PARK24 And Two Other Japanese Exchange Stocks Considered For Value Investing Opportunities

Amidst a backdrop of modest declines in the Japanese stock markets, with the Nikkei 225 and TOPIX indices experiencing negative returns due to uncertainties around monetary policy, investors might find value in exploring underappreciated stocks. In such an environment, identifying companies with solid fundamentals and potential for growth becomes crucial for those considering value investing opportunities in Japan.

Top 10 Undervalued Stocks Based On Cash Flows In Japan

Name | Current Price | Fair Value (Est) | Discount (Est) |

Link and Motivation (TSE:2170) | ¥454.00 | ¥890.56 | 49% |

Mimaki Engineering (TSE:6638) | ¥1879.00 | ¥3513.72 | 46.5% |

Plus Alpha ConsultingLtd (TSE:4071) | ¥1913.00 | ¥3566.19 | 46.4% |

Hibino (TSE:2469) | ¥2538.00 | ¥4877.08 | 48% |

OSAKA Titanium technologiesLtd (TSE:5726) | ¥2807.00 | ¥5524.33 | 49.2% |

S-Pool (TSE:2471) | ¥314.00 | ¥588.77 | 46.7% |

Gift Holdings (TSE:9279) | ¥2760.00 | ¥5374.10 | 48.6% |

Macromill (TSE:3978) | ¥866.00 | ¥1678.64 | 48.4% |

NIHON CHOUZAILtd (TSE:3341) | ¥1481.00 | ¥2806.45 | 47.2% |

freee K.K (TSE:4478) | ¥2397.00 | ¥4464.98 | 46.3% |

Here we highlight a subset of our preferred stocks from the screener

PARK24

Overview: PARK24 Co., Ltd. specializes in operating and managing parking facilities both in Japan and internationally, with a market capitalization of approximately ¥278.07 billion.

Operations: The company generates revenue primarily from the operation and management of parking facilities globally.

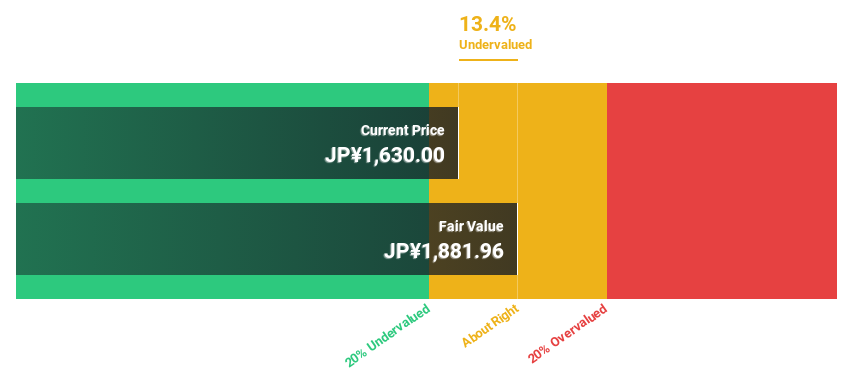

Estimated Discount To Fair Value: 13.4%

PARK24, currently trading at ¥1630, is perceived as undervalued based on DCF analysis with a fair value estimate of ¥1881.96. Despite its high debt levels, the company's earnings have grown by 67.5% over the past year and are expected to increase by 12.71% annually. Furthermore, PARK24's revenue growth is projected to outpace the Japanese market with a 5.5% annual increase compared to the market's 4.2%. However, its valuation remains slightly below significant undervaluation thresholds.

Insights from our recent growth report point to a promising forecast for PARK24's business outlook.

Dive into the specifics of PARK24 here with our thorough financial health report.

Strike CompanyLimited

Overview: Strike Company Limited (TSE: 6196) operates as a brokerage for mergers and acquisitions of small and medium-sized enterprises in Japan, with a market capitalization of approximately ¥90.64 billion.

Operations: The firm specializes in providing brokerage services for mergers and acquisitions targeting small to medium-sized enterprises across Japan.

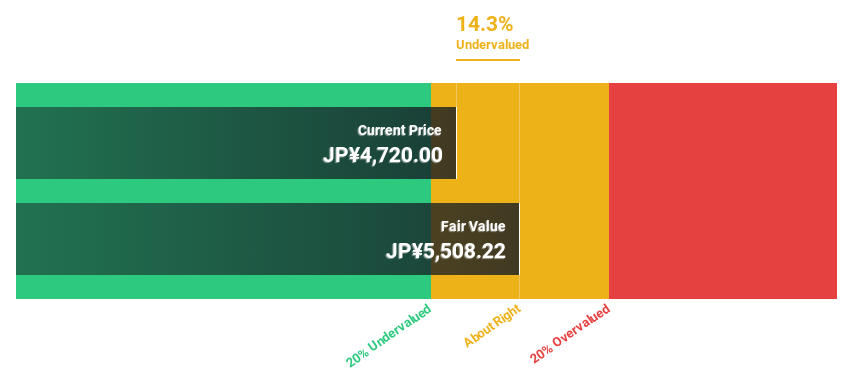

Estimated Discount To Fair Value: 14.3%

Strike CompanyLimited, with a current trading price of ¥4720 against a DCF-estimated fair value of ¥5508.22, appears modestly undervalued. The firm's recent upward revision in earnings guidance underscores robust operational momentum, projecting significant hikes in net sales and profits for the first half of FY2024. Earnings are expected to grow by 17.58% annually, outpacing the Japanese market average. However, its share price has shown high volatility recently, adding a layer of risk despite strong financial forecasts and performance indicators.

KATITAS

Overview: KATITAS CO., Ltd. operates in Japan, engaging in the surveying, purchasing, refurbishing, remodeling, and selling of used homes to individuals and families with a market cap of approximately ¥136.45 billion.

Operations: The company generates revenue primarily through its House for Resale Reproduction Business, which amounted to ¥126.72 billion.

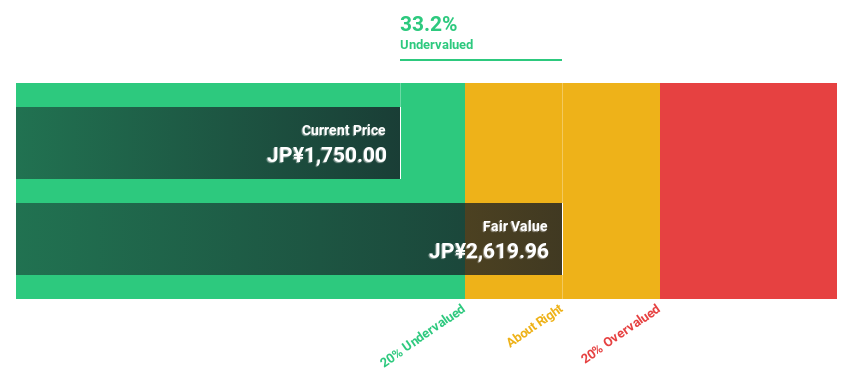

Estimated Discount To Fair Value: 33.2%

KATITAS CO., Ltd. is trading at ¥1750, significantly below the estimated fair value of ¥2619.96, indicating potential undervaluation based on cash flows. While its revenue growth (7.1% per year) and earnings growth (9.3% per year) are projected to outpace the Japanese market averages, concerns remain due to its unstable dividend track record and recent corporate actions including a resolution for treasury stock disposal as restricted compensation and an ongoing legal appeal. This mixed financial landscape suggests cautious optimism for investors looking at cash flow metrics for valuation.

Key Takeaways

Take a closer look at our Undervalued Japanese Stocks Based On Cash Flows list of 100 companies by clicking here.

Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include TSE:4666 TSE:6196 and TSE:8919.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance