Outlook on the Jewelry Global Market Report to 2030 - Featuring Louis Vuitton, Pandora Jewelry and Richemont Among Others

Global Jewelry Market

Dublin, July 20, 2022 (GLOBE NEWSWIRE) -- The "Jewelry Market Size, Share & Trends Analysis Report by Product (Necklace, Ring, Earring, Bracelet), by Material (Gold, Platinum, Diamond), by Region (North America, Europe), and Segment Forecasts, 2022-2030" report has been added to ResearchAndMarkets.com's offering.

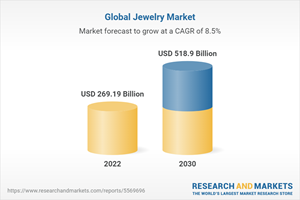

The global jewelry market size is expected to reach USD 518.90 billion by 2030. It is expected to expand at a CAGR of 8.5% from 2022 to 2030. The luxury goods industry continues to drive the market for jewelry, amid challenges concerning varying economic trends.

The demand for jewelry is increasing as the world is recovering from a recession and the global financial crisis of 2008. Over the past few years, consumer preference has turned to branded jewelry. This trend is more prominent among the emerging upper middle class or wealthy consumers, particularly in Asia Pacific, for whom branded jewelry is a status symbol. According to the World Gold Council, India and China accounted for more than 50% of the global gold jewelry demand in 2018.

Most consumers buy jewelry from international or established brands as they offer authentic and trustworthy products and unique designs. E-commerce is another important trend in the industry. Most consumers in this market prefer to research online before purchasing any product, and many make purchases from online portals for convenience.

Technological advancements have been transforming the jewel industry, from mining and discovering precious metals to cloud solutions and e-commerce platforms. Computer-aided design (CAD), 3D printing, and augmented reality (AR) are among the most notable technologies that have been prompting the growth of the industry in recent years. From a distribution standpoint, the emergence and popularity of these technologies have been aiding jewelry manufacturers around the world to realize higher profit margins in retail outlets.

A key trend that has been gripping the jewelry industry over the years is the transformation of the shopping experience using technology. For instance, in June 2017, YOOX NET-A-PORTER GROUP, an Italian online fashion retailer, partnered with Lumyer Inc., a U.S.-based app developing company, to launch an AR camera app designed to enable users to try on jewelry, sunglasses, and handbags in virtual reality.

The rising number of double-income households in emerging economies such as India, China, and Brazil have resulted in increased spending on luxury goods, including jewelry. Spending on luxury products is expanding at a more substantial rate in tier-II cities in India than in tier I cities. According to American Express, high-end spending in tier II cities between 2013 and 2018 grew 30 times faster than that in tier I cities. The rise in luxury spending in tier I and tier II cities is due to strict measures by the Indian government, such as an increase in excise duty on gold and diamond, demonetization, and a rise in taxes on luxury items to curb black money.

Jewelry Market Report Highlights

The ring product segment held the largest revenue share in 2021. The segment stood as the most popular product amongst end users as consumers' interest is growing in the intricate designs and details of the rings. Moreover, they are perceived as elegant and stylish statement-making jewelry among both men and women, which is supporting the growth of the segment

The gold material segment is projected to register the fastest growth rate over the forecast period. In 2020, the jewelry industry used over 1,400 metric tons of gold accounting for more than one-third of all gold demand worldwide

Asia Pacific held the largest revenue share in 2021. Highly populated and developing economies of the region including China and India generate humongous demand for jewelry boosting its consumption and revenue. Additionally, the high significance of jewelry in Indian culture, improving living standards, rising per capita income and spending power, and the rising influence of social media on consumers are fueling the growth of the market in Asia Pacific.

Key Topics Covered:

Chapter 1. Methodology and Scope

Chapter 2. Executive Summary

Chapter 3. Jewelry Market Variables, Trends & Scope

3.1. Market Introduction

3.2. Penetration & Growth Prospect Mapping

3.3. Impact of COVID-19 on the Jewelry Market

3.4. Industry Value Chain Analysis

3.4.1. Raw Material Trend

3.4.2. Manufacturing & Technology Trends

3.4.3. Sales Channel Analysis

3.5. Market Dynamics

3.5.1. Market Driver Analysis

3.5.2. Market Restraint Analysis

3.5.3. Industry Challenges

3.5.4. Industry Opportunities

3.6. Business Environment Analysis

3.6.1. Industry Analysis - Porter's

3.6.1.1. Supplier Power

3.6.1.2. Buyer Power

3.6.1.3. Substitution Threat

3.6.1.4. Threat from New Entrant

3.6.1.5. Competitive Rivalry

3.6.2. PESTEL Analysis

3.6.3. Major Deals & Strategic Alliances Analysis

3.6.3.1. Mergers & Acquisitions

3.7. Market Entry Strategies

Chapter 4. Consumer Behavior Analysis

4.1. Consumer Trends and Preferences

4.2. Factors Affecting Buying Decision

4.3. Consumer Product Adoption

4.4. Observations & Recommendations

Chapter 5. Jewelry Market: Product Estimates & Trend Analysis

5.1. Product Movement Analysis & Market Share, 2021 & 2030

5.2. Necklace

5.2.1. Market estimates and forecast, 2017-2030 (USD Million)

5.3. Ring

5.3.1. Market estimates and forecast, 2017-2030 (USD Million)

5.4. Earring

5.4.1. Market estimates and forecast, 2017-2030 (USD Million)

5.5. Bracelet

5.5.1. Market estimates and forecast, 2017-2030 (USD Million)

5.6. Others

5.6.1. Market estimates and forecast, 2017-2030 (USD Million)

Chapter 6. Jewelry Market: Material Estimates & Trend Analysis

6.1. Material Movement Analysis & Market Share, 2021 & 2030

6.2. Platinum

6.2.1. Market estimates and forecast, 2017-2030 (USD Million)

6.3. Gold

6.3.1. Market estimates and forecast, 2017-2030 (USD Million)

6.4. Diamond

6.4.1. Market estimates and forecast, 2017-2030 (USD Million)

6.5. Others

6.5.1. Market estimates and forecast, 2017-2030 (USD Million)

Chapter 7. Jewelry Market: Regional Estimates & Trend Analysis

Chapter 8. Competitive Analysis

8.1. Key global players, recent developments & their impact on the industry

8.2. Key Company/Competition Categorization (Key innovators, Market leaders, Emerging players)

8.3. Vendor Landscape

8.3.1. Key company market share analysis, 2021

Chapter 9. Company Profiles

9.1. Tiffany & Co.

9.1.1. Company Overview

9.1.2. Financial Performance

9.1.3. Product Benchmarking

9.1.4. Strategic Initiatives

9.2. Louis Vuitton SE

9.2.1. Company Overview

9.2.2. Financial Performance

9.2.3. Product Benchmarking

9.2.4. Strategic Initiatives

9.3. Signet Jewelers Limited

9.3.1. Company Overview

9.3.2. Financial Performance

9.3.3. Product Benchmarking

9.3.4. Strategic Initiatives

9.4. Pandora Jewelry, LLC

9.4.1. Company Overview

9.4.2. Financial Performance

9.4.3. Product Benchmarking

9.4.4. Strategic Initiatives

9.5. H.Stern

9.5.1. Company Overview

9.5.2. Financial Performance

9.5.3. Product Benchmarking

9.5.4. Strategic Initiatives

9.6. Richemont

9.6.1. Company Overview

9.6.2. Financial Performance

9.6.3. Product Benchmarking

9.6.4. Strategic Initiatives

9.7. Chow Tai Fook Jewellery Group Limited

9.7.1. Company Overview

9.7.2. Financial Performance

9.7.3. Product Benchmarking

9.7.4. Strategic Initiatives

9.8. Malabar Gold & Diamonds

9.8.1. Company Overview

9.8.2. Financial Performance

9.8.3. Product Benchmarking

9.8.4. Strategic Initiatives

9.9. Swarovski AG

9.9.1. Company Overview

9.9.2. Financial Performance

9.9.3. Product Benchmarking

9.9.4. Strategic Initiatives

9.10. GRAFF

9.10.1. Company Overview

9.10.2. Financial Performance

9.10.3. Product Benchmarking

9.10.4. Strategic Initiatives

For more information about this report visit https://www.researchandmarkets.com/r/rn8p0u

Attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood, Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900

Yahoo Finance

Yahoo Finance