Outlook on the Merchant API Global Market to 2027 - Increasing Incidence of Diabetes Drives Growth

Global Merchant API Market

Dublin, Jan. 06, 2023 (GLOBE NEWSWIRE) -- The "Global Merchant API Market: Analysis By Molecular Type, By Segment, By Type, By Type of Synthesis, By End-User, By Region Size And Trends With Impact Of COVID-19 And Forecast up to 2027" report has been added to ResearchAndMarkets.com's offering.

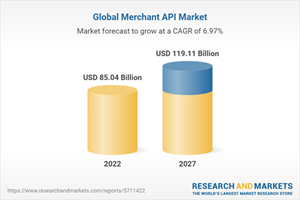

The global merchant API market was valued at US$79.50 billion in 2021. The market value is expected to reach US$119.11 billion by 2027.

The merchant API (or contract manufacturing) sits within the wider Pharma value chain and encompasses all activities related to the development and manufacture of active pharmaceutical ingredients (API) both for products clinical trials and commercial products.

There has been an increase in the willingness of, especially smaller pharma and biotech companies to collaborate with specialized entities due to the expertise and equipment required to manufacture the compounds.

Additionally, pharma companies are increasingly focusing on core capabilities like R&D and marketing, leaving the manufacturing side of the process to specialized entities.

Thus, merchant API market growth has increased due to increased pharma outsourcing to improve margins and potentially shorten time-to-market. The market is expected to grow at a CAGR of approx. 7% during the forecasted period of 2022-2027.

Market Dynamics:

Growth Drivers: The global merchant API market growth is predicted to be supported by numerous growth drivers such as increasing incidence of chronic and lifestyle diseases, aging population, increasing healthcare expenditure, increasing research and development spending, growing pharmaceutical industry, growing pharma outsourcing trend, and many other factors. Contract manufacturing offers many benefits to the associates as it provides them with a supply of drug products from clinical production to commercial manufacturing under Good manufacturing practices (GMP) manufacturing operations. Other than this, companies get the time and financial relief to work on selling and marketing products instead of only focusing on the drug manufacturing process. Thus, owing to these factors, the trend of outsourcing has increased which has positively influenced the merchant API market growth.

Challenges: However, the market growth would be negatively impacted by various challenges such as strict laws and regulations, lack of transparency and loss of control, etc.

Trends: The market is projected to grow at a fast pace during the forecast period, due to various latest trends such as growing use of artificial intelligence, new drug approvals, increasing patent expiry, etc. New and innovative drugs expand treatment options, for instance, for previously unmet needs or new population targets (e.g. children), increasing the number of drugs consumed. The need for APIs grows as more drugs are approved, thus companies outsource the manufacturing of the APIs to manufacture the drugs more economically. Thus, the demand for merchant APIs is anticipated to rise in the upcoming years as a result of the rise in novel medicine approvals.

Impact Analysis of COVID-19 and Way Forward:

In 2020, the global merchant API have experienced slower growth. Lower pharmaceutical volume demand has been seen in several areas, with lower rates of doctor visits and new diagnoses. However, many other contract manufacturing organizations saw some significantly increased demand related to new COVID vaccines and therapeutics projects. A significant spike in demand for novel drugs has led to the higher manufacturing, export, and import of APIs thus, leading to an average price hike in API products and intermediates. Moreover, favorable policies and initiatives taken by various governments are expected to smoothen the production of APIs in the long run, and this would support the merchant API market growth in the post-COVID era.

Competitive Landscape:

The global merchant API market is highly fragmented. The key players in the global merchant API market are:

Pfizer Inc. (Pfizer CenterOne)

Bachem Holding AG

Thermo Fisher Scientific Inc.

Teva Pharmaceutical Industries Ltd. (Teva API)

Sanofi (EuroAPI)

Siegfried Holding AG

Lonza Group AG

PolyPeptide Group AG

Divi's Laboratories Limited

Centrient Pharmaceuticals

Cambrex

Fabbrica Italiana Sintetici

To keep ahead of the competition, companies in the market undergo regular R&D operations. In order to stay ahead of the competition, companies operating on the global market are also anticipated to turn to aggressive expansion methods including mergers, acquisitions, and strategic alliances.

For instance, in 2022, Bachem Group announced the signing of a further work order for the delivery of large volumes of peptides over a five-year period from 2025-2029.

On the other hand, Sanofi and Innovent Biologics announced a collaboration to bring innovative medicines to patients in China with difficult-to-treat cancers. Also, Siegfried announced that the company had decided to extend the collaboration with Novavax, a US-based biopharmaceutical company, for the aseptic fill & finish of Novavax's protein-based coronavirus vaccine Nuvaxovid.

In 2021, Lonza held a share of 2.58% of the global merchant API market, whereas in CDMO market, Lonza had a market share of 4.6%.

Report Attribute | Details |

No. of Pages | 152 |

Forecast Period | 2022 - 2027 |

Estimated Market Value (USD) in 2022 | $85.04 Billion |

Forecasted Market Value (USD) by 2027 | $119.11 Billion |

Compound Annual Growth Rate | 7.0% |

Regions Covered | Global |

Key Topics Covered:

1. Executive Summary

2. Introduction

2.1 Active Pharmaceutical Ingredients (API): An Overview

2.1.1 Introduction to CDMOs and API

2.1.2 Pharma Value Chain

2.2 Merchant API: An Overview

2.2.1 Introduction to Merchant API

2.2.2 Advantages and Disadvantages of Merchant API

2.3 Merchant API Segmentation: An Analysis

2.3.1 Merchant API Segmentation

3. Global Market Analysis

3.1 Global Merchant API Market: An Analysis

3.1.1 Global Merchant API Market: An Overview

3.1.2 Global Merchant API Market by Value

3.1.3 Global Merchant API Market by Molecular Type (Small Molecules and Large Molecules)

3.1.4 Global Merchant API Market by Segment (CDMO and API Solutions)

3.1.5 Global Merchant API Market by Type (nnovative API and Generic API)

3.1.6 Global Merchant API Market by Type of Synthesis (Synthetic and Biotech)

3.1.7 Global Merchant API Market by Region (North America, Asia Pacific, Europe, and Rest of the World)

3.2 Global Merchant API Market: Molecular Type Analysis

3.2.1 Global Merchant API Market by Molecular Type: An Overview

3.2.2 Global Small Molecules Merchant API Market by Value

3.2.3 Global Large Molecules Merchant API Market by Value

3.3 Global Merchant API Market: Segment Analysis

3.3.1 Global Merchant API Market by Segment: An Overview

3.3.2 Global Merchant API CDMO Market by Value

3.3.3 Global Merchant API CDMO Market by Molecular Type (Small Molecules and Large Molecules)

3.3.4 Global Merchant API CDMO Molecular Type Market by Value

3.3.5 Global Merchant API CDMO Market by End-User (Peptides, Oligos, and Others)

3.3.6 Global Merchant API CDMO End-User Market by Value

3.3.7 Global Merchant API Solutions Market by Value

3.4 Global Merchant API Market: Type Analysis

3.4.1 Global Merchant API Market by Type: An Overview

3.4.2 Global Innovative Merchant API Market by Value

3.4.3 Global Generic Merchant API Market by Value

3.5 Global Merchant API Market: Type of Synthesis Analysis

3.5.1 Global Merchant API Market by Type of Synthesis: An Overview

3.5.2 Global Synthetic Merchant API Market by Value

3.5.3 Global Biotech Merchant API Market by Value

4. Regional Market Analysis

5. Impact of COVID-19

5.1 Impact of COVID-19 on Global Merchant API Market

5.2 Post COVID-19 Impact on Global Merchant API Market

6. Market Dynamics

6.1 Growth Drivers

6.1.1 Increasing Incidence of Diabetes

6.1.2 Aging Population

6.1.3 Increasing Healthcare Expenditure

6.1.4 Increasing Research and Development Spending

6.1.5 Growing Pharmaceutical Industry

6.1.6 Growing Pharma Outsourcing Trend

6.2 Challenges

6.2.1 Strict Laws and Regulations

6.2.2 Lack of Transparency and Loss of Control

6.3 Market Trends

6.3.1 Growing Use of Artificial Intelligence

6.3.2 New Drug Approvals

6.3.3 Increasing Patent Expiry

6.3.4 Growth of the High-potency Active Pharmaceutical Ingredients (HPAPI)

7. Competitive Landscape

7.1 Global Merchant API Players by Market Share

7.2 Global Merchant API CDMO Players by Market Share

7.3 Global Peptide Merchant API CDMO Players by Market Share

7.4 Global Oligos Merchant API CDMO Players by Market Share

8. Company Profiles

8.1 Pfizer Inc. (Pfizer CenterOne)

8.1.1 Business Overview

8.1.2 Operating Segments

8.1.3 Business Strategies

8.2 Bachem Holding AG

8.2.1 Business Overview

8.2.2 Net Sales by Product Categories

8.2.3 Business Strategies

8.3 Thermo Fisher Scientific Inc.

8.3.1 Business Overview

8.3.2 Operating Segments

8.3.3 Business Strategy

8.4 Teva Pharmaceutical Industries Ltd. (Teva API)

8.4.1 Business Overview

8.4.2 Operating Segments

8.4.3 Business Strategies

8.5 Sanofi (EuroAPI)

8.5.1 Business Overview

8.5.2 Operating Segments

8.5.3 Business Strategies

8.6 Siegfried Holding AG

8.6.1 Business Overview

8.6.2 Net Sales by Product Group

8.6.3 Business Strategies

8.7 Lonza Group AG

8.7.1 Business Overview

8.7.2 Operating Segments

8.7.3 Business Strategy

8.8 PolyPeptide Group AG

8.8.1 Business Overview

8.8.2 Operating Segments

8.8.3 Business Strategies

8.9 Divi's Laboratories Limited

8.9.1 Business Overview

8.9.2 Revenue by Region

8.10 Centrient Pharmaceuticals

8.10.1 Business Overview

8.10.2 Business Strategies

8.11 Cambrex

8.11.1 Business Overview

8.11.2 Business Strategy

8.12 Fabbrica Italiana Sintetici

8.12.1 Business Overview

For more information about this report visit https://www.researchandmarkets.com/r/ddl6e2

Attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood,Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./ CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900

Yahoo Finance

Yahoo Finance