Parnassus Mid Cap Growth Fund's Strategic Exits and New Positions Highlight Q2 2024 Moves, with ...

Insight into the Investment Shifts of a Veteran Value Investor

Jerome Dodson (Trades, Portfolio), the founder and chairman of Parnassus Investments, has reported significant changes to Parnassus Mid Cap Growth Fund's investment portfolio in the second quarter of 2024. Known for his ethical investment philosophy, Dodson has a history of focusing on companies with strong competitive advantages, quality management, and robust ESG practices. His investment decisions this quarter reflect a strategic realignment, emphasizing new growth opportunities while stepping away from previous holdings.

Summary of New Buys

Jerome Dodson (Trades, Portfolio)'s portfolio saw the addition of four new stocks in this quarter. Noteworthy among them are:

BILL Holdings Inc (NYSE:BILL), with 317,035 shares, making up 2.02% of the portfolio and valued at $16.68 million.

Western Digital Corp (NASDAQ:WDC), comprising 185,162 shares or approximately 1.7% of the portfolio, with a total value of $14.03 million.

MSCI Inc (NYSE:MSCI), added 26,308 shares, accounting for 1.53% of the portfolio and valued at $12.67 million.

Key Position Increases

The Parnassus Mid Cap Growth Fund also increased its stakes in five stocks, with significant boosts to:

Nutrien Ltd (NYSE:NTR), where he added 199,545 shares, bringing the total to 310,046 shares. This represents a substantial 180.58% increase in share count and impacts the portfolio by 1.23%, with a total value of $15.78 million.

Equifax Inc (NYSE:EFX), with an additional 27,666 shares, bringing the total to 147,699. This adjustment marks a 23.05% increase in share count, totaling $35.81 million in value.

Summary of Sold Out Positions

In a significant portfolio adjustment, Jerome Dodson (Trades, Portfolio)'s fund exited five positions entirely, including:

Block Inc (NYSE:SQ), where all 255,442 shares were sold, impacting the portfolio by -2.49%.

Copart Inc (NASDAQ:CPRT), with all 251,100 shares liquidated, resulting in a -1.68% portfolio impact.

Key Position Reductions

Reductions were also notable in the fund's strategy, with major cuts in:

Progressive Corp (NYSE:PGR), reduced by 51,903 shares, a -37.79% decrease, impacting the portfolio by -1.24%. The stock traded at an average price of $209.31 during the quarter.

Cintas Corp (NASDAQ:CTAS), reduced by 12,258 shares, a -28.52% reduction, impacting the portfolio by -0.97%. The stock's average trading price was $683 during the quarter.

Portfolio Overview

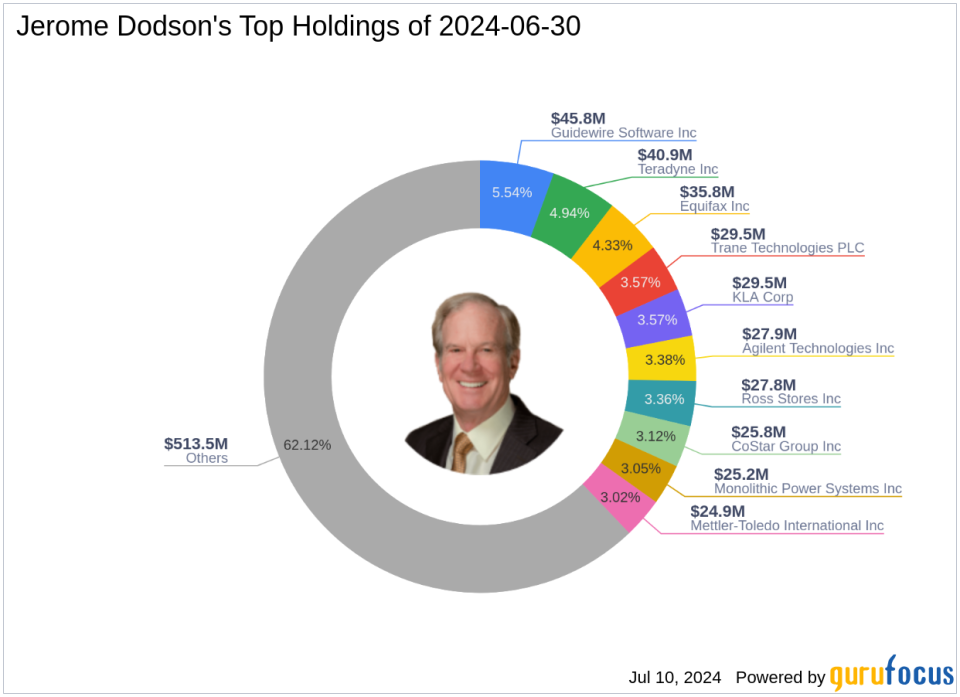

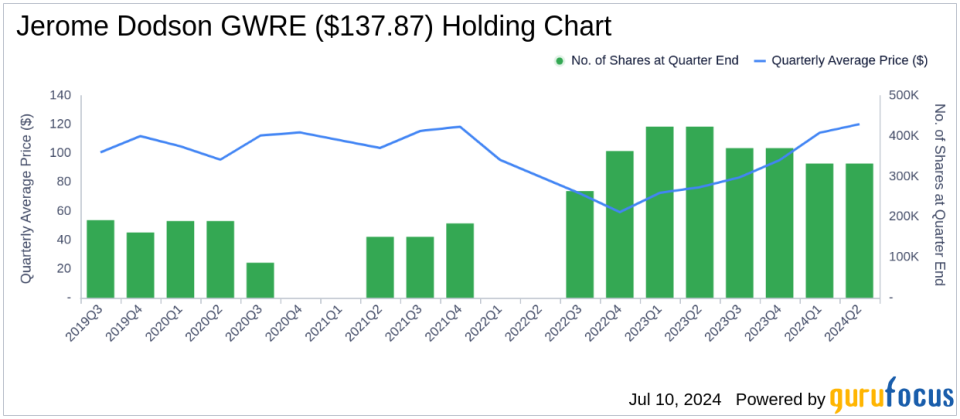

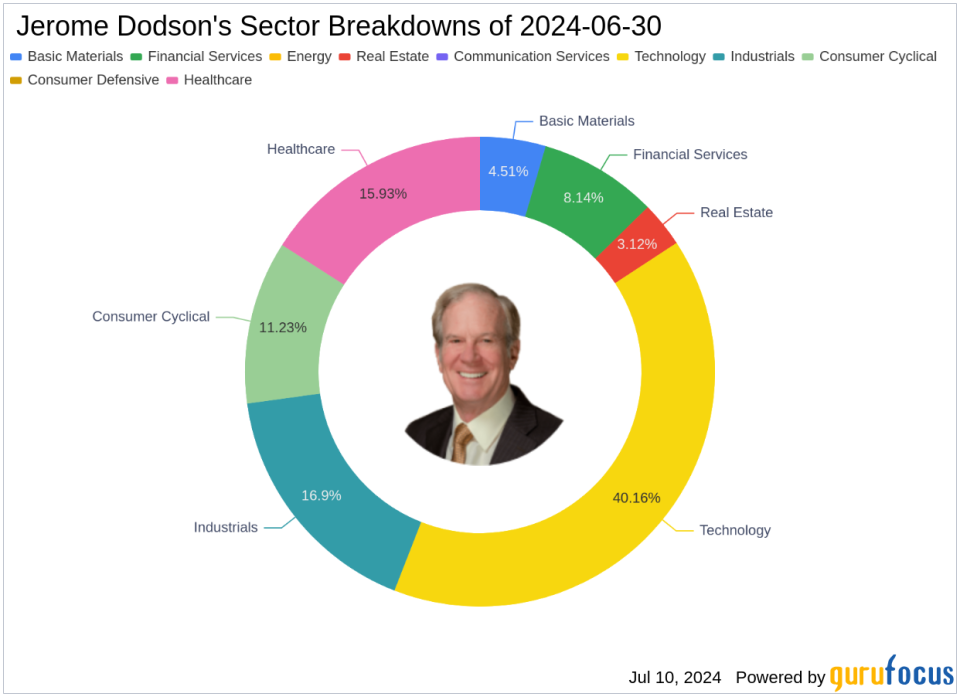

As of the second quarter of 2024, Jerome Dodson (Trades, Portfolio)'s portfolio included 40 stocks. The top holdings were 5.54% in Guidewire Software Inc (NYSE:GWRE), 4.94% in Teradyne Inc (NASDAQ:TER), and 4.33% in Equifax Inc (NYSE:EFX). The portfolio shows a strong concentration in sectors like Technology, Industrials, and Healthcare, reflecting Dodson's preference for industries with long-term growth potential.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance