Online Grocery Market Report 2024-2032 by Product, Purchaser, Delivery, Payment Mode, Region and Company Analysis - A Projected $2.98 Trillion Opportunity Dominated by Tesco, Walmart and Auchan

Online Grocery Market

Dublin, June 13, 2024 (GLOBE NEWSWIRE) -- The "Online Grocery Market Report by Products, Purchaser, Delivery, Payment Mode, Regions and Company Analysis 2024-2032" report has been added to ResearchAndMarkets.com's offering.

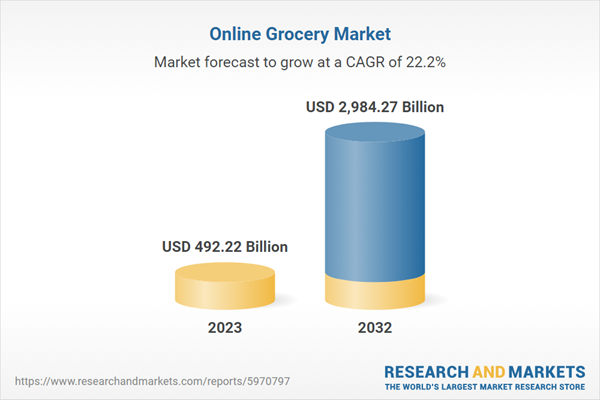

The Global Online Grocery Market was valued at US$ 492.22 billion in 2023 and is expected to reach US$ 2,984.27 billion by 2032. It is expected to grow at a CAGR of 22.17% from 2024 to 2032.

Recent Mergers & Acquisitions in Online Grocery Market

In July 2023, Swiggy acquired LYNK Logistics Ltd entered the food and grocery retail market

July & October 2023, Kering completed acquisitions of Creed & Purchase 30% Stake in Valentino

In 2023, Aldi acquired Winn-Dixie and Harveys Supermarket

April 2023, L'Oreal announced the acquisition of Aesop

In 2023, Ahold Delhaize USA sold FreshDirect to Getir

In 2023, Price Chopper d purchased 5 former New York ShopRite stores

In 2023, PFSbrands acquired Moser's Foods, a grocer in Mid-Missouri

In 2023, Foxtrot and Dom's announced a merger

In April 2024, SpartanNash acquired Metcalfe's Market, a three-store Wisconsin grocer

In October 2022, Kroger Co. and Albertsons Cos. announced the merger, raising concerns from industry stakeholders, national unions, The Federal Trade Commission, and various lawmakers

India's Online Grocery Market

By 2030, India is expected to have the second-largest online shopper base globally, with 500-600 million shoppers. The Indian online grocery market is booming, mainly due to the growth of the e-commerce industry, increasing mobile internet penetration, and the convenience of online shopping. Due to rising incomes and urbanization, online grocery stores are expanding to Tier-II cities. The need for online grocery stores arose due to changing working conditions and the challenge of finding extensive land within cities. The text states that by 2025, around 87% of Indian households will have internet access, with a 21% increase in mobile internet access compared to 2019.

BigBasket, India's biggest online grocery, received US$ 300 Million in funding from Alibaba in 2022, valuing the company at around US$ 950 Million.

Global Online Grocery Company News:

In January 2024 - Stor.ai and Mercatus Technologies merged to help independent and regional retailers offer e-commerce services to customers and compete with larger grocers.

In November 2023 - Ahold Delhaize USA is selling FreshDirect to Getir, a leader in ultrafast grocery delivery. The decision was made to focus on omnichannel investments.

In October 2023 - Kroger now accepts EBT payment for digital pickup and delivery orders.

In July 2023 - Woolworths New Zealand now offers more than 10,000 grocery items through the MILKRUN app. The retailer is committed to providing excellent supermarket experiences and has transitioned from Countdown to Woolworths New Zealand.

In January 2023 - Sainsbury's partnered with Eat Takeaway for faster grocery delivery.

Products - Market breakup in 6 viewpoints:

1. Ready-to-eat Breakfast & Dairy

2. Staples & Cooking Essentials

3. Snacks & Beverages

4. Meat & Seafood

5. Fresh Produce

6. Others

Purchaser Type - Market breakup in 2 viewpoints:

1. Ready-to-eat Subscription Purchase

2. One Time Purchase

Delivery Type - Market breakup in 2 viewpoints:

1. Ready-to-eat Click & Collect

2. Home Delivery

Payment Mode - Market breakup in 2 viewpoints:

1. Online

2. Cash on Delivery

Country - Market breakup of 5 regions and 25 countries:

1. North America

3. Asia Pacific

4. Latin America

5. Middle East & Africa

Company Analysis:

1. Tesco PLC

2. Walmart Inc.

3. Auchan S.A.

4. The Kroger Co.

5. Carrefour

6. Costco Wholesale Corporation

7. Koninklijke Ahold Delhaize N.V.

8. Target Corporation

All key players have been covered from 3 viewpoints:

Overview

Recent Developments

Revenue Analysis

Key Attributes

Report Attribute | Details |

No. of Pages | 210 |

Forecast Period | 2023-2032 |

Estimated Market Value (USD) in 2023 | $492.22 Billion |

Forecasted Market Value (USD) by 2032 | $2,984.27 Billion |

Compound Annual Growth Rate | 22.1% |

Regions Covered | Global |

Online Grocery Market Survey

There are currently over 26 million eCommerce websites across the globe, and new ones are being developed every day.

87% of customers reported using their mobile devices to shop for groceries online.

According to a recent study, 51% of Millennials stated that they would consider switching brands if they were offered digital services without flaws.

72% of customers prefer online grocery shopping due to convenience.

In 2022, 87.2% of US residents aged 15 or older usually shop for groceries online or in person. Of these, 19.3% have bought groceries online in the last 30 days.

By 2024, over 50% of online purchases in China will be made using mobile devices.

In China, digital grocery purchases increased from 9% in 2018 to 19% in 2021. This figure is predicted to reach almost 30% by 2025.

By 2023, India's e-retail shopper base is estimated to reach 230-250 million, with over 100 million added in the last three years. Seventy percent of online shoppers live in Tier 2+ cities, and one-third are Gen Z. About a third of online shoppers belong to low-income or low-middle-income groups.

For more information about this report visit https://www.researchandmarkets.com/r/7fpb01

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world's leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood,Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./ CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900

Yahoo Finance

Yahoo Finance