PC Maker Raspberry Pi, Backers Seek £157 Million in Rare UK IPO

(Bloomberg) -- British personal computer maker Raspberry Pi and its shareholders are looking to raise £157 million ($200 million) via an initial public offering in London, offering a ray of hope for tech listings in the financial hub.

Most Read from Bloomberg

S&P 500 Hits 25th Record This Year as Tech Soars: Markets Wrap

BlackRock, Citadel Back Texas Stock Exchange in Challenge to NYSE

Billionaire-Friendly Modi Is Punished by Millions of Poor Voters

Goldman Sees ‘Wall of Money’ Fueling Stock Market’s Summer Party

Raspberry Pi is looking to raise $40 million of fresh funding, while Raspberry Pi Foundation, a UK charity aimed at promoting computer science to young people and the firm’s main shareholder, will also sell some existing shares, according to a statement on Monday. The total deal size will be about £157 million, according to terms seen by Bloomberg News.

Raspberry Pi plans to sell shares at £2.60 to £2.80 each through June 10, with the start of conditional trading on June 11. The deal would give Raspberry Pi an implied free float of about 20%.

The small offering is a welcome addition to the London market, whose share has fallen to about 2% of the $12.6 billion raised in IPOs in Europe this year, the lowest in decades, according to data compiled by Bloomberg. It’s a sharp reversal of fortune for the City, which has long been the continent’s top listing destination.

Raspberry Pi was seeking a valuation of about £500 million via the listing, Bloomberg News reported last month. The IPO is set to be the biggest in London since Kazakhstan’s Air Astana JSC listed its global depositary receipts in February.

The investment arm of chipmaker Arm Holdings Plc has agreed to buy $35 million worth of shares in the IPO, while Lansdowne Partners UK LLP will purchase as much as $20 million worth. Both are existing shareholders in the company.

The company, which makes low-cost computers popular among educators, has in the past also raised money from Sony Group Corp.’s semiconductor division.

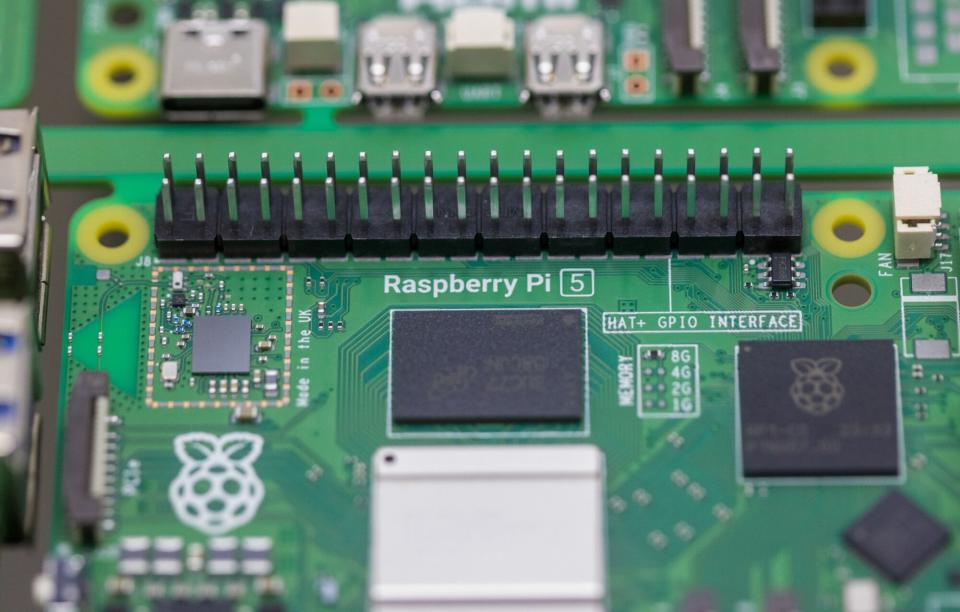

It has since evolved beyond its initial target market of hobbyists, with many of its products now being used for industrial and commercial purposes, particularly so-called Internet of Things applications.

Raspberry Pi’s pocket-sized computers incorporating Arm chips are being used in IoT systems, which have a wide range of uses from smart cities to self-driving cars and automated checkouts in supermarkets.

The company had revenue of $265.8 million last year and adjusted earnings before interest, taxes, depreciation, and amortization of $43.5 million. Raspberry Pi plans to use the proceeds for for engineering capital expenditure, to enhance its supply chain resilience and for general corporate purposes.

Jefferies International Ltd, and Peel Hunt LLP are joint global co-ordinators and joint bookrunners for the IPO.

--With assistance from Farah Elbahrawy.

Most Read from Bloomberg Businessweek

David Sacks Tried the 2024 Alternatives. Now He’s All-In on Trump

Startup Brings New Hope to the Pursuit of Reviving Frozen Bodies

The Budget Geeks Who Helped Solve an American Economic Puzzle

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance