O'Reilly Automotive Is Covered in Red Flags

O'Reilly Automotive Inc. (NASDAQ:ORLY) is the largest publicly traded auto parts retailer in the United States. Founded over 50 years ago in 1957, the company operates over 6,000 retail locations in 48 states under the name O'Reilly Auto Parts.

Financial results

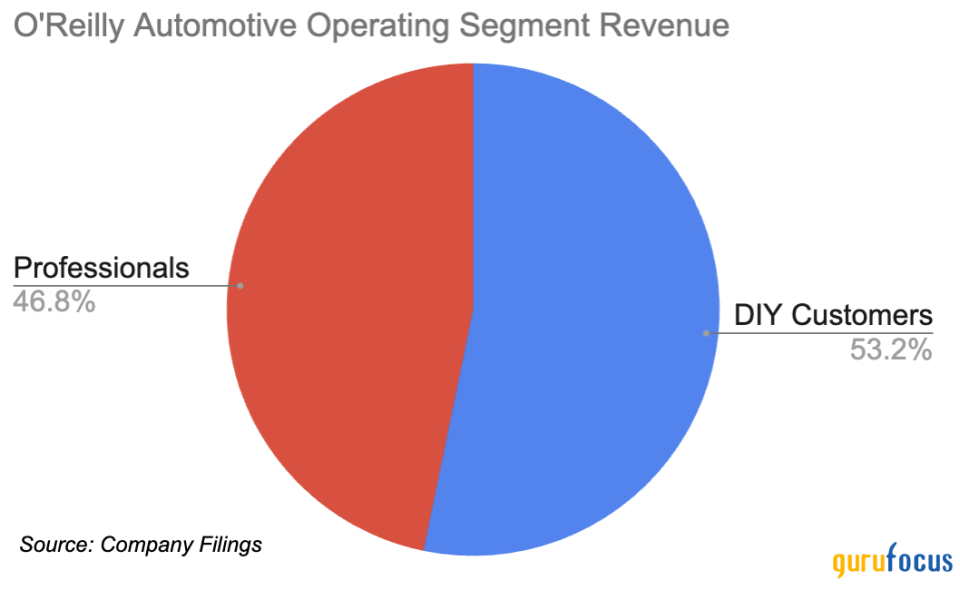

The company operates mainly in two segments: Sales to do-it-yourself customers (DIY customers) and Sales to professional service provider customers (professionals). Just over half of its current revenue comes from DIY customers, but professionals have taken a larger share recently.

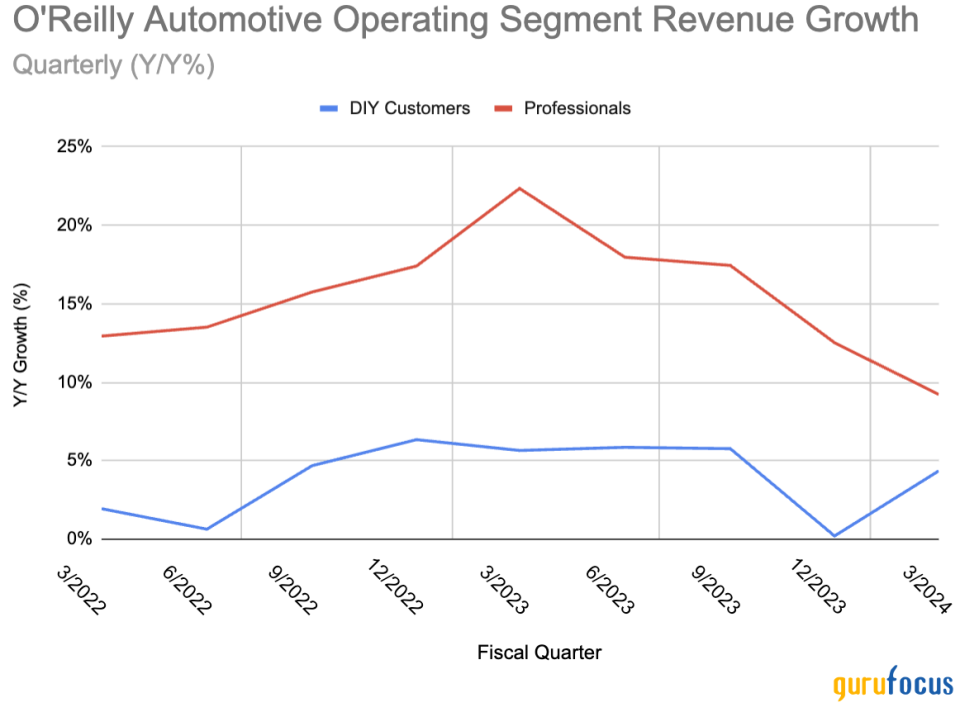

The Professionals segment has higher growth than DIY Customers. However, its growth rate has been slowing the last few quarters, which is a major concern.

Company management is blaming it on two factors: weather and tax refunds. Here are comments from CEO Brad Beckham during the first-quarter 2024 conference call:

"Moving past the winter weather in January, our business was negatively impacted through much of February by the timing of individual income tax refunds. Typically, we see a benefit starting early in February and ramping through the month that coincides with the distribution of tax refunds.However, there was a noticeable delay in the processing of refunds this year that pressured both sides of our business. These pressures moderated as the cumulative amount of refunds begin to catch up to the prior year, and we saw improved trends at the end of February in the first half of March. However, we also experienced unseasonably cool wet weather throughout March across many of our markets. As a result, March and the full quarter finished slightly below our expectations. The trends we saw as we exited the first quarter, have continued into April as we still really haven't seen the uptick in our business that typically accompanies sustained favorable spring weather.

In regards to the weather, I will buy what management is selling. According to the NOAA, The JanuaryMarch precipitation total for the contiguous U.S. was 8.15 inches, 1.19 inches above average, ranking 10th wettest in the 130-year record.

Bad weather will impact O'Reilly's results since consumers are less likely to work on their vehicles in poorer weather.

However, I do not agree that tax refund delays are materially impacting performance. Growth in the Professionals segment has been slowing since it peaked in the first quarter of 2023, which has nothing to do with tax refunds. Even fourth-quarter 2023 growth was down for both segments.

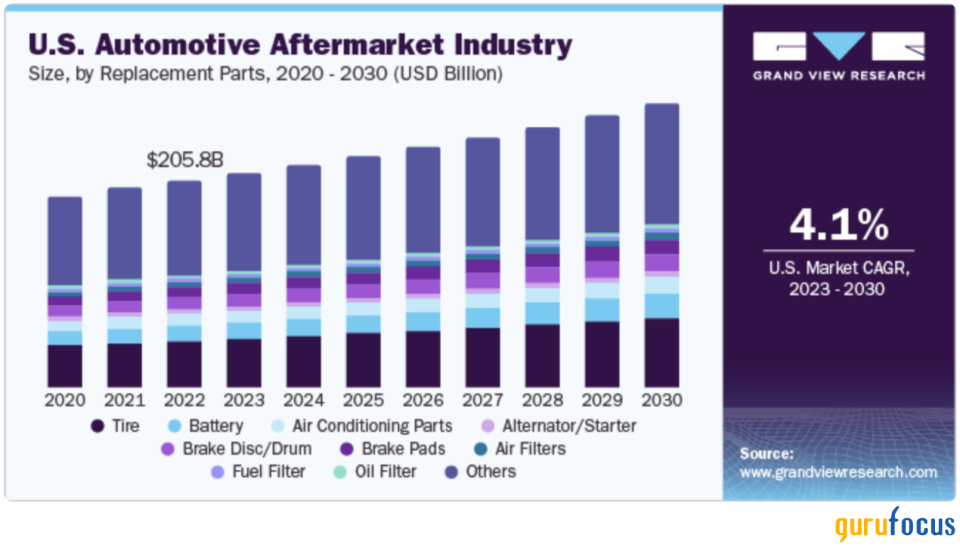

What is the reason for the drop in growth? Like I said earlier, the bad weather in the U.S. did play a part. However, there is a larger issue in that auto parts retailers are not expected to grow significantly over the next decade.

Wall Street analysts are forecasting O'Reilly will maintain this lower growth rate with 7% growth in fiscal year 2024 and 6% growth in 2025.

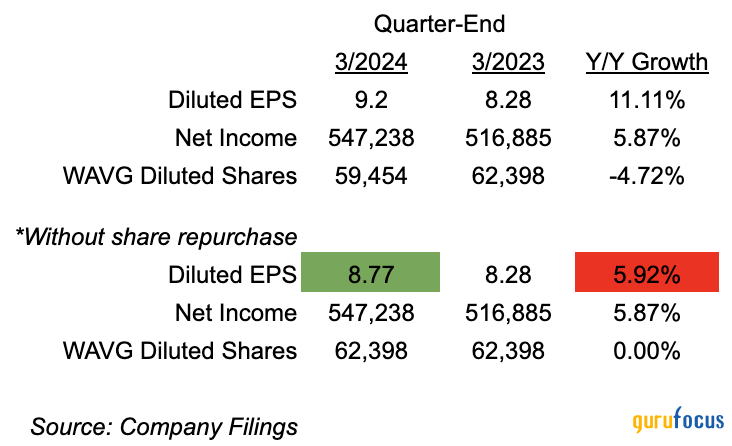

EPS history

If revenue growth is slowing, how is earnings per share impacted?

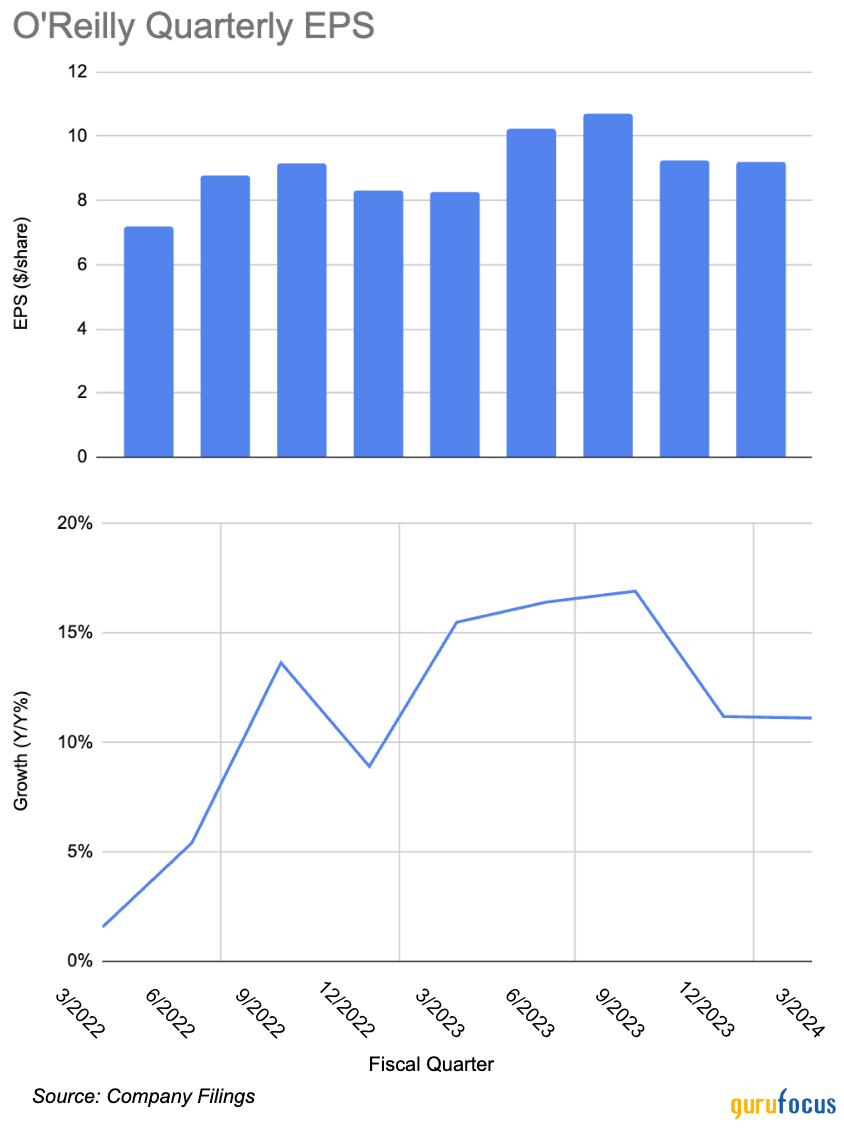

The company's earnings per share has maintained a low, double-digit growth rate the last five quarters, which implies it is able to keep costs under control. However, a lot of these gains are attributable to share repurchases rather than income growth. Let's look at first-quarter 2024 as an example.

O'Reilly's diluted earnings per share grew just over 11% in the first quarter compared to the prior year. However, if the company had not repurchased any shares over the last 12 months, that growth rate is only 5.90%. Over the last decade, O'Reilly has repurchased about 7% of its shares each year. Share repurchases can be great for investors as it increases their percent ownership of the underlying company. But they can also hide potential issues with a company's financials and make earnings per share figures appear better than they are and artificially inflate the share price.

Balance sheet is rough

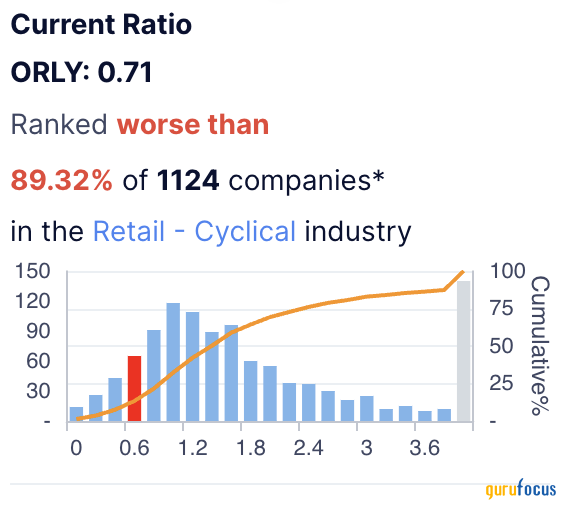

Whenever it appears a company's growth is slowing down, it is critical to investigate the balance sheet to determine if it has the financial flexibility to weather the slowdown. Unfortunately, the balance sheet for O'Reilly is not looking good. First off, the current ratio (ratio of current assets to current liabilities) of 0.70 is much lower than competitors.

A current ratio below 1 can signal a company that will have a difficult time paying off short-term obligations. Some investors would consider this a liquidity risk that might lead to the company needing to take on additional debt, issue more shares or sell off assets to generate cash. I am not going to go that far and argue that O'Reilly is about to have a cash crisis. However, it does lower the margin for error for the company and make it a riskier investment.

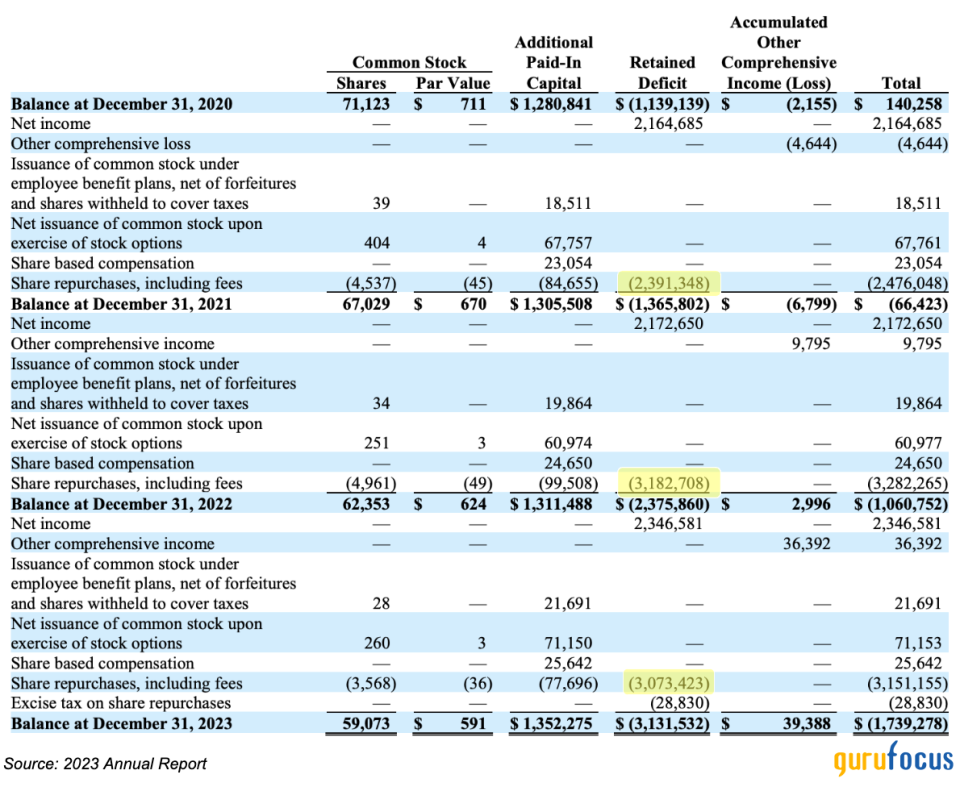

Second, O'Reilly has had negative shareholders' equity since 2021. This is far more concerning to me since it shows the company has too much debt and obligations to others.

The amount of debt the company has carried on its balance sheet has quadrupled in the last decade. And what has O'Reilly done with all of that extra capital? The statement of shareholders' equity points us in the right direction.

It is mostly going to share repurchases. The company's net income is not high enough to cover the share repurchases, so it is issuing more debt to cover the difference. This is not sustainable and makes O'Reilly a very risky investment.

Despite the risks, valuation ratios are high

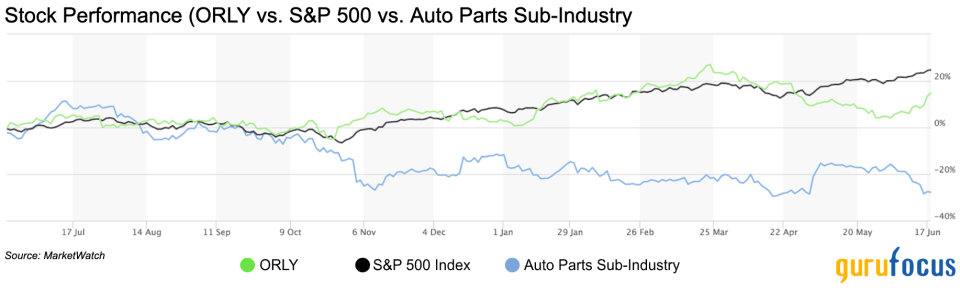

Regardless, O'Reilly has outperformed an industry that is really struggling.

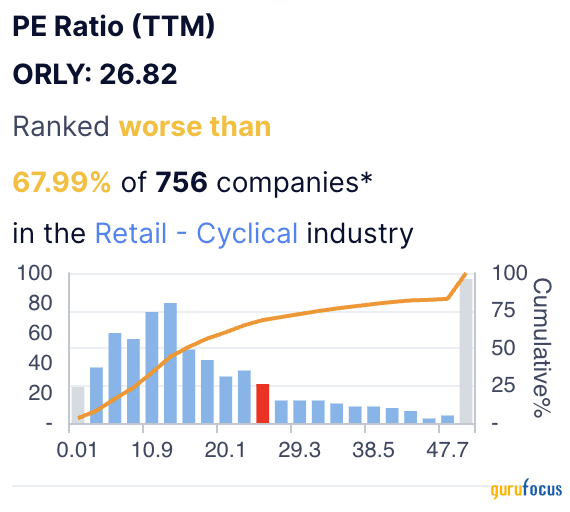

The company's price-earnings ratio is higher than two-thirds of its peers and 50% higher than the industry median.

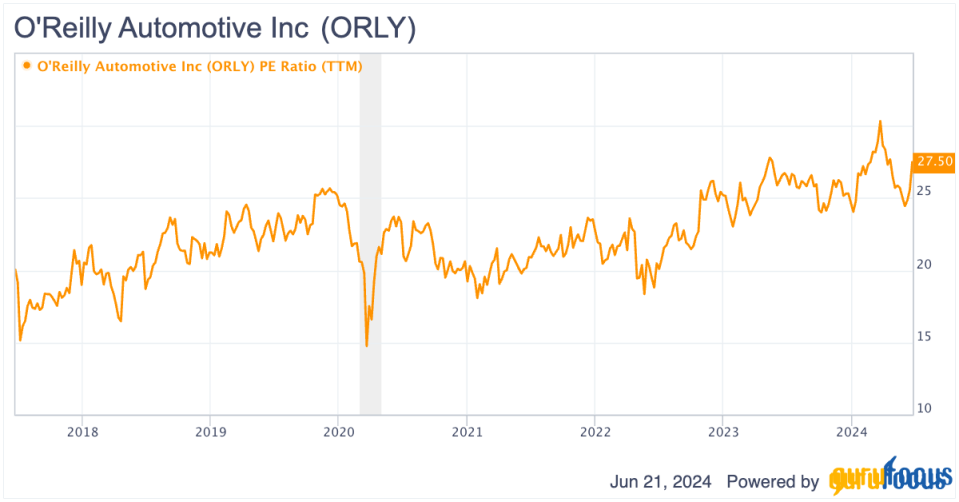

Historically, O'Reilly's price-earnings ratio is usually in the low 20s (15% below current values) and suggests the stock is currently overvalued.

ORLY Data by GuruFocus

Future risks to auto parts retailers

Auto parts retailers are in for some enormous changes. These issues are not unique to O'Reilly, but it must deal with the following changes or lose significant market share to competitors.

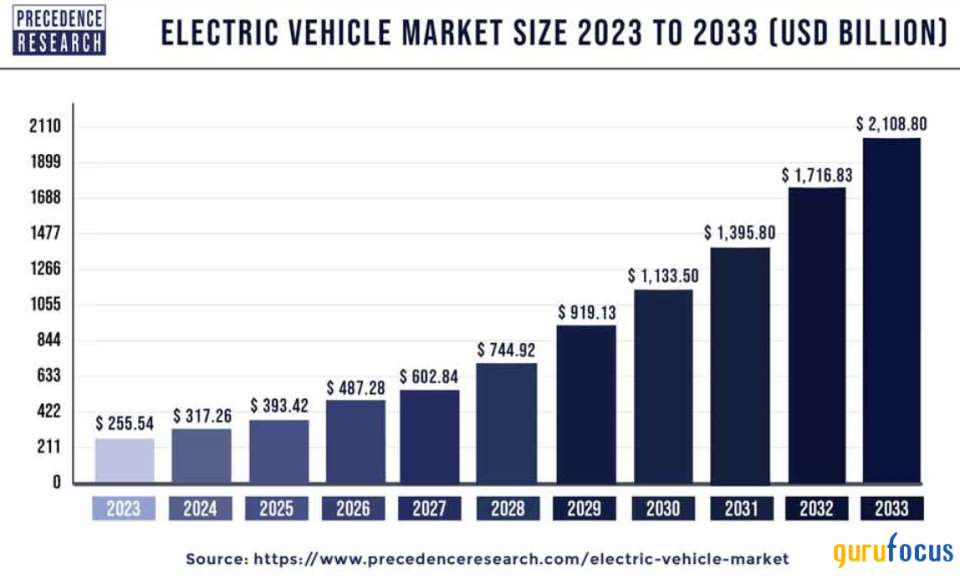

First, growth in electric vehicles will complicate the business. EVs are getting more and more common on the roads. Analysts expect the market size of EVs to be almost 10 times higher than current levels by 2033.

Why is this significant for auto parts retailers? Car parts for traditional gas-powered vehicles are very different from what is on an EV. Sure, things like tires, windshield wipers, brake pads and mirrors are needed for all types of cars regardless of how they move. However, things like filters, pumps and many other parts are not needed in EVs.

As such, auto parts retailers like O'Reilly have a decision to make. Do they cater to gas-powered vehicles and cater to a shrinking consumer base? Or do they try to carry parts for EV and gas-powered cars and thus increase their inventory levels and have additional training for their service technicians? Either way, a major shift for auto parts retailers that will need to be handled very delicately if a company like O'Reilly wants to maintain market share.

Second, online retailers are taking market share. While the overall auto parts market is growing at a slow 4%, online sales are expected to triple in the next decade. O'Reilly has invested in its online store to make sure it takes advantage of this shift, but it might not be enough. Online retailers are jumping into auto parts retail and taking away market share.

For instance, in the fourth quarter of 2023, Amazon (NASDAQ:AMZN) was reported to have just over 12% market share in the auto parts retail sector. This is significant growth compared to its just 7% share back in 2019.

Amazon is not the only online retailer making waves as eBay Motors, the auto parts segment for eBay (NASDAQ:EBAY), accounts for over $10 billion in gross merchandise value each year. That is almost 15% of the total for the entire company.

Amazon and eBay do not play nice and do online retail better than anyone. These companies setting their sights on auto parts retail is a significant risk to the existing players in the industry.

Finally, 3-D printing has the ability to completely revolutionize the auto parts industry. Currently, auto part retailers need to keep a lot of inventory to service their customers. If they decide to service EVs, it will get even worse.

Enter 3-D printing, which would allow retailers to eliminate their specialized inventory and simply produce the items a customer needs directly on-site. Sounds great for companies like O'Reilly, right? Not so fast. O'Reilly will need to completely redesign its stores and retrain employees on how to produce the parts as well as installation. Not to mention, lower inventory levels would level the playing field and reduce startup costs for new competitors entering the industry.

Does this sound far-fetched? Not quite as 3-D printing is already being used in the manufacturing of cars. BMW (XTER:BMW), Honda (NYSE:HMC), Ford (NYSE:F) and Toyota's (NYSE:TM) Lexus are just a few companies that have either used or are planning to use 3-D printing in their manufacturing process. If car manufacturers are looking to use this technology in their business, it is only a matter of time before it shows up in auto parts retail.

Final thoughts: Stay away

O'Reilly is a market leader in the auto parts retail industry. Its eanrings per share have been growing by double-digit rates the last few quarters and the price performance reflects that.

However, I think there are significant headwinds for the industry and O'Reilly will be impacted. A current price-earnings ratio of almost 27 is way too high given the current environment. I think a ratio around 20 would be more appropriate given the risk on the balance sheet and industry uncertainty. This would put a price target at around $830 (20x 2024 EPS of $41.60), which is over 20% below current values.

For most companies that are overvalued, I generally tell new investors to wait for a better price or existing investors to take some profits and sell some shares. O'Reilly is the exception. Its balance sheet is scary and the auto parts retail industry is getting squeezed by outside forces.

If you are a new investor looking to purchase some shares of O'Reilly, I would walk away and find another investment. If you are an existing investor, I would take all of your profits, get out now and never look back. If the price level drops to the low $800s, I would give it another look, but for now stay away.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance