Outlook on the Off-highway Electric Vehicle Global Market to 2030 - Featuring Caterpillar, Volvo Construction Equipment and Komatsu Among Others

Global Off-highway Electric Vehicle Market

Dublin, June 01, 2022 (GLOBE NEWSWIRE) -- The "Off-highway Electric Vehicle Market Size, Share & Trends Analysis Report by Application (Construction, Agriculture, Mining), by Electric Vehicle, by Region, and Segment Forecasts, 2022-2030" report has been added to ResearchAndMarkets.com's offering.

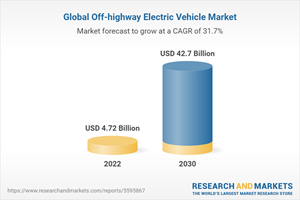

The global off-highway electric vehicle market size is expected to reach USD 42.70 billion by 2030, registering a CAGR of 31.7% during the forecast period. The commencement of re-development projects and growing infrastructural developments in developing countries are significant factors driving the market growth.

Moreover, stringent emission regulations by government agencies, such as emission standards for Greenhouse Gas (GHG) emissions by the U.S. Environmental Protection Agency (EPA) and European Commission, are driving the demand for off-highway EVs worldwide. Factors such as lower noise levels and vibrations, lower overhaul cost, and improved efficiency of these vehicles are further contributing to their demand.

Electrically-propelled equipment offers advantages such as enhanced overall efficiency and accuracy and high maneuverability during operations. The electrification of off-highway vehicles provides multiple benefits; nonetheless, its penetration in the market is expected to be slow owing to factors such as inadequate charging infrastructure and limited storage capacity of batteries. The limitations of electrically-propelled equipment have provided an advantage to hybrid off-highway electric vehicles, which are considered a feasible option.

However, the high cost associated with the development of these vehicles is restricting their growth in the market. Furthermore, the electrification of the powertrain for an off-highway vehicle is under the radar owing to the possibilities of noise generation and diesel-powered engine emissions. Off-highway vehicles, including agriculture, mining, and construction equipment, are being electrified for better performance, emission control, and reliability.

In the construction equipment segment, most light-duty vehicles, such as small wheel loaders and small excavators, are Battery Electric Vehicles (BEV). Light-duty construction equipment needs less power and a smaller battery compared to large equipment. Various equipment manufacturers, including Caterpillar, Komatsu Ltd., and Volvo CE, are offering larger loaders and wheel excavators in hybrid variants.

In the mining sector, off-highway electric vehicles are used for decreasing the exhaust emission inside the mines. Moreover, the concept of electrification is predominant in the agriculture sector as the equipment can be integrated with Artificial Intelligence (AI) and the cost of ownership of the equipment is low. In December 2020, Monarch Tractor announced the launch of a fully-electric and autonomous tractor. It is a fully-electric smart tractor integrated on a single platform and equipped with AI. The tractor can collect and analyze over 240 GB of crop data each day during operation on the field.

Off-highway Electric Vehicle Market Report Highlights

The market was valued at USD 4.42 billion in 2021 and is projected to register a CAGR of 31.7% over the forecast period.

The construction segment emerged as the largest segment in 2021 and is anticipated to generate a revenue of over USD 16.37 billion over the forecast period.

The BEV segment is projected to register the highest CAGR of 40.0% over the forecast period owing to a slowdown in the adoption of internal combustion engine vehicles and restrictions on CO2 targets.

The North American market accounted for the largest share in 2021 as the region is characterized by the presence of prominent original equipment manufacturers of off-highway EVs.

Key Topics Covered:

Chapter 1. Methodology and Scope

Chapter 2. Executive Summary

Chapter 3. Off-Highway Electric Vehicle Market Variables, Trends & Scope

3.1. Penetration and Growth Prospect Mapping

3.2. Global Off-highway Electric Vehicle Market Dynamics

3.2.1. Market Driver Analysis

3.2.2. Market Restraints Analysis

3.3. Industry Value Chain Analysis

3.4. Market Analysis Tools

3.4.1. Industry Analysis-Porter's Five Forces

3.4.2. Industry Analysis-PEST Analysis

3.5. Impact Of COVID-19 On Off-Highway Electric Vehicle Market

Chapter 4. Off-Highway Electric Vehicle Market: Application Outlook

4.1. Market Size Estimates & Forecasts and Trend Analysis, 2018-2030 (Revenue, USD Billion)

4.2. Construction

4.2.1. Market Estimates and Forecasts by Region, 2018-2030 (Revenue, USD Billion)

4.3. Agriculture

4.3.1. Market Estimates and Forecasts by Region, 2018-2030 (Revenue, USD Billion)

4.4. Mining

4.4.1. Market Estimates and Forecasts by Region, 2018-2030 (Revenue, USD Billion)

Chapter 5. Off-Highway Electric Vehicle Market: Electric Vehicle Outlook

5.1. Market Size Estimates & Forecasts and Trend Analysis, 2018-2030 (Revenue, USD Billion)

5.2. BEV

5.2.1. Market Estimates and Forecasts by Region, 2018-2030 (Revenue, USD Billion)

5.3. HEV

5.3.1. Market Estimates and Forecasts by Region, 2018-2030 (Revenue, USD Billion)

Chapter 6. Off-Highway Electric Vehicle Market: Regional Outlook

Chapter 7. Competitive Landscape

7.1. Key Company Analysis, 2021

7.2. Company Profiles

7.2.1. Caterpillar

7.2.1.1. Company Overview

7.2.1.2. Financial Performance

7.2.1.3. Product Benchmarking

7.2.1.4. Recent Developments

7.2.2. Volvo Construction Equipment AB

7.2.2.1. Company Overview

7.2.2.2. Financial Performance

7.2.2.3. Product Benchmarking

7.2.2.4. Recent Developments

7.2.3. Deere & Company

7.2.3.1. Company Overview

7.2.3.2. Financial Performance

7.2.3.3. Product Benchmarking

7.2.3.4. Recent Developments

7.2.4. Komatsu Ltd.

7.2.4.1. Company Overview

7.2.4.2. Financial Performance

7.2.4.3. Product Benchmarking

7.2.4.4. Recent Developments

7.2.5. Sandvik AB

7.2.5.1. Company Overview

7.2.5.2. Financial Performance

7.2.5.3. Product Benchmarking

7.2.5.4. Recent Developments

7.2.6. Hitachi Construction Machinery Co., Ltd.

7.2.6.1. Company Overview

7.2.6.2. Financial Performance

7.2.6.3. Product Benchmarking

7.2.6.4. Recent Developments

7.2.7. Epiroc AB

7.2.7.1. Company Overview

7.2.7.2. Financial Performance

7.2.7.3. Product Benchmarking

7.2.7.4. Recent Developments

7.2.8. Doosan Corporation

7.2.8.1. Company Overview

7.2.8.2. Financial Performance

7.2.8.3. Product Benchmarking

7.2.8.4. Recent Developments

7.2.9. J.C. Bamford Excavators Ltd.

7.2.9.1. Company Overview

7.2.9.2. Financial Performance

7.2.9.3. Product Benchmarking

7.2.9.4. Recent Developments

7.2.10. CNH Industrial N.V.

7.2.10.1. Company Overview

7.2.10.2. Financial Performance

7.2.10.3. Product Benchmarking

7.2.10.4. Recent Developments

For more information about this report visit https://www.researchandmarkets.com/r/483i69

Attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood, Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900

Yahoo Finance

Yahoo Finance