Peak Private Credit Fears Force Funds to Scrabble for Returns

(Bloomberg) -- In an effort to sustain the stellar returns of recent years, private credit funds are scrutinizing their cost of financing, switching up their investor base and targeting smaller, riskier businesses.

Most Read from Bloomberg

Donald Trump Becomes First Former US President Guilty of Crimes

World’s Largest Nuclear Plant Sits Idle While Energy Needs Soar

Insurers Sink as UnitedHealth Sees ‘Disturbance’ in Medicaid

‘Not Gonna Be Pretty:’ Covid-Era Homebuyers Face Huge Rate Jump

Blackstone Inc. and Apollo Global Management Inc. are negotiating lower borrowing costs for themselves and their funds in the bond market and have tapped the insurance industry for fresh funds. Blue Owl Capital Inc., Carlyle Group Inc. and HPS Investment Partners, meanwhile, are among the mega-funds that have started offering loans to companies once considered too small to be of interest.

They’re all ways to compensate for the fact that deal margins — the spread over a base rate and the biggest driver of private-credit profits — are drying up, casting a shadow over Wall Street’s shiniest corner of finance.

“Margin compression just shows how competitive this market really is,” said Igor Baranovski, chief portfolio manager for private credit and alternative investments at PenSam.

Read More: Why Is Private Credit Booming? How Long Can It Last?: QuickTake

With dealmaking still lackluster and the broadly syndicated loan market returning to life, competition in the burgeoning $1.7 trillion private credit market is forcing funds to adapt to a much harsher environment. Some firms are finding the going so tough, they’re choosing to walk away entirely.

Putting exact numbers on spreads on private loans is imperfect at best, and deals vary widely. Overall though, on a like-for-like basis spreads have shrunk about 100 basis points since last year, according to dealmakers who asked not to be identified discussing confidential information.

Direct lenders themselves fret the lavish returns of 2023 will be unmatched in 2024. The Cliffwater Direct Lending Index, which tracks nearly $315 billion of private loans to midsized companies, was up about 12% in 2023.

“Over the medium to long term we don’t expect investors to be content with accepting a significantly compressed risk premium,” said Patrick Ottersbach, the head of private credit for Europe at Macquarie Capital.

In the meantime, private credit funds are sprucing up their returns by cutting their own costs and chasing riskier, higher-yielding business.

Just like with any other debt, rates on bank loans and bonds have fallen in recent months and firms such as Blackstone and Apollo have taken advantage of this. Blackstone’s Private Credit Fund (BCRED) this month borrowed $500 million in the bond market for five years for a rate of 175 basis points more than government benchmarks. By contrast, private loans have recently paid spreads of between 475 basis points and 550 basis points over US benchmarks, according to data compiled by Bloomberg.

Another source of cheap funds is from alliances with deep-pocketed insurance companies ready to provide lower-cost capital. Blackstone, KKR & Co. and Apollo have either partnered with or bought insurance companies in recent years. One insurance company, Resolution Life, expects to bring its private debt exposure to as much as a quarter of its assets.

“Credit funds have diversified their sources of capital over the last 12-18 months to include insurance money and private wealth capital,” said Fergus Wheeler, a partner at Latham & Watkins. As such, funds “are able to provide more competitive debt packages with lower pricing.”

Read More: Blackstone Taps Vast Source of Cash in $1 Trillion Credit Push

Another lever is to lend more to smaller companies, where lenders can typically charge higher interest rates.

Antares Capital and Blackstone recently lent about $250 million to a business with $33 million of EBITDA. Blue Owl recently undercut other direct lenders on a credit facility of just $335 million.

Private credit funds are also going after more junior pieces of the capital stack. This debt gets paid back after the senior lenders, but in exchange reaps more money. Payment-in-kind debt, where the borrower pays interest with more debt, is even riskier.

Marc Chowrimootoo, portfolio manager and managing director at Hayfin Capital Management, expects high PIK issuance to continue into next year as private equity firms use borrow-now, pay-later arrangements to keep cash-pay leverage low while central bank rates are still high.

Among 10 of the largest BDCs 17% of loan portfolios had at least some interest payment from PIK, according to a Bloomberg Intelligence report in February. This is up from 10.5% in the previous year.

In the meantime, a slump in buyouts is stretching into yet another year, leaving more funds to chase a shrinking pool of deals and earn less for their trouble.

“Deal activity is still subdued,” said Ottersbach at Macquarie. “There is currently too much capital chasing too few deals.”

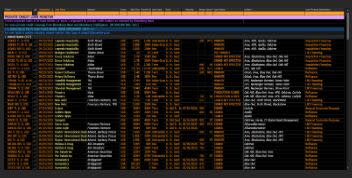

Deals

Hayfin Capital is planning to sell a telecom infrastructure portfolio in Italy valued at around €250 million

China Vanke Co. repackaged some of its privately issued debt into asset-backed securities, a move that effectively allows the builder to push back already deferred payments

Private credit lender Oak Hill Advisors is leading a roughly $1.4 billion debt package to help finance Advent International’s proposed purchase of a stake in Prometheus Group

KKR & Co. signed a deal with private credit lenders for about a A$200 million loan for MYOB Ltd., an Australian accounting software firm that the private equity giant acquired in 2019

Fundraising

Goldman Sachs Group Inc. has put together $21 billion for private credit wagers, its biggest war chest yet for Wall Street’s buzziest asset class

Private credit funds are trying to scoop up more of Japan’s ¥4.5 quadrillion of lendable financial assets, betting that inflation will prompt investors to channel more of that money into riskier overseas investments

Colonial First State, which manages A$151 billion of Australian pension and wealth assets, plans to add billions in private credit deals as it sees interest rates staying elevated for longer

Australia’s pension giants are looking to expand their private credit exposure to some nascent products, as the cash-flushed industry hunts for ways to diversify portfolios and boost returns

Capital Group and KKR announced an exclusive partnership to provide hybrid public-private markets investment solutions across multiple asset classes, geographies and channels

Private debt funds around the world raised $30.4 billion in the first quarter of 2024, the lowest 1Q figure since 2016

Job Moves

Three portfolio managers that helped create Aegon Asset Management’s sustainable fixed income strategy in the US left the firm last month to start a private credit fund that will focus on innovative climate technology

DC Advisory, the investment bank owned by Daiwa Securities Group Inc., hired Michael Moore and Jono Peters from Union Square Advisors as co-heads of US private-capital markets

Did You Miss?

Dimon Says ‘Could Be Hell to Pay’ If Private Credit Sours

CalPERS Bullish on Private Markets, CEO Frost Says (Video)

Smaller Private Credit Borrowers Drowning as Rates Stay High

For Private Credit’s Top Dogs, $1 Million a Year Is Not Enough

Matt Levine’s Money Stuff: Banks Want In on Private Credit

JPMorgan Hunts for Private Credit Firm to Grow in Hot Sector

--With assistance from John Sage.

Most Read from Bloomberg Businessweek

Disney Is Banking On Sequels to Help Get Pixar Back on Track

Why Dave & Buster’s Is Transforming Its Arcades Into Casinos

The Secret Ozempic Recipe Behind Novo’s Race to Boost Supplies

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance