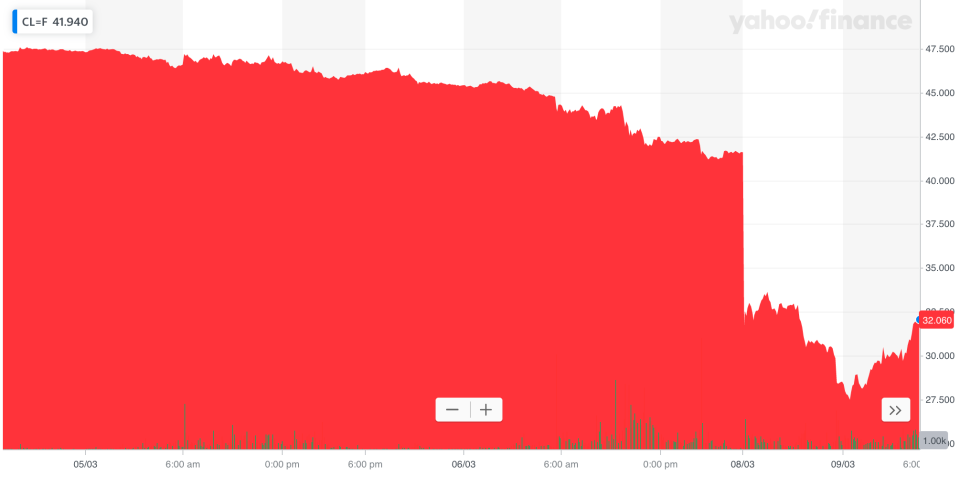

Oil dives 30% as Saudi Arabia starts price war

Crude oil suffered one of the biggest daily price falls on record on Monday, after Saudi Arabia moved to start a price war.

State oil company Saudi Aramco on Saturday said it would cut the price of crude by $6 (£4.5) per barrel in April, according to Reuters. It marks the steepest price cut ever from Saudi Arabia.

Separately, the Financial Times reported that Saudi Arabia will also raise production in a bid to put pressure on rivals.

The price cut, and reports of a price war, sent international oil benchmarks tumbling on Monday morning. Crude oil (CL=F) fell 30% at the open in Asia and crude was still down 25% to $30.59 by 8.15am GMT. It marked the biggest one-day fall for crude prices since the Gulf War, when prices fell 34.8% in 1991.

Brent (BZ=F) was down 23.7% to $34.52 at the same time.

“The deep price cuts signal a move by Saudi Arabia away from market price to market share at a time when the market is already reeling from severe demand destruction as the result of both the warmest winter on record in the Northern Hemisphere, and the impact of the coronavirus to demand,” said Chris Midgley, head of global analytics at S&P Global Platts, a commodity pricing agency.

The shock from declining oil prices rippled across other markets. The FTSE 100 (^FTSE), which is dominated by oil majors like BP (BP.L) and Shell (RDSB.L), crashed 8.8% at the open on Monday.

Over the weekend, Middle Eastern stock markets fell between 5% and 10%. Shares in Saudi Aramco (2222.SR) fell below their IPO price for the first time since listing in December.

The Saudi price cut follows the failure last week to agree a production cut at an OPEC meeting. Saudi Arabia had wanted to cut production among OPEC members and Russia, an OPEC ally, in a bit to prop up prices, which had been under pressure due to a coronavirus-linked market sell-off.

Read more: FTSE 100 crashes as oil shock wipes billions off stocks on ‘black Monday’

However, the meeting broke up without agreement and the Financial Times reported over the weekend that Saudi Arabia is now shifting strategy. Rather than cut production in order to prop up prices, Saudi Arabia now reportedly plans to flood the market with cheap oil in order to put pressure on rival producers.

“We believe the OPEC and Russia oil price war unequivocally started this weekend when Saudi Arabia aggressively cut the relative price at which it sells its crude by the most in at least 20 years,” Goldman Sachs analyst Damien Courvalin and team wrote in a note on Sunday.

Courvalin said the outlook was worse than 2014, when the last price war broke out, because of “the significant collapse in oil demand due to the coronavirus”. Goldman cut its target Brent oil price for the next six months to $30 per barrel.

Both Brent and crude futures were trading at levels not seen since early 2016, during the last oil market price war.

Watch the latest videos from Yahoo Finance UK

Yahoo Finance

Yahoo Finance