Patterson Companies (PDCO) Q4 Earnings Miss, Sales Rise Y/Y

Patterson Companies, Inc. PDCO reported fourth-quarter fiscal 2024 adjusted earnings per share (EPS) of 82 cents, which missed the Zacks Consensus Estimate of 83 cents by 1.2%. The bottom line also declined 2.4% from the prior-year quarter’s level.

GAAP EPS in the quarter was 74 cents, down 3.9% from the bottom line recorded in the year-ago period.

Adjusted EPS for full-year fiscal 2024 was $2.30, down 5% from the prior-year period’s level.

Revenue Details

Net sales in the quarter were $1.72 billion, in line with the Zacks Consensus Estimate. The top line improved 0.1% year over year. Internal sales, adjusted for the effects of currency translation, decreased 0.5% from the prior-year quarter’s figure.

Revenues increased 1.5% year over year to $6.57 billion for fiscal 2024.

Segmental Analysis

The company currently distributes products through its subsidiaries, Patterson Dental and Patterson Animal Health.

Dental Segment

This segment provides a complete range of consumable dental products, equipment, software, turnkey digital solutions and value-added services to dentists and laboratories throughout North America.

In the fourth quarter of fiscal 2024, dental sales declined 3.8% year over year to $657.8 million. Steady growth of consumables was partially offset by lower sales of equipment and value-added services.

Dental Consumable

Sales in the sub-segment totaled $366.3 million, up 3.7% from the year-ago quarter’s number.

Dental Equipment

Sales in the segment declined 12% on a year-over-year basis to $217.3 million.

Value-added Services and Other

This segment comprises technical services, parts and labor, software support services and office supplies. Sales declined 11% year over year to $74.2 million, primarily driven by the negative impact of the cybersecurity attack on Change Healthcare.

Animal Health Segment

The segment is a leading distributor of veterinary supplies to clinics, public and private institutions, and shelters across the United States.

In the fiscal fourth quarter, sales improved 3.1% to $1.06 billion from the prior-year period’s level.

Corporate

The segment recorded revenues of $0.7 million compared with $5.5 million in the year-ago quarter.

Patterson Companies, Inc. Price, Consensus and EPS Surprise

Patterson Companies, Inc. price-consensus-eps-surprise-chart | Patterson Companies, Inc. Quote

Margin Analysis

Gross profit in the reported quarter was $371.2 million, down 4.8% year over year. As a percentage of revenues, the gross margin of 21.5% contracted approximately 110 basis points on a year-over-year basis.

Operating expenses amounted to $283.4 million, down 0.5% from the prior-year quarter’s figure.

The company reported an operating income of $87.8 million, down 16.5% from the year-ago quarter’s level.

Financial Position

PDCO exited the reported quarter with cash and cash equivalents of $114.5 million compared with $124 million in the year-ago period.

Cumulative net cash used in operating activities at the end of the quarter was $789.4 million compared with $754.9 million in the prior-year period.

Fiscal 2025 Earnings Outlook

Patterson Companies issued its earnings guidance for fiscal 2025. The company projects adjusted EPS to be in the range of $2.33-$2.43, and the Zacks Consensus Estimate for the same is pegged at $2.37.

Our Take

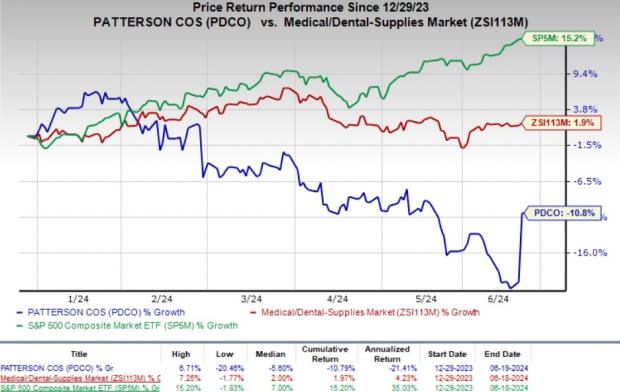

PDCO ended fourth-quarter fiscal 2024 on a mixed note, wherein earnings missed estimates while revenues were in line with the same. Quarterly results reflected the negative impact of a cybersecurity attack on the company’s claims processing vendor, Change Healthcare, leading to the inability to utilize services for processing insurance claims by many dental practices. Shares of this company have lost 10.8% so far this year against the industry's 1.9% gain. The S&P 500 Index has risen 15.2% in the same time frame.

Image Source: Zacks Investment Research

Dental consumables showed strong growth, exceeding market expectations. However, the dental equipment segment experienced a decline in internal sales, impacted by challenging comparisons and a lack of product innovation. Strong performance in the production animal business drove sales in the Animal Health segment, partially offset by lower companion animal sales due to moderation in veterinary clinic traffic.

PDCO has been making significant investments in developing its software and value-added services offerings across both its dental and Animal Health segments. These are likely to drive demand for its products.

The company launched a new all-in-one patient financing, dental insurance, and payment solution, CarePay+, during the fourth quarter. The new system will provide alternative payment options to patients for care, enabling increased patient retention and streamlined practice operations for PDCO’s dental customers. The company signed an agreement during the third quarter with Pearl, a leading AI solution provider for the dental business, to integrate a pathology detection feature set. It also recently launched a Turnkey insights platform to meaningfully advance Turnkey beyond tracking to a tool that supports better business decision-making.

Zacks Rank and Stocks to Consider

Patterson Companies currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader medical space are DaVita Inc. DVA, Boston Scientific BSX and Hologic HOLX.

DaVita, carrying a Zacks Rank #2 (Buy) at present, has an estimated long-term growth rate of 13.6%. Its earnings surpassed estimates in each of the trailing four quarters, delivering an average surprise of 29.4%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

DaVita’s shares have risen 35.7% compared with the industry’s 8.4% growth year to date.

Boston Scientific, carrying a Zacks Rank of 2 at present, has an estimated earnings growth rate of 12.5% in 2024. Its earnings surpassed estimates in each of the trailing four quarters, delivering an average surprise of 7.49%.

BSX’s shares have risen 32.1% year to date compared with the industry’s 3% growth.

Hologic, carrying a Zacks Rank of 2 at present, has an estimated long-term growth rate of 7.4%. Its earnings surpassed estimates in each of the trailing four quarters, delivering an average surprise of 4.94%.

Hologic’s shares have risen 0.1% year to date compared with the industry’s 5.6% growth.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Boston Scientific Corporation (BSX) : Free Stock Analysis Report

DaVita Inc. (DVA) : Free Stock Analysis Report

Hologic, Inc. (HOLX) : Free Stock Analysis Report

Patterson Companies, Inc. (PDCO) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance