PayPal Is a Huge Value Opportunity With Growth Risks

PayPal Holdings Inc. (NASDAQ:PYPL) is a company most people have heard of. It was spun off from eBay Inc. (EBAY) in 2015, and while the stock price surged 790% until July 2021, it is now down 80% from its all-time high. There are some significant reasons for this that I will address, but I am also confident the stock is currently one of the largest value opportunities on the market right now.

The GF Score currently ranks the company at 97 out of 100, which is nothing short of exceptional. However, I am also interested in picking apart some of the hidden discrepancies in the stock, looking into the operational details to find potentially overlooked defects and competitive struggles that could be coming.

Reasons for the share price decline

One of the major factors contributing to the company's share price decline is eBay's transition to its own payment system in June 2021. This significantly reduced how many people on eBay paid using PayPal. In 2021, Benzinga reported PayPal's revenue coming from eBay was just 4% due to this, after dropping 45% in a quarter. However, PayPal's payment volume went from $1.25 trillion in 2021 to $1.36 trillion in 2022, showing continued resilience and growth in the face of eBay's transition.

CNBC's Juhohn Lee observed the online payment provider thrived during the pandemic. He noted the company's revenue increased from $17.8 billion in 2019 to over $25 billion in 2021. At one point during the pandemic, e-commerce sales contributed 16.4% of all retail sales in the U.S., but it has been under 15% for the past two years. As life returned to normal, the stock began to crash.

Additionally, greater competition from the likes of Block (NYSE:SQ), Stripe, Apple (NASDAQ:AAPL) Pay and Google (NASDAQ:GOOG) (NASDAQ:GOOGL) Pay have thwarted areas that PayPal used to dominate. It is challenging to precisely ascertain PayPal's market share, especially in an ever-evolving industry focused on multiple revenue sources that I do not think accurately fall under one umbrella: the payment management market. Yet according to 6Sense, PayPal has the greatest share of this market with 40.43% as compared to Stripe's 36.99%.

However, Apple Pay, for example, does not appear in its peer comparison group despite Apple Insider reporting a transaction volume of $6 trillion annually for the service. PayPal's annual transaction volume in 2023 is approximately $1.49 trillion, calculated using real first-, second-, and third-quarter 2023 data. To do this, I sourced transaction volume data of $355 billion from the first quarter, $377 billion from the second quarter and $388 billion from third quarter, took an average and multiplied it by four as fourth-quarter earnings have yet to be reported. These foundational figures were sourced from Insider Intelligence, DemandSage and GuruFocus. As such, Apple Pay clearly dominates PayPal in this regard.

Moving forward, PayPal will struggle to remain resilient against such intense competition. As newer technologies take over, it is difficult for some older companies to stay current. This could be a slower growth chapter for PayPal, yet the investment still looks compelling.

Forward operational strategies

Of the most effective operational strategies PayPal is employing, its Buy Now, Pay Later initiative that it launched in August 2020, are the most convincing to me. The only issue is Apple Pay and Stripe also now have such services. Apple started rolling out its own Apple Pay Later in spring 2023. Stripe partners with third-party BNPL providers, including Affirm (NASDAQ:AFRM), Klarna and Afterpay.

One of the reasons I think PayPal will struggle to keep up is the power-dominant hardware providers now have to control consumers' tastes based on ease. For example, Apple Pay has such a straightforward application on people's phones that it almost seems silly to pull out PayPal in most in-person transactions. I have found PayPal most useful in online money transfers; perhaps this is a core area it could harness to remain competitive and corner a part of the payments business moving forward.

Let's look at how PayPal plans to harness artificial intelligence. It seems like every technology company in the world right now is planning on becoming AI integrated. I think there is a good reason for this; the companies that do not will get left behind and will not be able to keep up with the efficient and more attractive products of AI-integrated companies. PayPal is already using AI for fraud detection and payment processing, data management and improvements, enhanced security and, most interesting to me, machine learning models to improve authorization rates of valid transactions.

From my research, there are three core areas where PayPal will compete in the payments industry on AI integrations. These are:

Fraud detection harnessing AI to analyze datasets and detect fraudulent activities in real time.

Regulatory compliance using AI to review customer data and monitor transactions, ensuring compliance with financial regulations.

Customer service AI assistants processing payments and responding to queries, allowing humans to focus on more sophisticated tasks.

A deeper look at risks

While the risks I have presented thus far are related to future operations and not immediate revenue growth concerns, it is worth considering how this could play out to get a deeper perspective on future earnings.

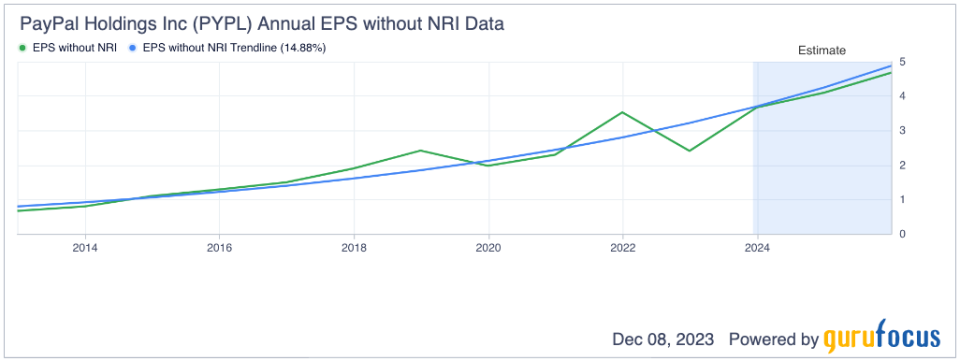

GuruFocus currently gives the company a growth rank of 10 out of 10. Evidence shows that a high score is warranted, including a 17.90% 10-year average annual revenue growth rate and a one-year growth rate of 12%. On an even stronger note, the earnings per share without non-recurring items 10-year average annual revenue growth rate was 15.5% and, on a one-year basis, it is a massive 47.10%.

While this shows continued resilience in the face of some of the operational challenges I have highlighted, I am not sure the company can sustain such intense growth forever. While removing PayPal's direct partnership with eBay was a big blow to the company, its strategies to remain relevant are working. Yet, could this be an era of slow growth for PayPal? Or will it miraculously innovate to become a cutting-edge, future-oriented and AI-focused electronic payment provider? Perhaps, but let's look at the evidence for this.

The company is rigorously entering the world of cryptocurrency, introducing measures like Checkout with Crypto, allowing users to buy and sell crypto through their PayPal account, and integrating crypto utilities into Venmo, a mobile payment service owned by the company. This strategy is smart, and one of the ways it could remain one of the most crucial payment services in the world is by fulfilling a more extensive, more fully integrated payment system that accommodates all types of currencies and easy exchanges.

However, it is worth noting that just in the last few days, it has been widely reported that Amazon (AMZN) will no longer accept Venmo as of Jan. 10, 2024. This will significantly affect Venmo's revenue and transaction volume and hurt PayPal's stock.

Yet the most significant risk to PayPal remains the heightened competition. Becoming the "everything to do with money app" is not a small task, and multiple prominent players, including Elon Musk, who started at PayPal as one of the founders, want to achieve this. As such, I am pondering which company's leadership has the direction and resolve to make it happen. Arguably, with the old guard of PayPal moving on to their own respective platforms and enterprises, the innovation needed to pull this off could be gone.

However, I do not think that is the case. Instead, I believe the company has to rigorously face its competitors and innovate quickly toward an evolved goal to remain relevant. If it does that, it could avoid a worst-case scenario of being phased out in the decades to come as an initial e-payment provider that more revolutionary enterprises have since dominated. I believe this will be the defining factor contributing to a decline or continued growth in PayPal's future revenue and earnings.

Closing thoughts

To reiterate, PayPal is currently a significant value opportunity. It will require work to remain competitive and keep its revenue growth rates up, and this is the most significant risk I see for the company moving forward.

Yet, with a significantly low price, a forward price-earnings ratio of 10 and a fantastic discounted cash flow analysis, one has to wonder why not buy the shares. I know I definitely am. This is as true a value investment as they get; the only question is whether it can double up as a growth stock in the future. Either way, it is a sensible capital allocation while I watch the operations unfold.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance