Patterson Companies' (PDCO) Launch to Boost Insurance Workflow

Patterson Companies, Inc.’s PDCO subsidiary, Patterson Dental Supply, Inc., recently announced new integrations available with DentalXChange. The integrations are available for Fuse, Eaglesoft, Dolphin Management and Dolphin Blue practice management customers.

Patterson Dental practice management software customers now expected to have additional electronic insurance processing and electronic patient statement solutions available via DentalXChange.

The latest addition to Patterson Companies’ product portfolio is expected to significantly boost its Dental business unit.

Significance of the Launch

The new integrated solutions will likely provide Patterson Dental practice management customers with additional options for their electronic insurance processing workflow and patient billing statement workflow.

Per management, the recent cyber incident impacting Change Healthcare had an unprecedented impact on how dental offices have been able to complete electronic insurance tasks, including sending electronic claims and attachments and having a service available to print and mail patient statements. Management expects to offer enhanced solutions to Patterson Dental practice management software customers and make the revenue cycle management process easy and streamlined via DentalXChange.

Industry Prospects

Per a report by Grand View Research, the global dental practice management software market was estimated at $2.6 billion in 2023 and is anticipated to witness a CAGR of approximately 10.2% between 2024 and 2030. Factors like increasing dental visits and the growing adoption of healthcare IT solutions in oral practice procedures are likely to drive the market.

Given the market potential, the latest launch is expected to solidify Patterson Companies’ foothold in the niche space.

Notable Developments

Last month, Patterson Dental Supply, Inc. announced a new product, Patterson CarePay+. The product is available to new and existing Eaglesoft practice management software customers.

In March, Patterson Dental expanded its Eaglesoft claims processing and insurance services to include Vyne Dental. The collaboration with Vyne Dental will likely ensure rapid resolution of insurance claims and attachments, real-time eligibility checks and electronic remittance advice.

In February, Patterson Companies reported its third-quarter fiscal 2024 results, wherein it recorded an uptick in its internal sales driven by dental consumables growth and a year-over-year increase in internal sales of dental consumables (excluding the deflationary impact of certain infection control products).

Price Performance

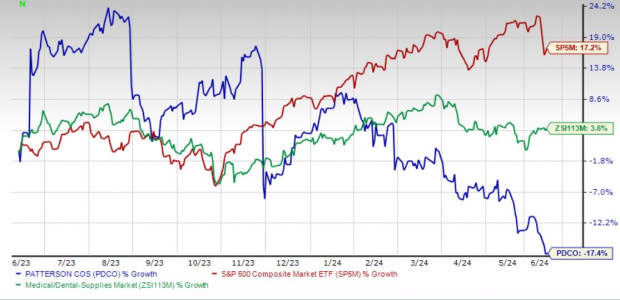

Patterson Companies’ stock has lost 17.4% over the past year against the industry’s 3.6% rise and the S&P 500's 17.2% growth.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

Currently, Patterson Companies carries a Zacks Rank #4 (Sell).

Some better-ranked stocks in the broader medical space are DaVita Inc. DVA, Boston Scientific Corporation BSX and Ecolab Inc. ECL.

DaVita, carrying a Zacks Rank #2 (Buy) at present, has an estimated long-term growth rate of 13.6%. DVA’s earnings surpassed estimates in each of the trailing four quarters, with the average surprise being 29.4%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

DaVita’s shares have gained 46.4% compared with the industry’s 18% rise in the past year.

Boston Scientific, carrying a Zacks Rank of 2 at present, has an estimated long-term growth rate of 12.5%. BSX’s earnings surpassed estimates in each of the trailing four quarters, with the average being 7.5%.

Boston Scientific has gained 45.2% compared with the industry’s 0.8% rise in the past year.

Ecolab, carrying a Zacks Rank of 2 at present, has an estimated long-term growth rate of 14.3%. ECL’s earnings surpassed estimates in each of the trailing four quarters, with the average surprise being 1.3%.

Ecolab’s shares have rallied 34.4% against the industry’s 11.9% decline in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Boston Scientific Corporation (BSX) : Free Stock Analysis Report

Ecolab Inc. (ECL) : Free Stock Analysis Report

DaVita Inc. (DVA) : Free Stock Analysis Report

Patterson Companies, Inc. (PDCO) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance