Oxford biotech seals $842m deal for experimental gene therapy treatment for Parkinson's

A gene therapy company that started life at the University of Oxford has signed an $842.5m (£627.3m) deal with an American start-up to commercialise a promising injectable treatment for Parkinson's Disease, sending its shares up by 20pc.

Oxford Biomedica will get an upfront payment of $30m when it transfers the drug to Axovant Sciences, a US company founded just three years ago by 32-year-old hedge fund manager-turned-biotech entrepreneur Vivek Ramaswamy.

There will be further payments when the gene therapy reaches certain milestones, such as completing clinical trials or gaining regulatory approval, to a possible total of $842.5m.

The agreement is significant for Oxford Biomedica, which made £37.6m in sales last year but is still loss-making and has a market capitalisation of just £565m.

A major part of the company's strategy is to sell or license out pre-clinical drug candidates to third parties, who then go on to develop and commercialise them. It has done deals like this in the past, but this is the first one in nearly a decade.

Chief executive John Dawson said: "It’s very important for us, this is our crown jewel of drugs."

Shares in Oxford Biomedica jumped 20pc to 869p when news of the deal broke.

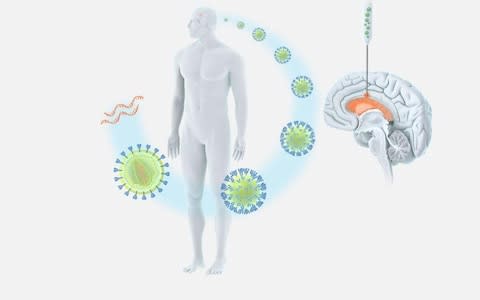

The treatment is called OXB-102. It works by using a harmless virus as the vehicle with which to introduce the treatment into the cells of the patient. That treatment consists of genes that have been modified to produce dopamine, a chemical in the brain that sends signals to other nerves and which people with Parkinson's lack.

It is injected directly into the brain and it his hoped it will stop or improve the symptoms of Parkinson's.

Phase one trials are due to begin by the end of the year in up to 30 patients associated with Cambridge University Hospital and UCL's Queen's Square Institute of Neurology in London.

"We've been working on this with regulators for quite some time," said Mr Dawson. "The patients in this first trial are ones who have had Parkinson's for ten years or so."

The deal, which has been about nine months in the making, will "certainly improve our numbers significantly", Mr Dawson said.

As well as being a good deal for Oxford Biomedica, it’s also a huge bet for Axovant, whose share price has never recovered since it took a plunge in September last year when an Alzheimer’s drug it bought from GlaxoSmithKline failed in clinical trials.

The company’s initial strategy when it debuted onto the US stock market with a $3bn public listing was to buy experimental drugs in the field of neuroscience that larger pharmaceutical companies had binned because they didn’t seem to work.

This strategy failed when Axovant revealed last year that the Alzheimer’s treatment it had taken from GSK didn’t make any difference to patients. The share price has lingered at $1.75 ever since, compared with its listing price of $15 a share.

Mr Dawson said several companies had been interested in the Parkinson's therapy, but that Axovant was the best one, both from a financial and technological point of view.

"They have the people and expertise and we think we have a fantastic partner," he said. "This is very important for them too and will be there lead drug."

Oxford Biomedica was founded in 1996 and listed on the London Stock Exchange in 2000.

Yahoo Finance

Yahoo Finance